Chinese crude demand to contract for ‘first time this century’, says IEA

Forecast crude supplies will struggle to meet demand in 2023, which will surpass pre-pandemic levels

Chinese imports underpin the health of VLCC demand, with falls adding pressure on the segment, with charter rates below breakeven levels for more than 18 months

THE International Energy Agency has forecast that China’s oil demand will contract in 2022 for the first time this century, adding further pressure on charter rates for the very large crude carrier tanker segment.

Demand headwinds continue to weigh on the 900-strong fleet of tankers, already battered by pandemic-induced, loss-making spot rates for more than 18 months.

News that the world’s biggest importer of seaborne crude and largest charterer of VLCC tonnage will be shipping less over the remainder of the year as it implements zero-Covid policies is another negative.

Chinese oil demand for 2022 was revised down to 15.4m barrels per day, 130,000 bpd lower than last year, according to the IEA’s monthly oil report.

However, China is expected to drive demand growth next year, with the IEA estimating global consumption to surpass 2019’s pre-pandemic level, rising to 101.6m bpd. About half of the world’s oil consumed is shipped by sea.

This year’s demand estimate was revised slightly higher on the prior month, to 99.4m bpd, which is 1m bpd below 2019.

Some 76% of China’s seaborne crude imports are delivered via VLCCs, Lloyd’s List Intelligence data show. Between 195 and 220 tankers called monthly discharging between 9.7m bpd and 10m bpd over January-May.

Average time charter rates for VLCCs are currently assessed at minus $21,000 per day for older, less fuel-efficient types, according to shipbroker Braemar ACM.

Rates can be higher, at about $12,000 daily, for newer ships with sulphur abatement technology that allows them to use cheaper high-sulphur marine fuel oils.

The supply of crude will struggle to keep up with demand next year, the IEA concludes, with additions from Saudi Arabia and the United Arab Emirates leaving “wafer thin” spare capacity.

Production cuts agreed in April 2020 by 23 oil producing nations that are members of the Organisation of the Petroleum Exporting Countries and their allies will be fully unwound by September, the IEA estimated.

This will partially compensate for cuts to Russian crude output and add to VLCC business in the Middle East Gulf.

Economic sanctions on Russia’s crude and shipping sector are recalibrating global oil flows and have disrupted diesel trades, adding tonne miles to tanker shipping, especially for smaller aframax tankers that can load from Russia.

This has improved prospects for smaller tanker types and the global fleet of product tankers, especially medium range tankers.

Demand for middle distillates including gasoil, jet fuel and diesel will outpace the production capacity of refineries into 2023, the IEA said.

This volatility is another positive for MR tankers, whose spot rates benefited most from oil market disruption since Russia invaded Ukraine on February 24.

Refinery activity “is set for a solid recovery”, another positive for product tankers.

“The extent of the impact of higher prices, macroeconomic factors and policy drivers on oil consumers will become clearer during the year,” the IEA said, noting demand destruction for gasoline in the US and Europe. “The rate at which the Chinese government relaxes its measures to fight Covid and the speed of the subsequent demand response remain sources of considerable uncertainty with significant downside risks.

“However, if consumption in developed countries is stronger than anticipated and China’s economy reverts to growth in short order, oil demand could surpass our projections.”

Increased jet fuel consumption was so far compensating for worsening economic outlook in Europe, according to the report.

