In search of price-feasible ‘alternative’ marine fuel

OWNERS are feeling the pressure to reduce CO2 emissions, not currently taxed or regulated, from investors, clients and environmental groups.

The European Union is mulling options to potentially reduce emissions starting next year or 2024, and the International Maritime Organization is requiring owners to reduce CO2 emissions by 40% by 2030 from 2008 base levels.

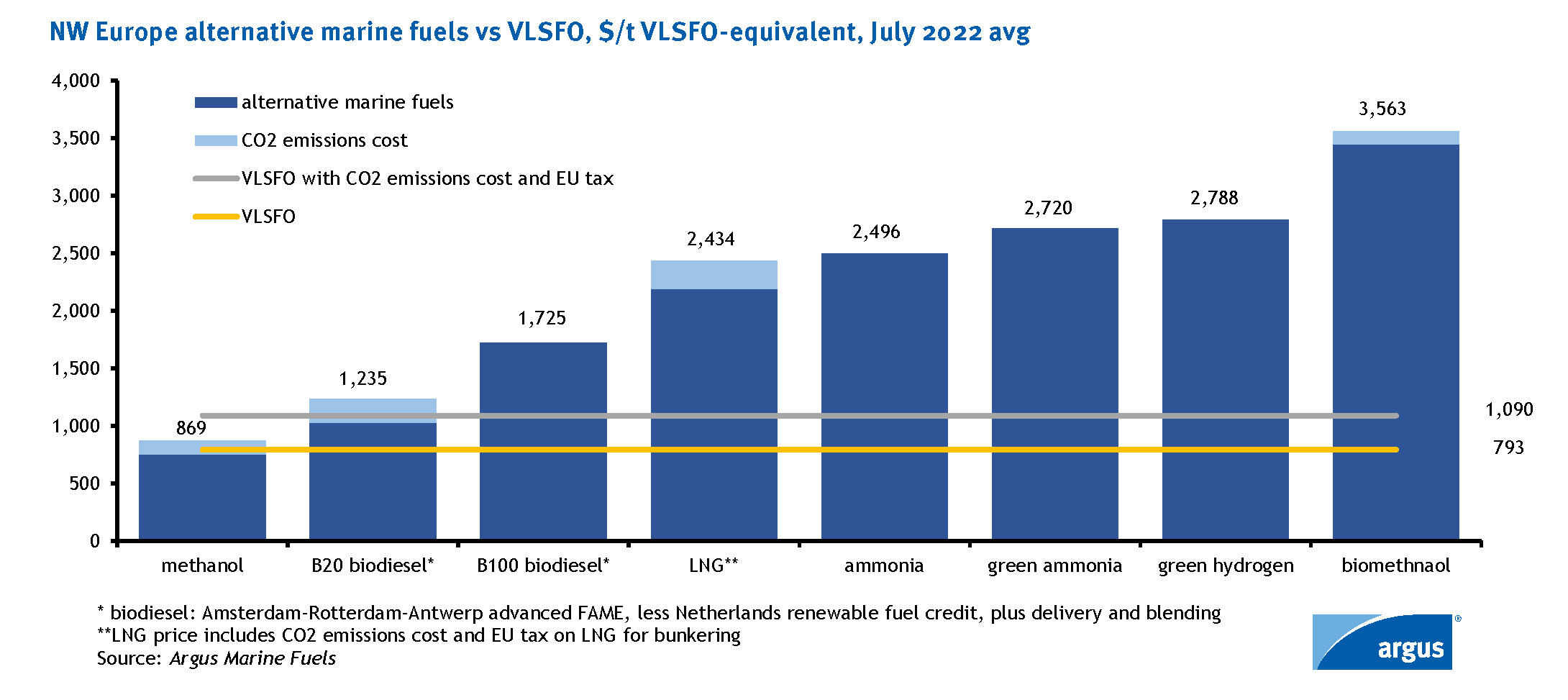

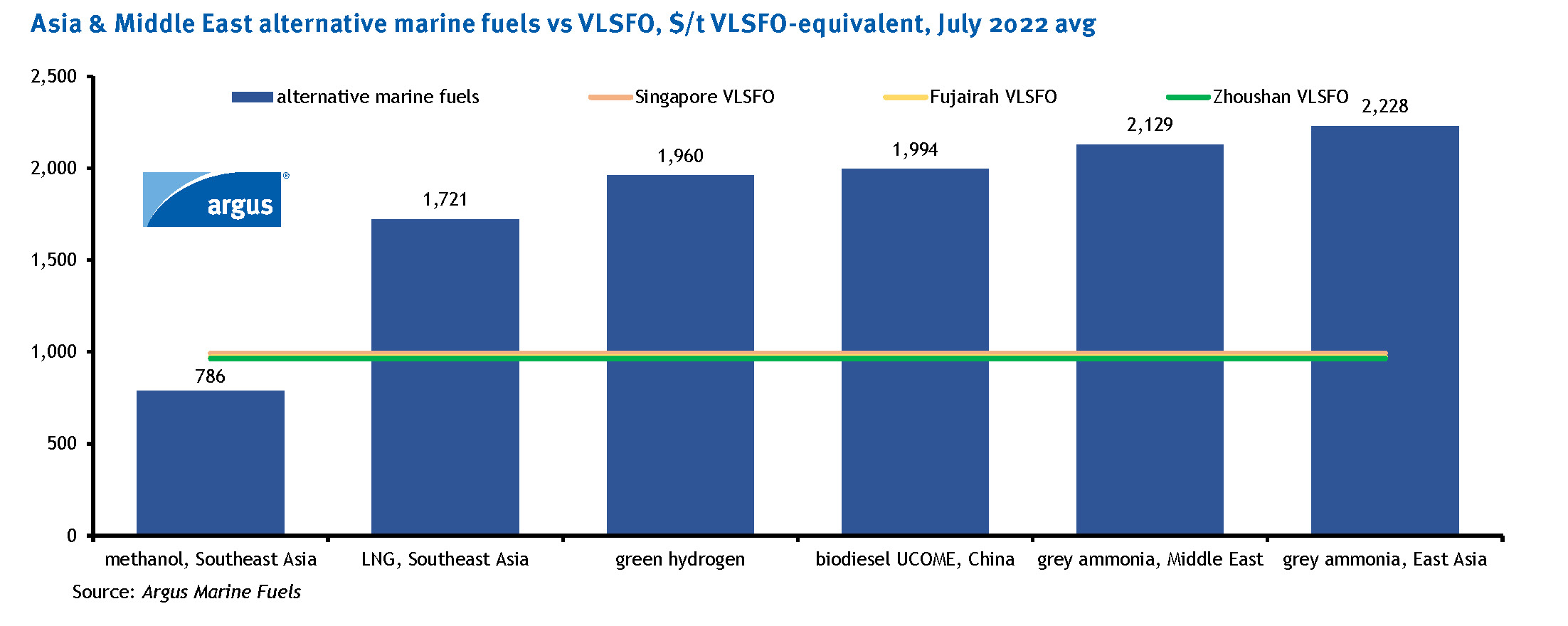

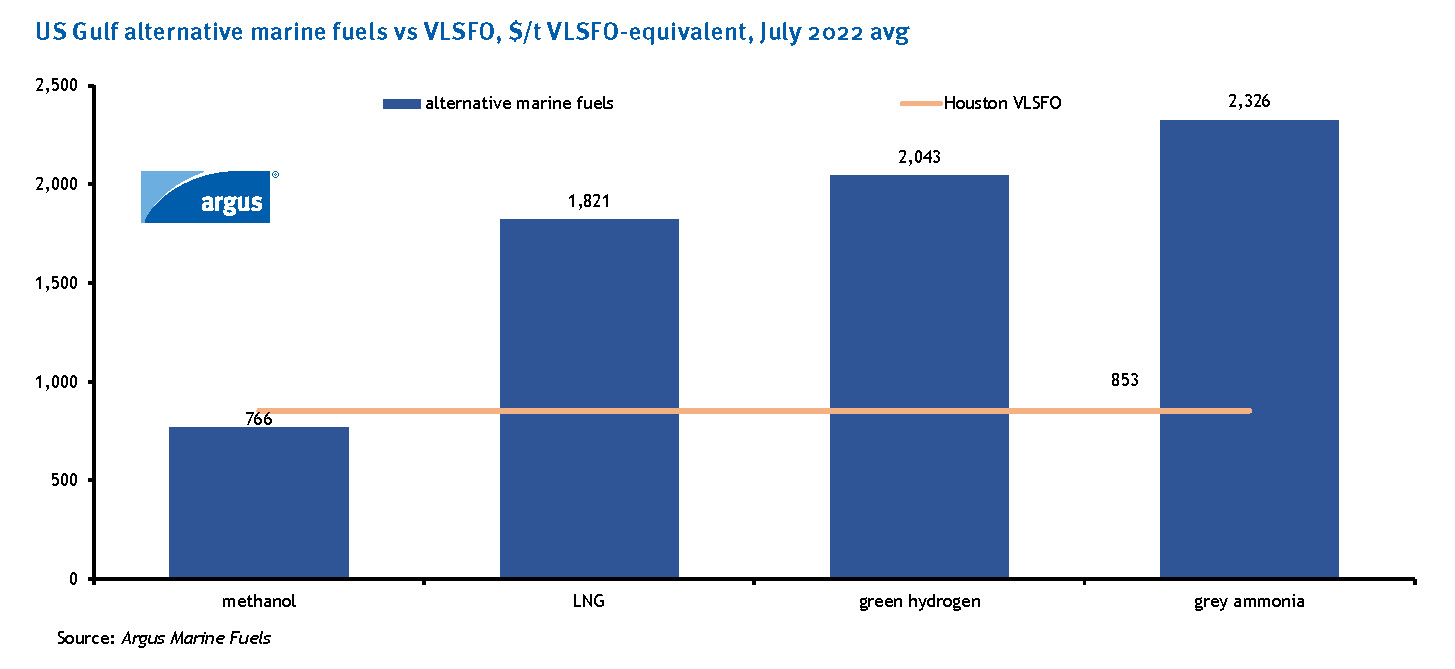

This article takes a snapshot of how methanol, ammonia, liquefied natural gas, biodiesel and hydrogen stack up against each other on price and explains current supply-demand fundamentals driving price movements.

Methanol

Grey methanol was the only alternative marine fuel priced below very low sulphur fuel oil (VLSFO) in July. Methanol prices have been moving sideways to slightly softer on tepid demand and stronger production.

India’s methanol demand has been dampened by the ongoing monsoon season. Europe’s domestic methanol production improved as Norwegian energy major Equinor’s methanol unit returned to production at the end of July, following a near three-month outage. Malaysia’s Petronas returned from a planned outage, which began in mid-May and ended in July. Chinese methanol in the third quarter is expected to be no lower than the second quarter, but there is little confidence in how much it could grow.

Ammonia

Ammonia’s price premium to conventional marine fuels is likely to remain wide for the remainder of the year, thanks to higher natural gas prices and an expected rebound in fertiliser demand in the autumn/fall. In July, northwest Europe grey ammonia was assessed at three times the price of VLSFO, and at slightly more than twice the price of marine gasoil (MGO) sold in Amsterdam-Rotterdam-Antwerp, Argus assessments showed.

