‘Dire implications’ for tankers if floating storage fails to offset demand contraction

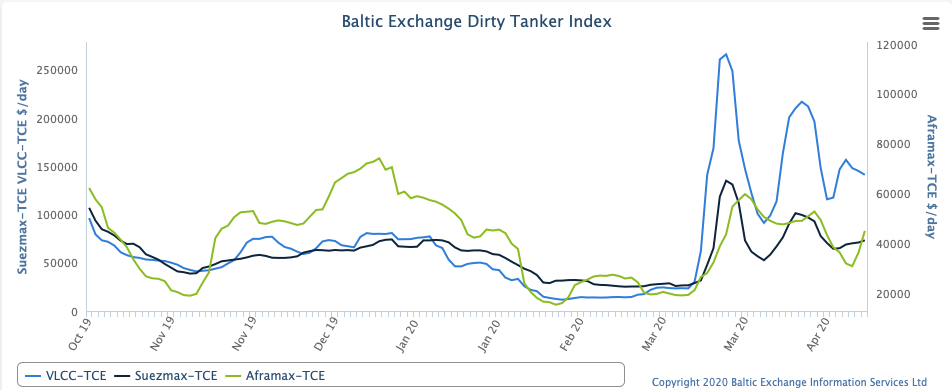

Earnings face ‘massive downward pressure’ beyond April with an end to the unexpected rates rally of the first quarter of the year

Average time charter equivalent rates have dipped from a record $210,000 daily on April 2 to today’s levels of $170,000 daily, with floating storage providing a floor to the coronavirus-led collapse in oil demand

BIMCO has warned of “dire implications” for the oil tanker shipping market and projected an end to the unexpected rates rally of the first quarter of the year, with earnings facing “massive downward pressure” beyond April.

“The first quarter of 2020 has been one of the most profitable quarters in the past decade for crude oil tankers, which will hopefully provide a liquidity buffer for the challenging months that lie ahead,” said BIMCO chief shipping analyst Peter Sand. “Once the production cuts set in, the profitable journey is likely to grind to a halt.”

BIMCO has one of the industry’s most pessimistic assessments of what the Organisation of the Petroleum Exporting Countries crude production cuts will mean for the tanker market. Just three weeks ago leading tanker chief executives talked up the oil demand shock as a “once in a generation” opportunity for the sector at an international investor forum.

But Mr Sand estimated that the removal of tonnage to floating storage to deal with oil overcapacity will not be enough to offset the sliding demand.

“With oil demand collapsing from one quarter to another, the crude oil tanker market is facing disruption on an unparalleled scale,” he said in an emailed report.

“It seems plausible that the market will not return to ordinary supply and demand fundamentals until perhaps the third quarter of 2021.”

Despite oil demand contracting at a record pace, shipbroker Braemar ACM provides a more optimistic scenario, suggesting that floating storage in coming months will provide support to current tanker rates.

Very large crude carriers are currently earning some $170,000 daily on benchmark rates to Asia from the Middle East Gulf, with gains cascading down to smaller tanker sizes. Average time charter equivalent rates have dipped from a record $210,000 daily on April 2 to today’s levels with floating storage providing a floor to the coronavirus-led collapse in oil demand.

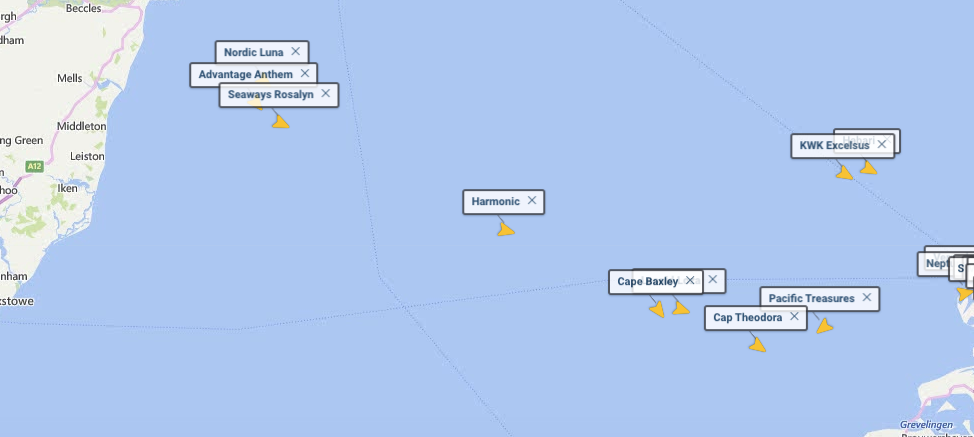

Some 146m barrels of crude is in floating storage on 110 tankers for the week ending April 10, according to Lloyd’s List Intelligence, equal to the highest in records going back to 2009, data shows. Last week the same volumes were seen on 114 tankers. Numbers have risen as traders book vessels to store the crude and products surplus and also to take advantage of a market contango, when the future price is higher than the spot price.

While the floating storage figure is double levels seen last June, volumes are inflated by 38 Iranian-owned VLCCs which cannot trade because of US sanctions and are holding crude and condensate cargoes off the country’s coast.

‘What remains certain is that tanker demand will grow as oil literally has nowhere else to go when storage fills up globally,” said Braemar ACM in its weekly report. Discharge delays were also helping reduce tanker availability, lending further support to rates.

Export volumes for May for crude and product tankers appear similar to April levels, said another London-based shipbroker, Affinity Tankers, which also provided a more positive assessment of what the Opec-plus agreement means for shipping. The agreement sees production cut by 9.7m barrels per day over coming months.

“We expect sustaining interest in floating storage, which will also be supported further by the imminent running out of onshore storage capacity,” the report said.

“This tightening of supply will, at least in the short term, offset much of the impact of the Opec-plus production cuts and provide a floor for rates. In the longer term, even once these vessels taken out for storage return, many will require inspections and be considered compromised going forward. Even with lower volumes ex-Middle East Gulf, Russia and the US, the supply side of the equation remains supportive, with limited deliveries expected and potentially higher scrapping levels.”

Despite BIMCO’s gloomy estimates, VLCC fixtures continue to be done at levels above $180,000 daily, according to information provided by tankers pool, Tankers International. Voyages from the Middle East Gulf to China were provisionally agreed at rates equivalent to as much as $187,000 daily today.

With oil demand destruction “on an unprecedented scale”, Frontline chief executive Robert MacLeod said, on March 31, that land-based inventories were filling up five times faster than in 2015 — the last time crude and product tanker rates were buoyed as oil traders turned to storing oil on ship at sea.