The Outlook Forum

We asked Lloyd’s List readers and key market participants what they thought would be the key issues shaping shipping over the next 12 months. The results point to another year of uncertainty in 2020, underpinned by political, technological and regulatory disruption

We asked Lloyd’s List readers and key market participants what they thought would be the key issues shaping shipping over the next 12 months and the results point to another year of uncertainty in 2020, underpinned by political, technological and regulatory disruption

THE annual Lloyd’s List Outlook Survey posed a series of questions to our readers and the wider market about the dynamics shaping shipping. The responses confirmed that uncertainty pervades most of the major decisions yet to be made across the industry and reinforces the view that there are no clear answers when it comes to choices about fuel types, digitalisation and the pathway to a zero carbon future.

However, the responses, which were discussed at length by an expert panel of industry leaders during our Outlook 2020 Forum held in London on December 10, also offer some much-needed insight on current industry thinking about strategy and sentiment. The shipping industry is clearly looking to investment in new technology and to develop the benefits of closer integration with other forms of transport, but it is also preparing for the changes that the widespread adoption of big data will deliver for maritime businesses.

The charts below summarize the responses to our poll which was put out to Lloyd’s List subscribers and our social media followers throughout November and December 2019. It also incorporates votes cast live by the audience attending our Outlook 2020 Forum.

The panellists for our forum were:

• Katharina Stanzel, Managing Director, Intertanko

• Michael Parker, Chairman of Citi’s shipping and logistics division

• Knut Ørbeck-Nilssen, Chief executive officer of DNV GL Maritime

• Dr Grahaeme Henderson, Vice-president of shipping and maritime at Shell International Trading and Shipping

• Peter Sand, Chief Shipping Analyst at BIMCO

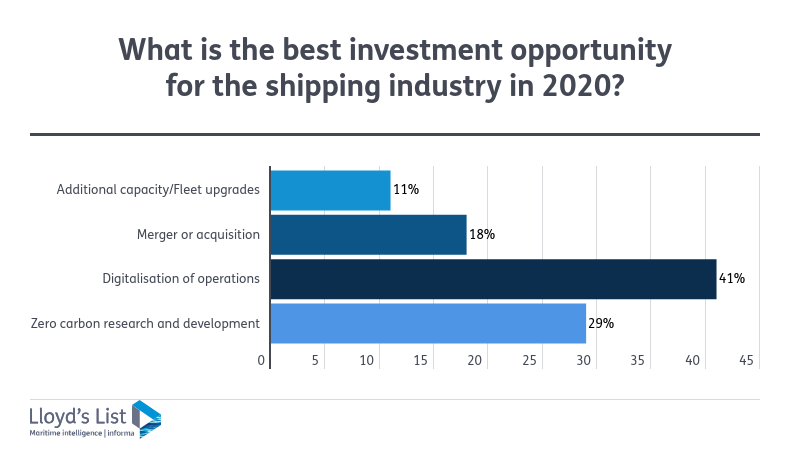

What is the best investment opportunity for the shipping industry in 2020?

While the end goal of zero emissions shipping will clearly require immediate investment from the industry, it seems the lack of immediate investment opportunities beyond ‘transitional’ options such as LNG-fuelled tonnage have left the majority of our respondents focusing on the more immediate focus of digitalisation. That is perhaps surprising given that the immediate project for most companies is to focus on operation efficiencies and the near-term returns of a more efficient, digitalised fleet that can be integrated into a wider supply chain offers more tangible returns on investment.

Speaking at the Outlook Forum, Citi’s Michael Parker explained why he had voted for merger and acquisitions as the most important investment: “Climate change is the biggest issue facing the world.

Speaking at the Outlook Forum, Citi’s Michael Parker explained why he had voted for merger and acquisitions as the most important investment: “Climate change is the biggest issue facing the world.

