From the News Desk: Coronavirus impact, carbon plans and UK freeports

Quarantine activities and the extended Chinese New Year holidays are expected to take a big toll on the economic growth of China and even beyond the giant Asian economy in 2020

While some in the sector at first seemed uncharacteristically relaxed about the potential of the coronavirus outbreak to cause major disruption to shipping markets, events in the past week have proven that initial apathy was somewhat misplaced.

NEW figures from Lloyd’s List Intelligence reveal a startling drop in the number of boxship calls to Shanghai and Yangshang ports in comparison with year-ago numbers.

With the extended lunar new year holidays and the large-scale shutdown of Chinese manufacturing, there have been fewer exports. Total boxship calls to Shanghai fell to 206, from 257 in 2019, in week 5 of 2020 (w/c January 29), while for the five days of week 6 recorded so far (Feb 5-9), calls are down to 147 from 186 in 2019. Week 6 was the time of the holiday last year.

The fallout from the virus will impact container lines far into the second quarter of 2020, according to Orient Overseas Container Line president Grace Liang. She said the extended factory closures had already caused a significant number of blankings announced, but that more were likely to follow if output fails to return to its normal seasonal levels.

While most Chinese provinces ordered local businesses to resume operations from Monday (February 10), many remain closed and officials have blocked a large number of rural roads, making it difficult for people based in the countryside to return to work.

One Shanghai-based truck company estimates that around 90% of container truck drivers have yet to report back following the holiday at the ports of Shanghai and Ningbo due to travel bans, and carriers have reported slow pickups of reefer boxes in the past week.

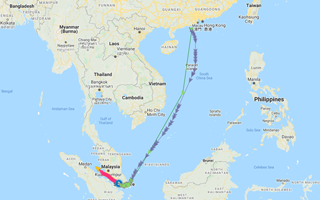

Reefer boxes awaiting pick-up at terminals may be temporarily stored and plugged on board a vessel docked alongside, while those in transit to Shanghai or Tianjin may be re-routed for transshipment.

The quarantine activities and extended Chinese New Year holidays are expected to take a big toll on the economic growth of China and even beyond the giant Asian economy.

Tanker and bulk markets plummet

Tanker shipping is clearly feeling the impact. While the freeing of the previously sanctioned Cosco Shipping fleet has contributed to a decline in rates, the spreading virus is taking a toll on the demand side, with oil consumption expected to drop considerably in the near term.

Tanker shipping is clearly feeling the impact. While the freeing of the previously sanctioned Cosco Shipping fleet has contributed to a decline in rates, the spreading virus is taking a toll on the demand side, with oil consumption expected to drop considerably in the near term.

The market conditions “have already changed beyond recognition” since China locked down Wuhan in mid-January, said London-based shipbrokers Gibson in a report last week.

Further adding to the bearish market tone, New York-based McQuilling has predicted that 2020 earnings for very large crude carriers will average just $24,600 daily. That’s less than half the $53,000 per day currently forecast for 2020 by Norwegian investment bank Cleaves Securities and the $50,000 per day cited by New York bank Jefferies.

The rate is also 40% below the average time charter equivalent rate for VLCCs in 2019.

Meanwhile, the effect on the bulk market is painfully evident when looking at the Baltic Capesize Index (BCI), which, after slipping into negative territory for the first time ever on February 3, is now at the astonishing level of -254.

Coronavirus is clearly not the only concern in the sector, with seasonal weakness, higher fuel prices and the contribution of the backhaul route (C16) to the index, but the Baltic Exchange will nonetheless carry out a review of the weightings it uses to compile the BCI.

The virus is also the subject of the latest Lloyd’s List podcast; Editor Richard Meade is joined by China Editor Cichen Shen, BIMCO’s chief analyst Peter Sand, and Andrew Rigden Green, a leading shipping lawyer from Stephenson Harwood, to give you the inside track on the latest market disruption.

EU plans on carbon reduction out of step

Away from the coronavirus, the other big ongoing concern for the sector, decarbonisation, took another turn last week when the European Parliament’s rapporteur on maritime emissions proposed changes to the EU’s Monitoring, Reporting and Verification regime that could see the issuing and allocation of carbon emissions to ships using ports in the bloc.

Away from the coronavirus, the other big ongoing concern for the sector, decarbonisation, took another turn last week when the European Parliament’s rapporteur on maritime emissions proposed changes to the EU’s Monitoring, Reporting and Verification regime that could see the issuing and allocation of carbon emissions to ships using ports in the bloc.

The proposed rules would mark the first major legally binding greenhouse gas emissions restrictions on international shipping. It would affect almost 12,000 ships and could force owners from various jurisdictions to change their business operations to comply.

The proposals have been flatly rejected by shipping groups including the International Chamber of Shipping (ICS) and BIMCO, with ICS deputy secretary-general Simon Bennett arguing shipping’s decarbonisation can only be achieved through the global regulatory framework of the International Maritime Organization (IMO).

Coincidentally, the IMO’s emissions policy chief last week announced he is stepping down from the role in order to set up his own maritime consultancy. Edmund Hughes, who has been the head of the air pollution and energy efficiency of the IMO since 2013, has overseen the adoption and implementation of some of the most consequential shipping emissions regulations during his time in the position.

Freeports plan floated

Meanwhile, with the UK officially leaving the European Union at the end of January, attention is turning to what plans the government has for shipping post-Brexit.

Meanwhile, with the UK officially leaving the European Union at the end of January, attention is turning to what plans the government has for shipping post-Brexit.

Treasury Secretary Rishi Sunak announced over the weekend that the administration plans to accord freeport status to 10 areas across the UK and many of the largest ports are expected to declare an interest. Applications will be open as soon as a 10-week consultation period is completed, with gradual rollout from 2021 onwards.

Stellar line-up for Qatar

The Qatar Maritime and Logistics Summit takes place on February 18 in Doha. Featuring a stellar line-up of speakers, this free-to-attend summit will explore the challenges faced by maritime and logistics players over the coming decade.

The Qatar Maritime and Logistics Summit takes place on February 18 in Doha. Featuring a stellar line-up of speakers, this free-to-attend summit will explore the challenges faced by maritime and logistics players over the coming decade.

For more information and to register, follow this link. A preview podcast of the Summit is also available here.