Saudis in VLCC chartering spree as oil war escalates

Saudi Arabia's pledge to flood global markets with crude sees tanker rates spike as Bahri charters at least nine VLCCs in one day, paying as much as $197,500 per day for one ship

Oil companies race to book tonnage as the oil price war between Russia and Saudi Arabia escalates in a battle for market share. Crude demand is forecast to contract for the first time in a decade on the coronavirus outbreak

SAUDI Arabia has followed through with its promise to flood the market with crude, chartering at least nine very large crude carriers on Tuesday to load more than 20m barrels of crude in late March, pushing rates to the stratosphere in the process.

The kingdom’s national shipping arm Bahri provisionally booked at least nine VLCCs, paying freight costs that were as much as 10 times more than average earnings on Monday, according to fixtures posted by Tankers International.

The rush and scale of the charters are reminiscent of panicked fixing seen in early October after US sanctions on China’s Cosco saw deals agreed, but not concluded, as high as $300,000 per day.

Bahri paid Worldscale 98 to charter the 2016-built Agios Fanourios for a voyage from the Middle East Gulf to the Red Sea. That equated to time charter equivalent earnings of $132,680 per day, Tankers International calculated. Bahri also paid a staggering $197,500 daily for the 2012-built Boston. Like the Agios Fanourios, it is making a voyage from the Middle East Gulf to the Red Sea. Average daily VLCC earnings doubled in a day, according to the Baltic Exchange, reaching just over $60,000.

The rapid-fire tanker charters reflect the escalating scale and pace of the evolving oil war with Russia as the world’s second-largest exporter aims to retain market share as the price falls. Saudi Arabia said on Tuesday that it would ramp up production by 2.5m barrels per day from current levels in what analysts called an unprecedented “shock and awe” strategy.

Bahri has also chartered the 2017-built Agios Sostis, the 2013-built Dalian and the 2009-built Front Kathrine, all loading between March 20-25, Tankers International said on Tuesday. The 2016-built Agio Fanourios, as well as the 2013-built Hong Kong Spirit and DHT Panther were also chartered. Three of the vessels are chartered for discharge in the US Gulf, another two for discharge in the Red Sea and another for South Korea. Rates paid equated to daily earnings of between $132,000 and $134,000 daily.

The latest fixtures were among the 18 VLCC provisional charters listed on Tuesday by Tankers International as oil companies scrambled for tonnage. All were on subjects, with the market waiting to see whether any are lifted before assessing further charters.

The rapid boost pushed the overall VLCC market higher, after yesterday’s gains of some 6% on a Worldscale basis, as well as suezmax and aframax tankers.

These gains were made on expectations that cheap crude and floating storage would offset contracting global oil demand, boosting tanker employment.

Brent crude tumbled by as much as 35% in trading after the Organisation of the Petroleum Exporting Countries oil cartel’s three-year alliance with Russia ended on Friday. On late Tuesday Brent was recovering some lost ground to trade at $36.78 per barrel, after sliding to a four-year low of $31 early on Monday.

The price slide followed Russia’s resistance to further co-ordinated production cuts to arrest free-falling prices amid a coronavirus-led collapse in demand for air and land transportation fuels. Instead, Russia and Saudi Arabia are now locked in a race to the bottom to maintain market share, boosting output precisely as crude demand shrinks for the first time in a decade.

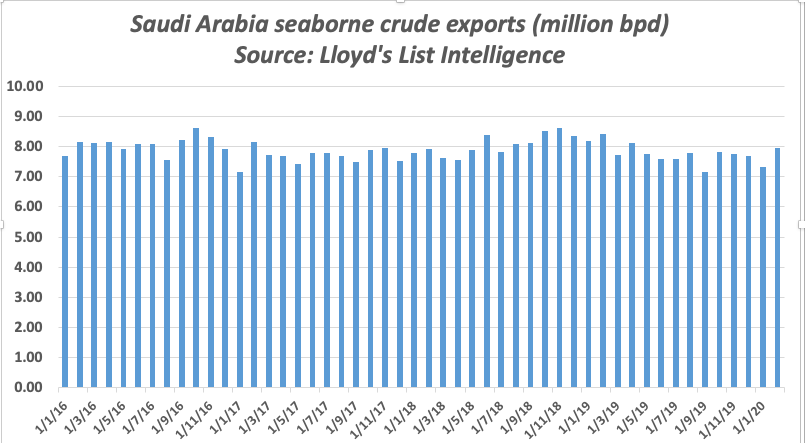

Saudi Arabia exported 7.94m bpd in February, the highest since April 2019, according to data from Lloyd’s List Intelligence. The kingdom’s market supply was 9.65m bpd last month, with a baseline capacity to produce 10.6m bpd, according to the International Energy Agency.

Unlike Russia, which is pumping at capacity, Saudi Arabia is able to boost production quickly. Tuesday’s pledge to supply a further 2.5m bpd would see as much as 12m bpd in the market. Exports of refined products from the country’s refineries are also expected to gain, as well as additional crude shipments. Some 29 crude tankers have sailed from Saudi Arabian ports so far this month.