Saudis in record-breaking tanker charter exceeding $370,000 daily

Bahri has now chartered 15 VLCCs in the past four days, driving up rates 12-fold on key routes to Asia, sending futures trading volumes to a record and spooking other charterers to fix tonnage at ever-increasing levels

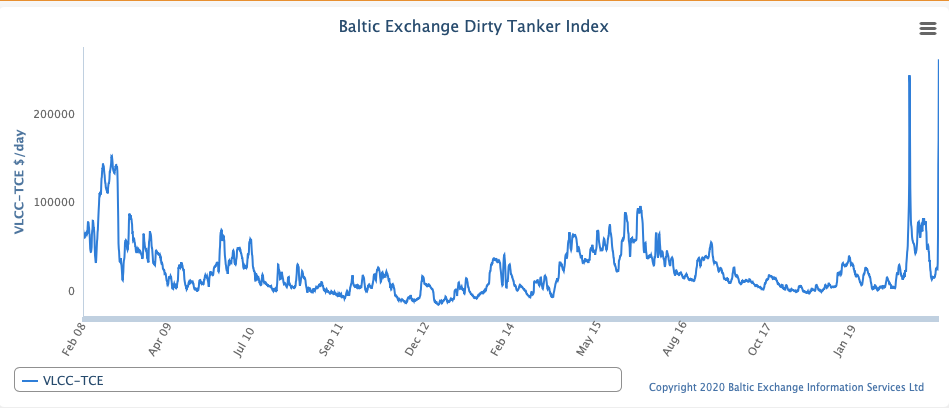

Tanker rates are now rising at levels not seen since the Iraqi tanker wars in the 1980s, and have even exceeded the stratospheric charters for capesize bulk carriers at the height of the commodities super-cycle

SAUDI shipping company Bahri has chartered a very large crude carrier at a record-breaking rate that equates to daily earnings of $370,000, as the Kingdom’s strategy to flood oil markets continued the tanker markets rally into the weekend.

The 2012-built Sea Splendor owned by Sinochem Corp was provisionally chartered at a Worldscale rate of 195 to load 280,000 tonnes of crude from the Middle East Gulf from April 2, according to fixtures reported by Tankers International. That equated to earnings of about $370,000 daily, the commercial tanker pool said.

If concluded, the figure is the most paid for tonnage since the Iraqi tanker wars, and exceeds even the stratospheric charters for capesize bulk carriers at the height of the commodities super-cycle. Back then, deals reached $260,000 daily.

Bahri has now chartered 15 VLCCs in the past four days, driving up rates 12-fold on key routes to Asia, sending futures trading volumes to a record and spooking other charterers to fix tonnage at ever-increasing levels. Some 52 VLCCs were reported chartered this week.

Shipbrokers told Lloyd’s List that Bahri had taken some 20 VLCCs in total, with the details of others yet to be reported in the public domain.

The record-breaking fixtures propelled tanker indices to fresh records on the London-based Baltic Exchange. Average VLCC timecharter earnings gained $92,000 in one day to close at $258,700 daily. That’s some $230,000 higher than the same time last week.

US Gulf-China loadings exceeded $18.7m, or some $9.11 per barrel, almost a third of the value of the crude being loaded.

Of the 52 reported fixtures, some 29 remained ‘on subjects’ by 1530 GMT, March 13, meaning the outlined terms of deal are yet to be finally agreed by charterer and shipowner. Nineteen of the VLCC charters have gone ahead, and one has failed. Subjects were lifted for the 2012-built Boston at earnings of $195,000 daily, providing the first indication of where the market is sitting.

The tanker Boston is part of the Dynacom Tanker Management fleet owned by the Prokopiou family.

The sustainability of these surging tanker rates remains uncertain given the circumstances underpinning it are unprecedented. Shipbroker Braemar ACM believes that this rise is different to the sizzle-and-fizzle of October, when rates fell as quickly as they rose.

“VLCC owners remain firmly in the driving seat as tight lists and high levels of enquiry in the Middle Eastern Gulf forces rates higher,” the shipbroker said in a daily report.

“This market has a much greater feeling of sustainability due to the continuing high levels of demand and a shortage of available vessels.”

Shipbroker Gibson said in a weekly report: “The massive Saudi production hike is the stand-a-lone catalyst and so long as that level of production is maintained, so the market will remain in stratospheric rate territory.”

Similar sentiments are seen for the suezmax sector, as higher VLCC rates see cargoes from West Africa and other area split from a 2m-barrel shipment to two, 1m-barrel shipments on the smaller vessel size.

The Saudis launched their ship-and-awe strategy on Monday, after sharply dropping oil prices over the weekend following the collapse of so-called Opec-plus agreement. Bahri made the shock move to hoover up as much available tonnage as possible, in addition to its own tonnage which includes more than 30 of its own VLCCs. Bahri will ship an extra 30m extra barrels over the past 10 days of March and first week of April on chartered tonnage in addition to crude loaded on Bahri-owned tankers or on those fixed by oil companies or refineries.

The tanker armada is seen as the kingdom’s response to Russia’s refusal to support the Organisation of the Petroleum Exporting Countries’ plan to curb production and bolster prices in the wake of a coronavirus-led contraction in crude demand. The strategy immediately wiped 30% off the price of Brent crude. It threatens crude output growth in the US, where indebted shale producers need higher prices to remain profitable. Rapidly rising shale oil exports from the US Gulf have undermined Opec curbs since 2016, when the US administration removed export restrictions.

Some nine of the Bahri cargoes are loading and will sail for the US Gulf, which will potentially raise monthly exports for May to the highest in more than three years. While Saudi Arabia’s national oil company owns the Motiva refinery in the US Gulf, Saudi imports have tumbled in recent years as US energy independence has gained.