P&I Clubs issue North Korea sanctions ‘reminder’ as surveillance scrutiny on shipping is stepped up

International Group Clubs issue a collective industry circular urging owners to reassess any possible links to North Korean entities. Circular not prompted by any specific event or incident

Government agencies focusing on shipping and insurance to police sanctions regime and searching for unusual shipping activity including AIS switch-off as a leading indicator for investigations

P&I CLUBS have collectively urged shipowners and brokers to reassess the risk posed by the North Korean sanctions regime amid intensifying enforcement and increasingly forensic investigations focused on shipping activity by the US government.

A circular issued by all members of the International Group of P&I clubs this week was officially positioned as a “reminder” of the 2017 sanctions introduced by the UN Security Council, but insurance insiders cite recently increased scrutiny of shipping from governments policing the sanctions and looking specifically at evasion tactics.

The circular notes that members of the UN Security Council have stepped up surveillance of any maritime activity that arouses a suspicion of sanctions evasion.

According to the circular, which was issued with similar wording by all IG clubs, “surveillance agencies” are looking out for indicators of potential evasion activity, including unexplained diversions or AIS transmitters being deliberately turned off to conceal the ship’s voyage pattern.

“The relevant authorities are monitoring vessel movements with satellites and other resources, and vessels may be subject to search and detained at ports whilst suspicious activity is investigated,” stated the circular.

According to International Group chief executive Andrew Bardot, the circular was not prompted by any specific event or incident.

“We have noticed increased interest on the part of governments and the UN on the policing of sanctions on trade with North Korea, so felt it timely to remind shipowners through the recently published Group circular,” said Mr Bardot.

Other IG members suggested to Lloyd’s List that while Iran and Syria have remained high-profile sanctions issues across the industry, the North Korean regime has fallen down the agenda and this was simply an attempt to ensure it does not “slip under the radar”.

China and Russia have both said the UN should consider relaxing sanctions on Pyongyang, while Washington, backed by the UK, France and Japan, is demanding that North Korea give up its nuclear arsenal before any relief from sanctions is granted.

With a possible second denuclearisation summit between North Korea and the US hanging in the balance, diplomatic pressure is building along with scrutiny from government agencies policing the sanctions.

While no recent cases have been revealed, the UN Panel of Experts on North Korean sanctions has documented extensive examples of ships being used to evade sanctions and P&I Club executives suggest that governments are now “going after” shipping and insurance to police the sanctions regime.

In the last published UN report the panel found “extensive use of a combination of multiple evasion tactics, including indirect routes, detours, loitering, false documentation, transhipment through third countries and manipulation of Automatic Identification System signals and destinations/estimated times of arrival, as well as changes to the class, length and draft of the vessels”.

The panel concluded that such tactics were being deliberately used to obfuscate actual routes, conceal port calls and give the impression that sanctioned cargoes were loaded in ports other than in North Korea.

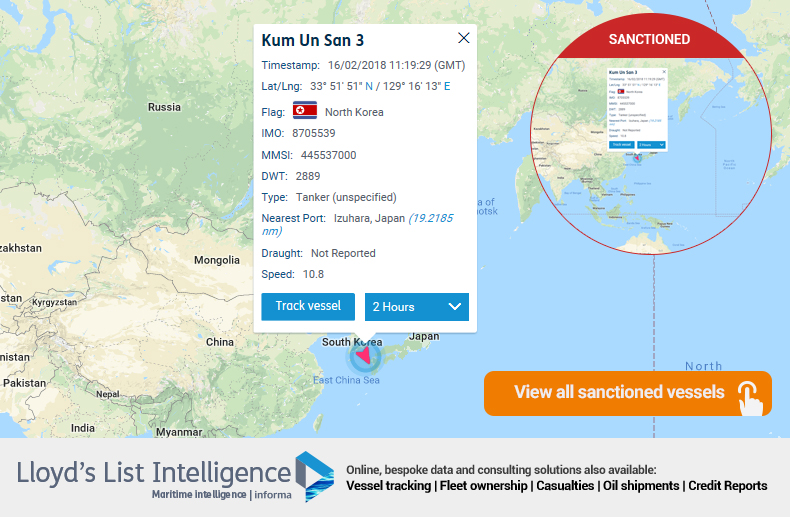

In October, the UN Security Council designated three vessels as subject to de-flagging as a result of illicit ship-to-ship transfers. It said the ships were likely dealing in oil transfers and named them as Shang Yuan Bao, New Regent and Kum Un San 3.

In light of the increased scrutiny the P&I clubs have reminded members that any activity that breaches sanctions will result in insurance cover being withdrawn. The clubs strongly urged members “to reassess the risks of undertaking any business with North Korea including ship-to-ship transfer operations and should also exercise the fullest possible due diligence to ensure that they are not unwittingly entering into prohibited activities with North Korean entities”.

Due to the current government shutdown in Washington DC, the Office of Foreign Assets Control — which administers and enforces US economic and trade sanctions — did not respond to queries from Lloyd’s List concerning stepped up procedures against North Korea.