The week in charts: China port calls slow as tanker freight futures spike

Cosco Shipping Ports chairman warns of short-lived recovery in container volumes, while shore-based crude storage expected to fill up quickly, bolstering tanker forward freight agreement contracts

Signs of the slowdown in container volumes are already starting to emerge in China, despite the recent recovery in production as factories resume work

DATA from Lloyd’s List Intelligence show that the number of calls by container-related vessels to Shanghai and Yangshan dipped back down in week 12 following a period of recovery since the slump following Chinese New Year.

Feng Boming, chairman of Hong Kong-listed Cosco Shipping Ports, this week said shipping companies were prepared for the virus impact from China but did not foresee the disease turning into a pandemic, which could make the current recovery in container volumes rather short-lived.

He added that cargo being shipped now was ordered before the virus outbreak and will drain in May. He urged shipping companies to find quick and effective solutions, including cost reduction, to tackle the possible shrink in revenue.

(If watching on a mobile device, select Open Media where relevant to view the graph)

Freight futures

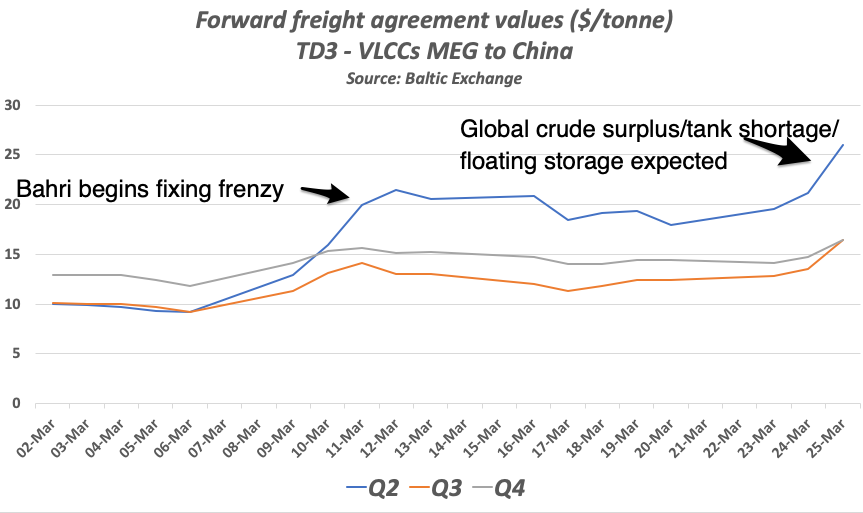

New signals have emerged that oil traders anticipate shore-based crude storage to quickly fill up as the value of tanker forward freight agreement contracts for the next six months soared 22% in one day.

The spike in freight futures provides further insight into market sentiment as the scope of the oil demand collapse and the scale of a looming crude and products surplus begins to emerge. The spike suggests traders and oil companies expect floating storage to surge in coming weeks, pushing up rates for tankers even as global demand for crude falls.

The second-quarter contract for very large crude carriers shipping 280,000 tonnes from Saudi Arabia to China — the most frequently traded FFA — closed at $25.99 per tonne on March 25, according to the Baltic Exchange. The contract gained 24% from the prior day and is 260% higher than its value at the beginning of the month.

The third-quarter FFA contract on the same route is now at $16.42 per tonne, up from $13.56 on March 24. The less-liquid second-quarter FFA contract for suezmax tankers showed a smaller gain of 11% on the previous day.

