Floating storage and subterfuge oil trades pose earnings drag on tankers

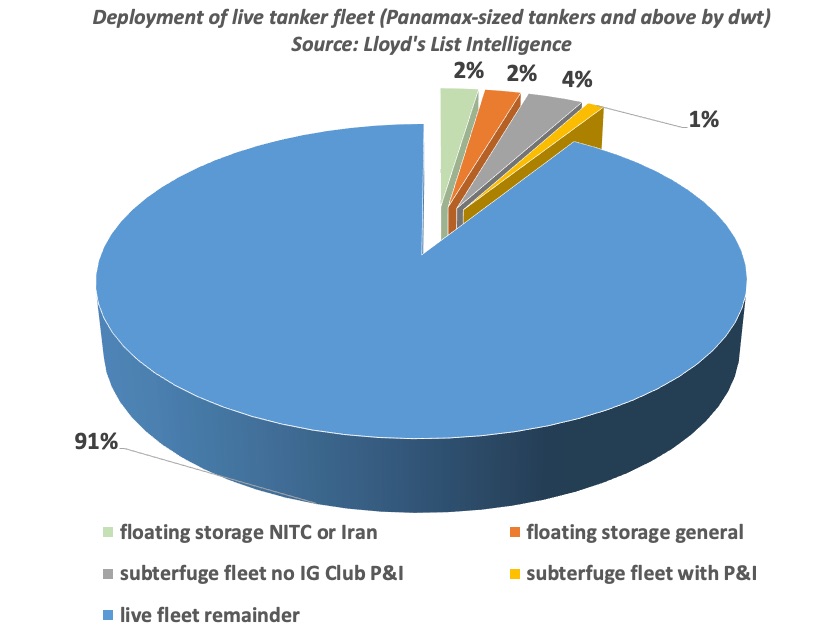

Subterfuge and floating storage shipping employs 6.3% of the existing live fleet of some 2,800 tankers of 55,000 dwt and above, Lloyd’s List Intelligence data shows

Releasing tonnage once US sanctions on Iran’s oil and shipping sector are lifted will weigh on an already oversupplied market

LIFTING US sanctions on Iran’s oil and shipping sector could release more than 140 tankers to regular trading as vessels used for floating storage or subterfuge trading return to markets.

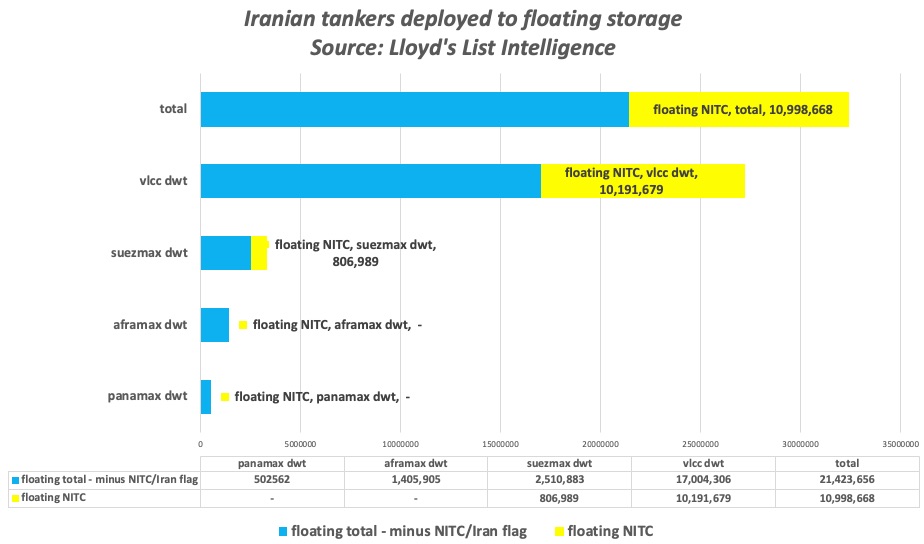

Lloyd’s List Intelligence analysis shows that 49% of the 21.4m dwt in panamax-sized tankers and larger currently being used for clean and dirty floating storage are owned by state-owned Iranian companies.

Floating storage has tumbled 56% from the July 2020 high of 254 tankers totalling 48.7m dwt.

A further 104 tankers totalling 16m dwt are deployed in subterfuge trades without protection and indemnity coverage from the International Group of 13 clubs that insure 90% of the world’s fleet.

These vessels — most of which have unknown or anonymous owners — are involved in shipping at least 400,000 to 500,000 barrels per day in US-sanctioned Iran-origin crude, according to information compiled by Lloyd’s List.

Shipments involve other National Iranian Tanker Co tankers that are not being used for floating storage, typically via a series of ship-to-ship transfers at offshore anchorages in the United Arab Emirates, Malaysia, Iraq and Indonesia.

Floating storage and subterfuge shipping accounts for some 6.3% of the existing live fleet of tankers of 55,000 dwt and above, data shows.

Iran-flagged ships account for 33 very large crude carriers and five suezmaxes in floating storage for 20 days or more for the week ending February 28, totalling some 10.9m dwt, Lloyd’s List Intelligence data shows. There are 2,726 tankers of panamax-size and above currently trading.

The release of so much tonnage would weigh on tanker earnings, even as the easing of sanctions potentially adds as much as 2m bpd — equivalent to one additional VLCC loading every day — to export trades.

Earnings for the global fleet of crude and product tankers have been below operating expenses for most of 2021 amid a surplus of tonnage and fewer cargos as north America and Europe fail to return to pre-pandemic crude demand levels.

Of the 19 crude tanker routes assessed by the Baltic Exchange, seven are showing negative time charter equivalent rates. Just three are above levels needed to cover basic operating expenses.

On the clean side, four of the 19 routes have negative time charter rates and 11 are assessed lower than operating expenses.

Negative earnings are partly due to rising oil prices which are at 13-month highs and have pushed up bunker costs.

The timing sanctions relief is uncertain, although the Biden administration has pledged to overturn the Trump presidency’s “maximum pressure” campaign on Iran.

Iran’s foreign ministry on Sunday rejected overtures to open talks with the US over the terms of any re-engagement in a nuclear deal that would end sanctions. Iranian presidential elections are being held in four months, adding to the political sensitivities.