Prices for natural gas, a feedstock for ammonia, are not expected to ease for the rest of 2022, as the market responds to concerns Russia will continue to squeeze or cut natural gas exports to Europe.

Western European ammonia producers continue to scale back output in response to the higher prices, and increasingly are seeking imports from lower-cost sources. Germany’s BASF, for example, plans to cut its ammonia production in the event of gas supply shortages.

Separately, US agricultural chemicals producer LSB Industries expects higher corn prices — driven by supply concerns from South America and the western US, coupled with strong demand for corn in China and resilient ethanol demand in the US — to support farmer earnings and higher ammonia pricing through the fourth quarter and into 2023.

LNG

Northwest European LNG for bunkering demand has taken a hit, after the average LNG premium to conventional marine fuels widened to $1,400 per tonne in July, nearly triple the price of VLSFO.

The EU has made progress in its drive to diversify its gas supplies, but those efforts are unlikely to fully substitute for missed deliveries from Russia, even if Norway and Azerbaijan are able to maximise exports, the International Energy Agency warned.

The European Commission mandated gas consumption cuts from industries able to switch fuels, starting in August and continuing through March of next year. Additional reductions could be found through auctions, tenders and interruptible contracts, with industries offering gas consumption reductions in return for compensation. To preserve LNG for heating this winter, European countries could disincentivise LNG for bunkering.