“We have to address it quickly, but for that to happen rapidly it requires a lot of capital, it requires a lot of government support and it requires therefore, in my view, a lot of companies that want to focus on this to really look at how bringing that together, bringing that capital together in the form of bigger companies able to face those challenges.

“You’ve seen that in the tech world, and there’s no reason for it not to happen in the industrial world. I think in order to address the challenges as rapidly as possible, there needs to be a lot of consolidation not just in shipping but also in other sectors to help this happen.”

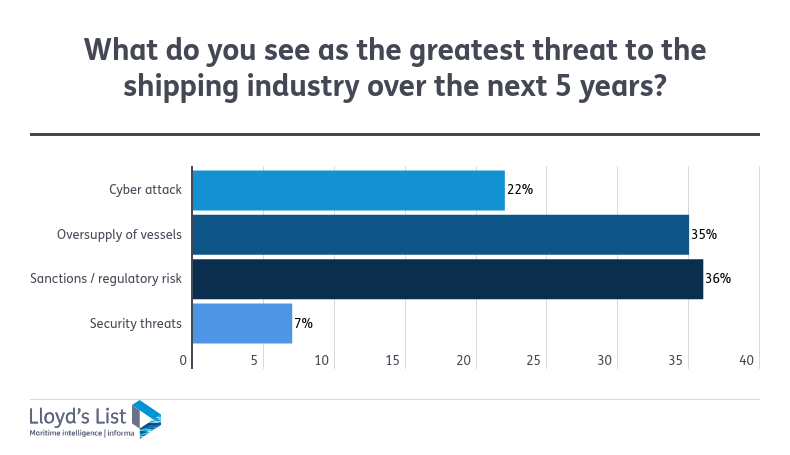

What do you see as the greatest threat to the shipping industry over the next five years?

The fact that oversupply of vessels was almost at the top of our poll looking for the biggest risk to shipping, is almost inevitable. The basic balance of supply and demand has always been a persistent issue for the industry, but the past decade has seen some particularly debilitating spikes that have clearly left it front and centre in our audience’s list of concerns.

The timelier theme of sanctions and regulatory risk reflects the concerns that have bubbled up to the top of the worry pile this year amid an increasingly complex landscape of political risk for shipping. The action of the US Treasury’s infamous Office of Foreign Assets Control officials who have been particularly vociferous in targeting Iran and Venezuela this year has had a very direct impact on the tanker trades and left lawyers and insurers moving swiftly to protect assets against increasing uncertainty when it comes to their clients.

Speaking at the Outlook Forum, Intertanko managing director Kathi Stanzel agreed with the poll and explained why she voted for sanctions as the greatest threat: “It is a huge risk because of the complexity of the situation.

Speaking at the Outlook Forum, Intertanko managing director Kathi Stanzel agreed with the poll and explained why she voted for sanctions as the greatest threat: “It is a huge risk because of the complexity of the situation.

“The issue is that it’s going to get politically so complex that decisions are made that aren’t not actually logically foreseeable. You can’t predict what’s going to happen — somebody has a knee-jerk response to a situation because, I don’t know, somebody tweeted something… nobody can predict or plan for that.

“What we are into is really a round of Darwinian revolution where ultimately, it’s not the strongest that survive, it’s those that happen to be in an environment that they can survive in at the time. You can’t predict that, you can’t business plan for it and that’s the difficulty and that’s why it’s so dangerous, I think. Yes, it is a huge concern and I would actually join the audience in selecting that part.”

What is the greatest challenge to the future efficiency of operations in shipping?

In the context of the 2020 sulphur cap and a frenetic 12 months of industry debate and planning around the 2050 decarbonisation targets set by the International Maritime Organization last year, it unsurprising that fuel uncertainty topped our poll this year.

