Baltic tanker earnings slump even as Russian exports climb

Pipeline disruption continues to affect inland supplies of Urals oil across eastern Europe, and oil exports from the Russian Federation maintain strength. But the earnings of tankers shipping from Russian ports linger at marginal levels

German and Polish diesel and gasoil imports hit a six-month high in May

EARNINGS for crude and product tankers shipping Russian diesel and oil from Baltic ports remain at marginal levels equal to operating costs, even as a pipeline disruption continues to affect inland supplies of Urals across eastern Europe, and oil exports from the federation maintain strength.

German and Polish diesel and gasoil imports hit a six-month high in May as a contaminated pipeline interrupted inland crude supplies to the countries’ refineries, boosting seaborne trade on handymax tankers from the Russian Baltic port of Primorsk.

Some 1.16m tonnes were imported by Poland and Germany last month, the highest since November 2018, according to oil analytics provider Vortexa, which monitors global flows of refined products.

That included 474,000 tonnes from Primorsk, the Baltic’s biggest diesel export port and largest supplier of gasoil and diesel to countries in northwest Europe.

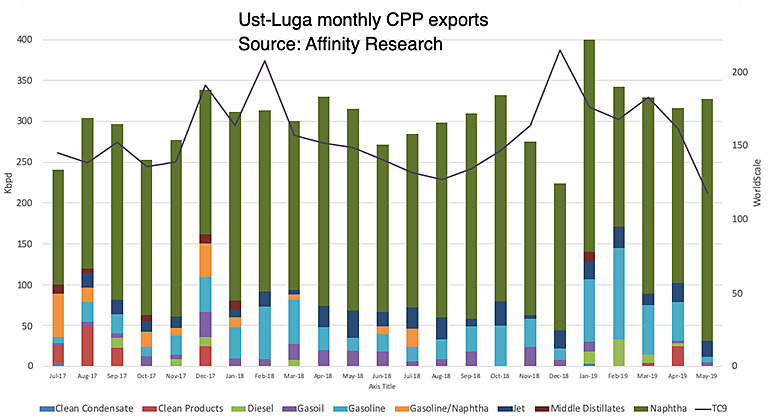

The total exports of gasoil and diesel from Primorsk in May were at 907,000 tonnes, or around 218,000 barrels per day, Vortexa told Lloyd’s List. The June export pace is now seen at 220,000 bpd, Vortexa said.

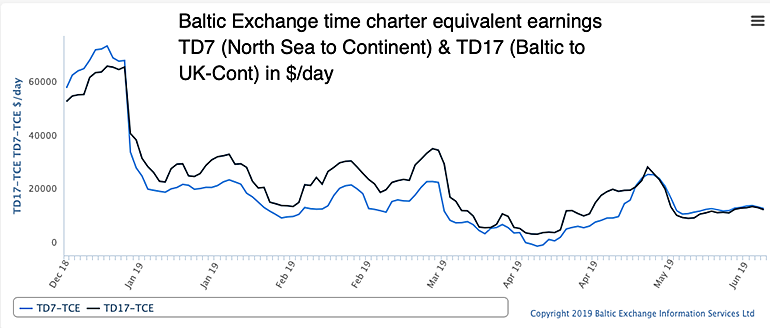

Although Druzhba pipeline flows are not fully restored, earnings for handymax tankers are now at $6,300 per day to ship 30,000-tonne refined products cargoes from Baltic ports to northwest Europe or the UK.

They had surged to nearly $13,700 daily on April 23 — when news first emerged of the pipeline’s suspension —according to the Baltic Exchange.

Excessive levels of organic chloride in the 1.4m bpd Druzhba pipeline halted Urals supplies in late April.

The pipeline, which originates in the Urals region, serves a number of inland eastern European refineries, including in Poland and Germany, with the shutdown affecting some 200,000 bpd of capacity.

Urals oil is also shipped from the port of Ust-Luga from Druzhba via the Baltic pipeline trunk. About 14% of Russian crude exports are loaded from there, with at least 10 contaminated cargoes sailing in late April before shipments were temporarily suspended.

However, earnings for aframax crude tankers loading oil from Baltic ports have now slipped, after briefly spiking in late April though to mid-May on the news.

Charles Chasty, an oil and tanker analyst with the research arm of London-based shipbroker Affinity, said: “A significant number of vessels in the area had already loaded before the contamination was made known, resulting in them being forced to anchor and await further instruction, effectively removing them from the market. A suddenly tighter market forced rates up.”

The daily time charter equivalent rate to load 100,000-tonne crude cargoes from Baltic ports, discharging in northwest Europe or the UK, reached $27,349 on May 10, according to the Baltic Exchange. That was the highest since March 19. Rates are now flatlining at around $6,000 per day.

The Druzhba pipeline closure also boosted rates for crude tankers shipping from the North Sea to Europe, as refineries turned there to replace lost cargoes from Russia, Mr Chasty said.

He added rates gained by nearly 30 Worldscale points between the third decade of April and May 10. Rates on this route are also around $6,000 daily, after reaching as high as $24,000 in early May.

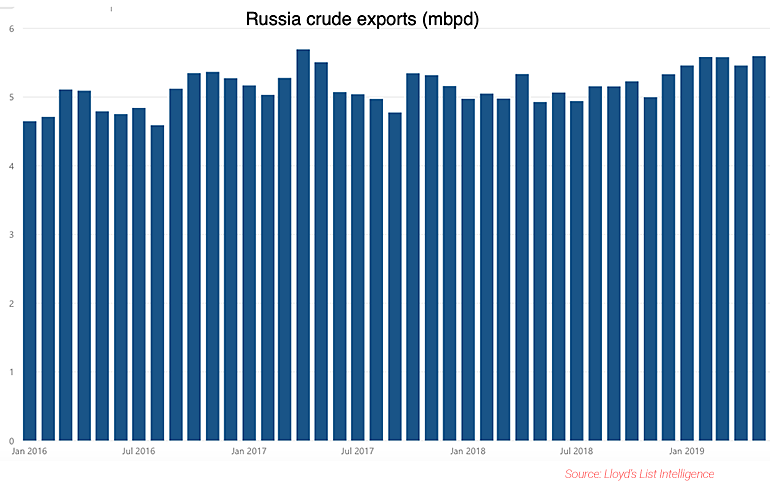

The poor earnings come as Russia is boosting crude exports to the highest in more than two years.

Some 173m barrels of crude on 220 tankers — equivalent to 5.6m bpd — sailed from Russian ports in May, according to Lloyd’s List Intelligence data. That is the most since April 2017, data show.

Some 78 tankers sailed from Baltic ports with crude cargoes last month, including 44 from Primorsk and 33 from Ust-Luga.