Bahri-chartered VLCCs on the move

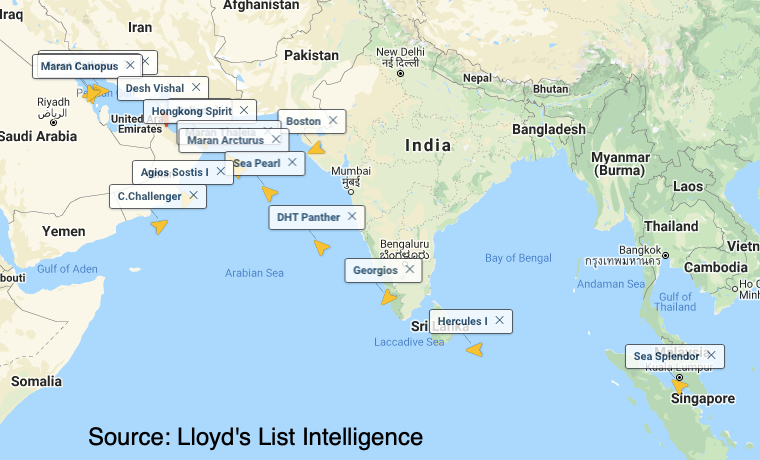

After Saudi Arabia pledged to flood the market with crude oil to retain market share earlier this month, state shipping company Bahri chartered some 25 VLCCs on the spot market between March 9-20 to load extra cargoes, resulting in the tanker rates spike seen in mid-March.

These VLCCs are now sailing to Saudi Arabia, as can be seen in the map from Lloyd’s List Intelligence, with loading dates starting from March 25 to April 2.

But with refineries worldwide cutting runs and the crude surplus rising, its unclear whether there will be buyers for cargoes to be loaded on the armada of VLCCs due to more people working from home and decisions taking longer.

At least four of the Bahri-chartered VLCCs are heading for the Red Sea port of Ain Sukhna where the national oil company has storage facilities, but a further 10 are sailing for the US Gulf, where refineries there are already reducing utilisation levels.

Scrubber cancellations

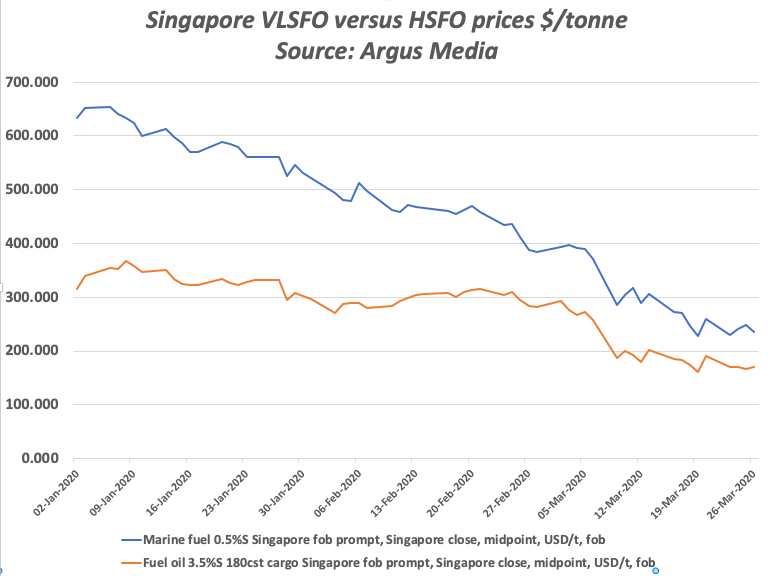

Dry bulk and containership owners are among the first to scrap plans to retrofit or install scrubbers, according to Alphatanker, which forecasts a “flood of cancellations” as cost-cutting and the erosion of marine fuel oil premiums render the sulphur abatement technology redundant.

The price of 0.5% very low sulphur fuel oil now used by some 70% of the international global fleet has plunged by 278% in Singapore since the beginning of 2020, when it was as high as $653.75 per tonne, according assessments compiled by price reporting agency Argus Media.

The difference in price between compliant VLSFO and 3.5% high sulphur fuel oil used by vessels with scrubbers has shrunk to $50 per tonne, from more than $400 per tonne earlier this year, according to Alphatanker. Argus Media prices for Singapore today assess the spread as $64.50 per tonne.