The supply chain digitalisation challenges that have been so visible in the container lines’ strategy this year, and the largely overlooked change management and personnel issues required to deal with a new generation of technology and hardware, of course feature in our respondents’ thinking, but fuel choice is the big one. What is more, it’s likely to feature at the top for several years to come yet because, as the discussion at our Forum confirmed, there is no silver bullet on the horizon. Even the promise of some silver buckshot is looking a little elusive right now for 2020.

Speaking at the Forum, Shell’s Grahaeme Henderson explained why: “I don’t think that the fuel choice of the future has been made yet.

Speaking at the Forum, Shell’s Grahaeme Henderson explained why: “I don’t think that the fuel choice of the future has been made yet.

“I think there’s a long way to go on this. The more that I look at these fuels, the more that my technology team in Shell looks at these, the more that we see challenges. [There are] challenges in the production of these fuels, bearing mind that most of them are made from natural gas with a carbon capture scheme of some description. [There are] the challenges of the fuels, things like hydrogen, which liquefies at -253° Celsius.

“I used to think of LNG as cold at -162° but -253° brings in a whole host of issues. We cannot use the same inerting systems as we do with LNG, the materials crack that we use, we need new materials and all of these fuels actually at the moment, the cost of these fuels are two to three times the current, if you take LNG for example. There are issues with all of these fuels, they will require technology. They will require a lot of studying and we are undertaking that studying with others.”

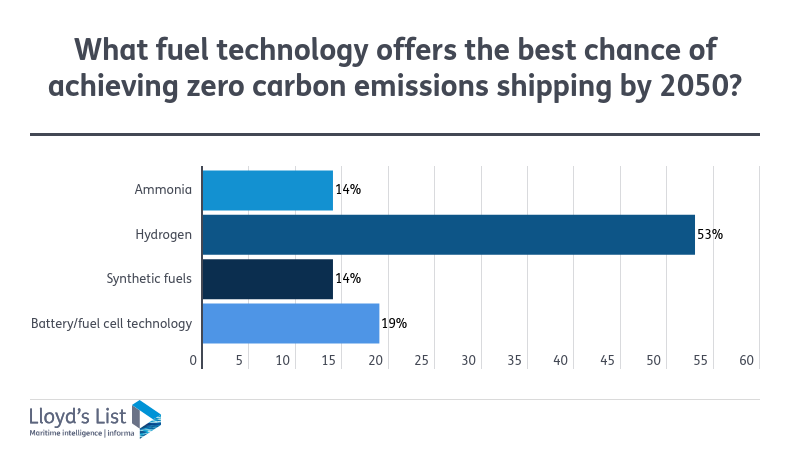

What fuel technology offers the best chance of achieving zero carbon emissions shipping by 2050?

Given the responses to the previous question, it was perhaps surprising that so many of our respondents considered hydrogen to be the answer.

Given a multiple choice it is perhaps an attractive option, but the reality is that hydrogen is still years off being a viable choice even in basic engineering terms, but the bigger block to its uptake is going to be the question of the energy supply chain itself. Without some rapid steps towards zero-emissions power generation on land, the production of hydrogen as a potential zero-emissions fuel is dead in the water.

Our panel agreed that collaboration across industries and governments would ultimately be required for any of the choices to be viable, but they also pointed out that a big issue for shipping will be how it competes with other sectors for these zero-emissions fuels.

Kathi Stanzel explains her thinking here: “For me, it’s the regulatory aspect that needs attention because we know how long it takes to get things through IMO, focusing on safety, making sure that all the members states of the United Nations are aligned. So, what we need is the political will to make this happen.

“I also don’t think that there’s going to a single solution in terms of fuels. There will probably continue to be horses for courses, as we say. So, batteries and fuel cells will be the answer for maybe the ferry sectors or the shortsea shipping sectors, whereas the blue water tonnage will be looking at something else… We need something now, there’s no excuse to sit back, relax and go, ‘We don’t have the perfect solution yet.’ We won’t have a perfect solution.”