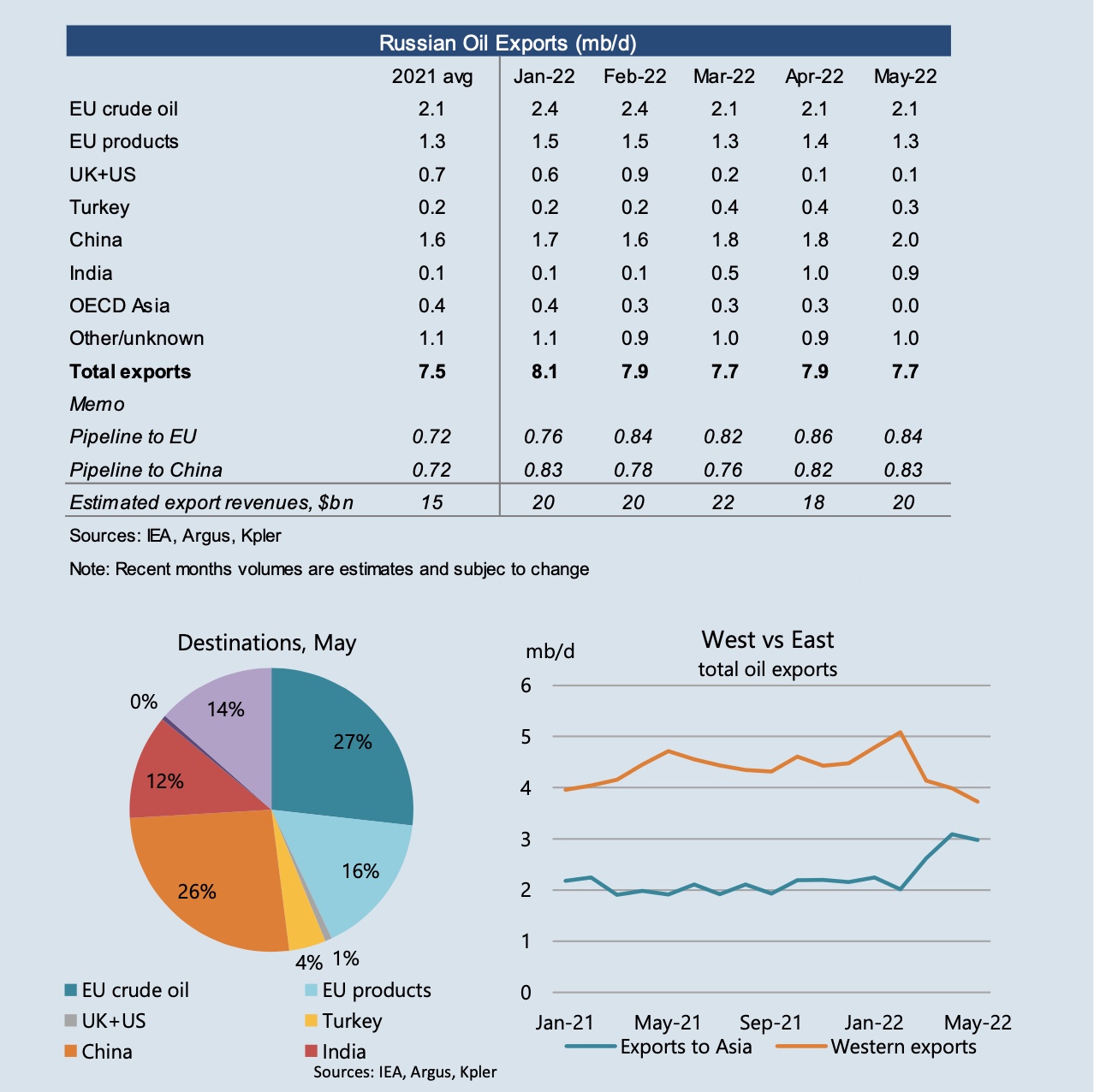

Russian crude exports “remained resilient” over May. Average annual output of crude, condensate and NGLs was estimated to fall by 500,000 bpd to 10.37m bpd this year. Some 3m bpd of Russian production would be shut in over 2023, dropping the country’s oil supply to 8.7m bpd.

Russian exports to the European Union 27 member states dropped by 170,000 bpd to 3.3m bpd over May, according to the IEA, with overall crude exports assessed at 7.9m bpd in April.

Increased shipments to China from Russia reached 2m bpd for the first time and offset falls in export volumes to Europe.