Outlook 2024

Global maritime trade is down in 2023, but it has proven remarkably resilient to successive shocks to the system. A proliferation of protectionist obstacles to international trade and investment, however, could prove to be a much bigger barrier — even for shipping’s endless adaptability.

Shipping can adapt to anything as long as trade remains global

Global maritime trade is down in 2023, but it has proven remarkably resilient to successive shocks to the system. A proliferation of protectionist obstacles to international trade and investment, however, could prove to be a much bigger barrier — even for shipping’s endless adaptability

The Lloyd’s List Podcast: The outlook for shipping in 2024 and beyond

The world is living through the most dangerous time since the Cuban missile crisis. Geopolitical tension is keeping everyone awake at night, but there is at least a confidence among our expert panel from BIMCO, Citi, Shell and Cargill that shipping will manage to meet the International Maritime Organization’s goal of net zero emissions sometime around mid-century, probably…

Tankers: Will the market take the hard road or an easier pathway in 2024?

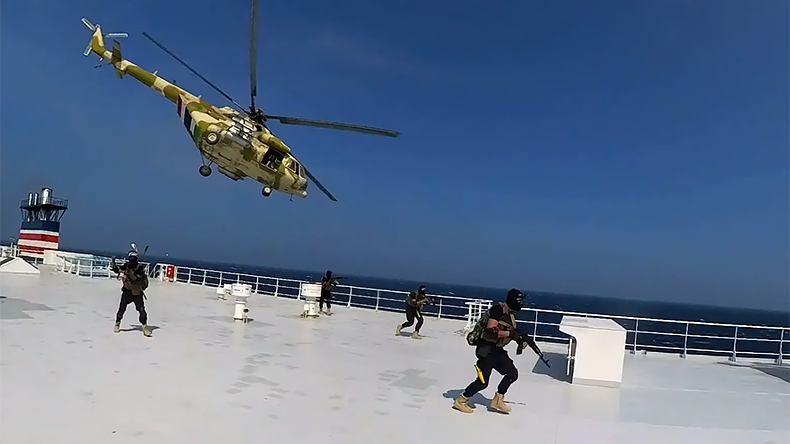

Forget the fundamentals; geopolitics will likely play an outsized role in the tanker markets in 2024

Dry bulk: Q4 rally could breathe life into seasonal slumber

Record grain exports from Brazil and continuing restrictions in the Panama Canal have been buoying up healthy demand

Shipping will ‘get there by 2050’, industry heavyweights tell Lloyd’s List Outlook Forum

World is living through most dangerous times since Cuban Missile Crisis, claims Citi’s Parker, with political tension keeping Cargill’s Abdalla up at night

LNG and LPG: Panama Canal restrictions to keep freight rates high in 2024

Weak seasonal demand during the first quarter of 2024 will be offset by increasing tonne-miles because of reduced capacity in the Panama Canal, while an expansion of propane dehydrogenation plants in China will be driving growth for the LPG sector

Ship finance: Diversity of funding is wider than ever, but banks narrow their focus

Many financiers are going ‘big’ and ‘green’, putting in doubt future funding for smaller owners of older vessels

Regulation: IMO deliberations to dominate agenda

The International Maritime Organization’s debate on an economic measure to complement its revised greenhouse gas strategy and implementation of the EU’s Emissions Trading System tax will be key subjects to watch in global shipping regulation during 2024

Containers: Box shipping swings into down cycle

Container shipping is in one of its cyclical downturns; it will need discipline to contain capacity if rates are to recover to profitable levels

Geopolitics and cost of decarbonisation top Outlook Poll of industry concerns

Lloyd’s List’s annual outlook poll for 2023 found widespread doubts that the 2030 and 2040 targets can be met, while geopolitics has surpassed fears on the economy as a key risk

Shipbuilding: Back in the black

Strong newbuilding ordering activity from the dry cargo, gas and vehicle carrier sectors looks set to continue in 2024, while thin orderbooks for crude and product tankers are set to expand

Marine insurance: moderate hardening expected across all main lines

With January 1 and February 20 renewal deadlines looming, and continued conflict in Ukraine and Gaza, war risk premiums will remain high

You must sign in to use this functionality

Authentication.SignIn.HeadSignInHeader

Email Article

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.