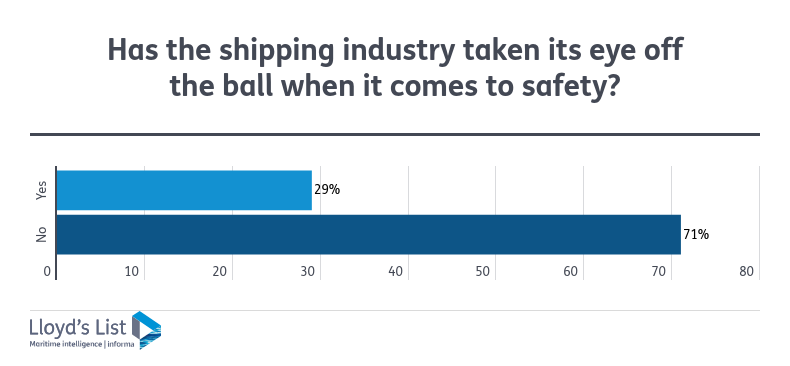

Has the shipping industry taken its eye off the ball when it comes to safety?

While the casualty statistics have not spiked, there have been enough safety concerns this year to make this a pertinent question worth considering. While it’s perhaps heartening to confirm that majority of the industry respondent don’t think it is the case that we have taken our eye off the ball, the fact that nearly 30% consider it to be an issue should be enough to sound alarm bells.

The discussion at our Forum focused on whether the green agenda had taken centre stage to the detriment of safety. With the focus on new fuels, new technology and new practices foremost in everyone’s minds, as DNVGL’s maritime chief Knut Ørbeck-Nilssen put it: “We have to keep safety as the prime concern.”

Shell’s Grahaeme Henderson said: “We should never ever forget that behind those statistics which trip off the tongue very easily, they are people and they are people like you and they’re people like me. I know when I’ve seen and experienced incidents around me, the impact it has on me and the impact it has on everybody. We all should work very strongly every minute of every day to make sure we get the safety right.”

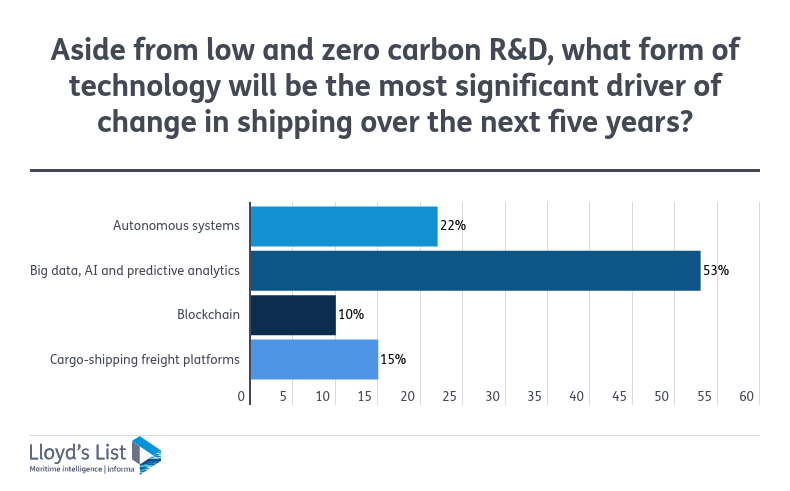

Aside from low- and zero-carbon R&D, what form of technology will be the most significant driver of change in shipping over the next five years?

While decarbonisation may have topped the agenda this year in terms of headlines and column inches, the other D, digitalisation, continues to pervade almost every aspect of the industry with varying degrees of complexity and completion on the horizon.

While the box sector has toyed with blockchain and the prospect of cargo-freight platforms is still a topic of conversation around the conference circuit, it seems that our respondents were cooler on their revolutionary prospects than many would have assumed. The autonomy development appears to have taken a more pragmatic turn over the past 12 months, but is still clearly in the minds of our respondents, but it was the big data, artificial intelligence and predictive analytics that came out top in this year’s vote.