Biodiesel

Shipowners have been eyeing biodiesel as a plug-and-play fuel option. By comparison, other alternative marine fuels — LNG, methanol, ammonia and hydrogen — require a vessel retrofit.

Advanced biodiesel FAME, derived from renewables and sold in the Netherlands’ major bunkering ports of Rotterdam and Amsterdam, enjoys government subsidies. In July, the Netherlands’ subsidy reduced the outright advanced biodiesel price from $2,750 per tonne to about $1,725 per tonne, or more than double the price of VLSFO.

Shipowners have been testing B20-B40 biodiesel and fuel oil blends as a way to reduce CO2 emissions while keeping the price below that of biofuel with 100% purity. A B20 blend, comprised of 20% advanced FAME and 80% VLSFO, in July would have cost 1.3 times the price of VLSFO.

Outside of western Europe, biodiesel for marine fuel use is not yet subsidised.

Hydrogen

Hydrogen is deemed by marine shipping a beyond 2030 fuel option.

In August, the US Senate passed the Democrats’ Inflation Reduction Act, which would enact a long-awaited hydrogen production tax credit of up to $3 per kg. But the tax credit alone would not guarantee the development of the US’ green hydrogen market. Mass deployment of renewables would be needed to support increased electrolysis capacity, while some regard electrolyser manufacturing capacity itself as a potential bottleneck.

Argus Media, Lacon House, Theobald’s Road, London, WC1X 8NL, Tel: +44 20 7780 4200 | sales@argusmedia.com

Stefka Wechsler is the Editor, Argus Marine Fuels | Stefka.wechsler@argusmedia.com