As DNVGL’s Knut Ørbeck-Nilssen explained: “I would absolutely agree that artificial intelligence is one of the really very important opportunities going forward. We are carrying out so many manual repetitive tasks in the industry.

As DNVGL’s Knut Ørbeck-Nilssen explained: “I would absolutely agree that artificial intelligence is one of the really very important opportunities going forward. We are carrying out so many manual repetitive tasks in the industry.

“If you break down artificial intelligence to machine learning algorithms and you say that some of these repetitive tasks you can really train algorithms to perform on a large dataset.

“The bigger the dataset, the more accurate your algorithms will become. The faster decisions will be made and you will have a lot of improvements in efficiency. This is really a great opportunity.”

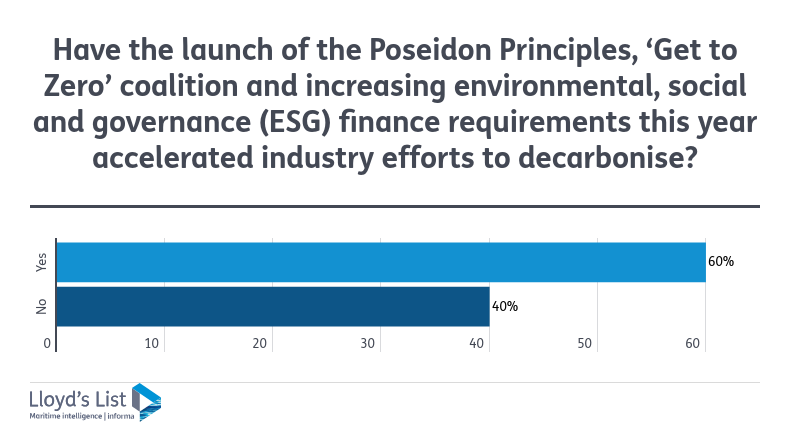

Have the launch of the Poseidon Principles, Get to Zero Coalition and increasing environmental, social and governance (ESG) finance requirements this year accelerated industry efforts to decarbonise?

Citi Bank’s Michael Parker debuts in our Top 100 most influential people in shipping this year on account of his leading role in the launch of the Poseidon Principles, an initiative that ties financial lending to climate impact that could — if developed, expanded and applied — lay new blueprints for shipping lending.

Meanwhile, the Get to Zero Coalition — a powerful alliance of more than 80 companies within the maritime, energy, infrastructure and finance sectors, supported by key governments and intergovernmental organisations — also gained traction this year. The coalition is committed to getting commercially viable deep sea zero emission vessels powered by zero emission fuels into operation by 2030 — maritime shipping’s moon-shot ambition, as they put it. And it seems that the majority of our respondents agreed that this activity represented a viable step in the right direction.

Grahaeme Henderson said: “I think the biggest threat is sitting back and waiting. What we should be doing is taking all the practical steps that we can now, and today, to reduce carbon emissions.

“We believe we can get up to 20% [emissions reduction] here and now. If you add to that things like Flettner rotor sales, wind sales, where we’ve done trials and have reduced the emissions fuel capacity by about 8%. You take air lubrication to reduce the friction underneath the hull of the ship, we’re putting that on our ships and we can reduce the emissions by 5%. If you take all of these relatively easily and today, we can reduce our emissions by something about 40% on new ships”

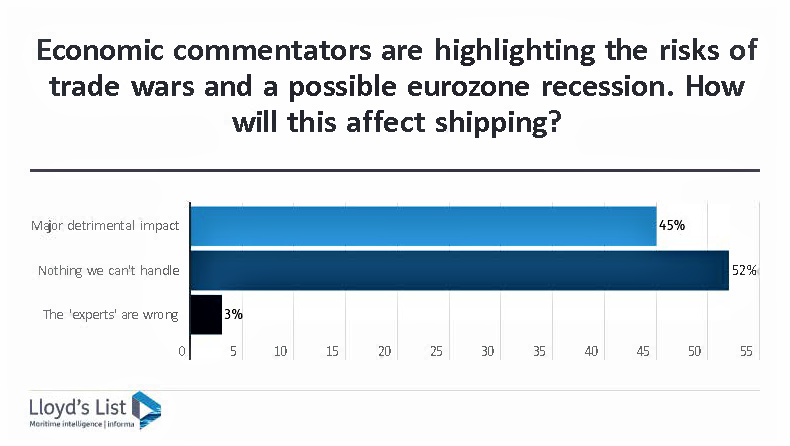

Economic commentators are highlighting the risks of trade wars and a possible eurozone recession. How will this affect shipping?

While a thin majority of our respondents fall into the stoic “nothing we can’t handle” camp, it’s fair to say that some amount of macro-economic disruption is clearly on the agenda for 2020.

Here’s how BIMCO’s chief analyst Peter Sand described the situation at our Forum: “The world economy is becoming much more protectionistic going forward. This is geopolitics in the real world.

“So, naturally slower economic growth and shipping, being a servant to that whole building of at least the emerging and developing economies right now, with a slowing economic growth especially there, it is likely to bring around a lower level of demand going forward.

“So, naturally slower economic growth and shipping, being a servant to that whole building of at least the emerging and developing economies right now, with a slowing economic growth especially there, it is likely to bring around a lower level of demand going forward.

“We have seen that for the last decade, coming around since the massive meltdown in the financial markets back in 2008. It’s been 11 years now but it’s still what we’re dragging along with, a lower level of what we tend to brand as the GDP to trade multiplier that is now halved from what it once was a decade ago. When we at the same time see slower growth going forward, it’s a double whammy.”

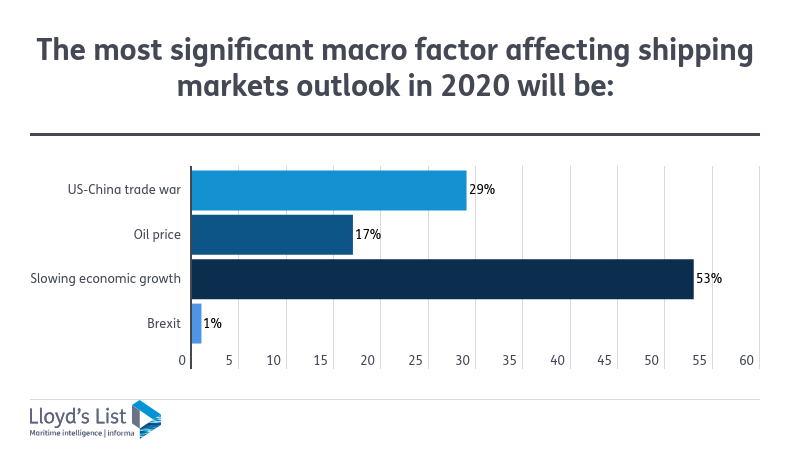

The most significant macro factor affecting shipping markets outlook in 2020 will be:

Unsurprisingly, given Peter Sand’s comments from the above question, the prospect of slowing economic growth outstrips all other concerns on the macro market outlook for next year. But let’s also not ignore the continuing impact of the trade war in shipping.

Suggestions that China and the US could finally be nearing some kind of trade deal is to be welcomed, but should also be treated with a dose of circumspection. A truce, which is allegedly imminent at the time of writing, after an 18-month-long trade war between the world’s largest two economies, presents a mixed short-term picture in different sectors of shipping.

As Peter Sand told the Forum: “I think we just need to accept that we’re working in a different environment going forward. Trade war or not; call it what you like. This is a thing that has come into the global trade now”.

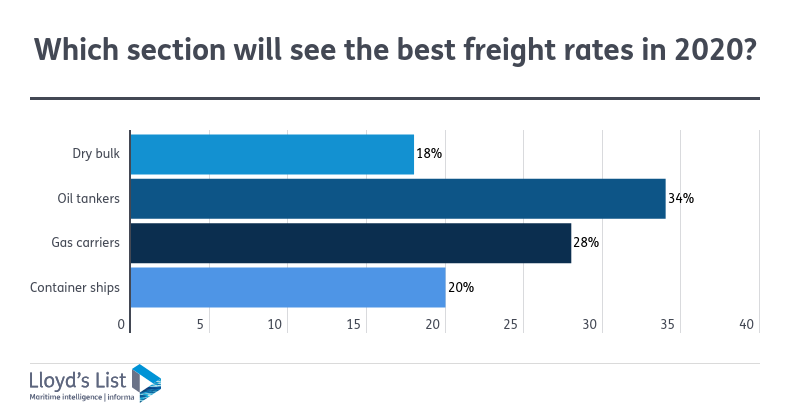

Which section will see the best freight rates in 2020?

The optimism surrounding gas trades was reflected in this year’s survey results, but the stand-out performer for next year promises to be tankers, according to Lloyd’s List readers.

Asked for her opinion on the result, Katharina Stanzel from Intertanko said: “It is 2020 in terms of the sulphur fuel situation that is probably going to add to that.

“ The competition here is awful, right? Dry bulk, containerships, they are all at appalling levels right now. Come 2020 they will face a barrage of issues as well. Oil tankers, in all fairness, it’s not fundamentally driven, it’s not like we have a very tight balance between supply and demand. This is geopolitics putting the freight rates on fire. Enjoy it while it lasts!”

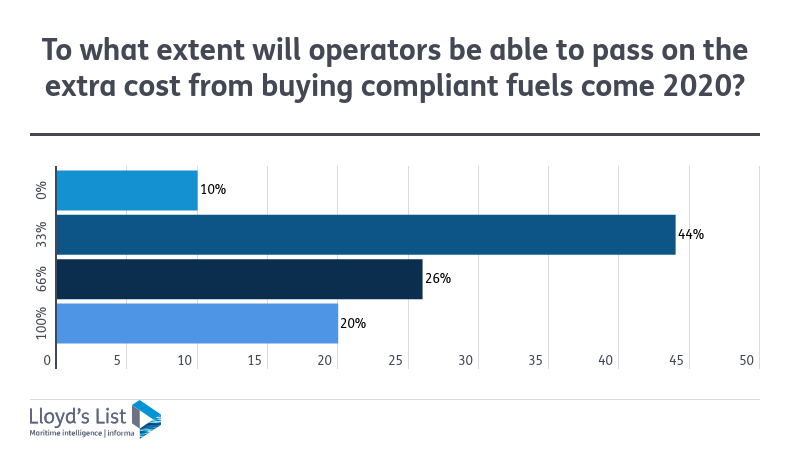

To what extent will operators be able to pass on the extra cost from buying compliant fuels come 2020?

Our final question was something of a test to see whether the industry felt that they would be able to pass on the cost of compliant fuels next year given the increased fuel bills headed their way. The answer, apparently, is, “sort of”.

Peter Sand’s take on the somewhat confusing response added a little clarity: “They need to be able pass on this extra cost to their clients. Naturally, just looking at container shipping in particular, where our members control almost 80%, it’s increasingly difficult trying to just explain how the bunker adjustment factor suits your purposes as a shipper particularly on this trade, why it’s different on this trade and different from this trade, regardless of the liners that are in the same alliance. It’s been Mission Impossible to try to explain this.

“It brings me down to the conclusion that it all depends on the negotiation power between any parties involved in any fixture.

“At the end of the day this a truly global, a competitive business and all freight rates are down on negotiation power. That would be the proof come 2020. How strong are you in negotiating and sticking to your guns and passing it on?”