Tanker earnings downgraded as recovery stalls

Seven of the eight listed tanker companies covered by investment bank Evercore ISI are projected to be unprofitable this year as ‘putrid’ rates seen at loss-making levels

Only a ‘black swan event’ can derail 2023 earnings rebound as higher rates return owners to black, says investment bank

EVERCORE ISI has revised lower its tanker earnings forecasts for 2022 and projected that seven of the eight listed shipowning companies it covers will be unprofitable this year as the long-anticipated market recovery stalls.

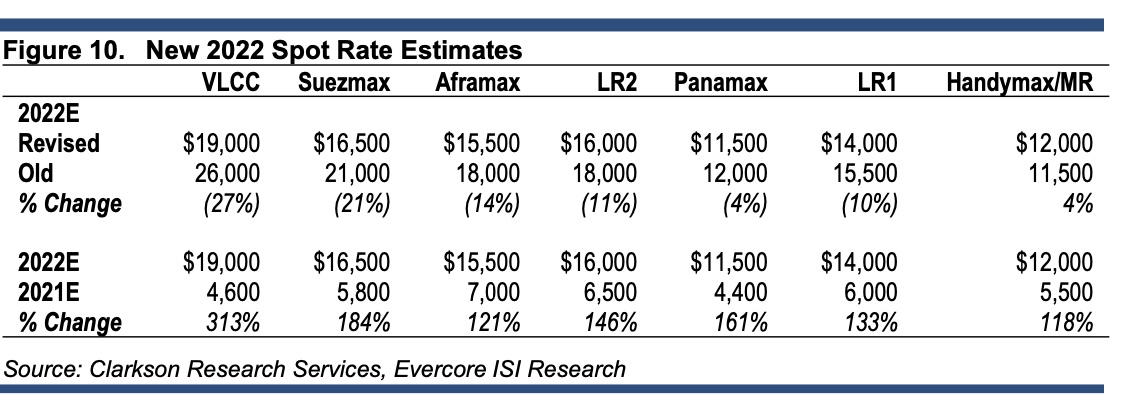

Average earnings estimates for very large crude carriers for 2022 are now at $19,000 per day, 27% lower than forecast in late 2021. New rates estimates for suezmax tankers are at $16,500 daily, a 21% downgrade.

Long range two, aframax, long range one and medium range tonnage also saw downward shifts in estimated average earnings of between 14% and 4%.

Most of the pain will be seen in early 2022 said Jonathan Chappell, senior managing director for the New York investment bank’s Surface Transportation & Marine Transportation Equities, describing the current rates environment as “putrid”.

Tanker companies would return to profit in 2023, according to Evercore’s 2022 tanker outlook.

“The slow release of Opec barrels, short-term mobility impact of Omicron, and perpetual inventory draws through much of the northern hemisphere winter continue to weigh on the spot markets, creating excess capacity that continually shows no signs of creating a floor,” Mr Chappell said in the report. “As such, our 2022 quarterly spot rate forecasts are back-end loaded, as we expect normal seasonal trends to be disrupted by a slow and eventually accelerating lift off the bottom as the year progresses.

“If the quarterly progressions play out as we presently project, most companies should be ending this year in the black, or close to it, setting up well for a more triumphant return to profitability in 2023.”

Only a black swan event could derail a recovery in 2023, the report concluded, as increased oil supplies and demand at pre-pandemic levels boosted tonne-miles for the global tanker fleet amid constrained capacity growth.

Tonne-mile growth would outpace fleet growth for the next three years, according to the bank. Net fleet growth was forecast at 2.1% in 2022 and 0.6% in 2023, attributed to the small number of tankers on the newbuilding orderbook.

Torm, the Danish product tanker owner, was the one company projected to operate profitably this year, according to the report, “with the potential for that figure to eventually turn red pretty high”.

Highly leveraged tanker owners Scorpio Tankers and Frontline were singled out as at risk of liquidity issues if the prolonged slump in rates since the third quarter of 2020 continued beyond 2022, the report said.

“If we are still writing about imminent inflection points in 12 months, the financial leverage of Outperform-rated Frontline and Scorpio Tankers could cause some liquidity issues,” the report said. “If our base case is correct, this leverage would work in the opposite manner, likely resulting in substantial outperformance of these shares.”

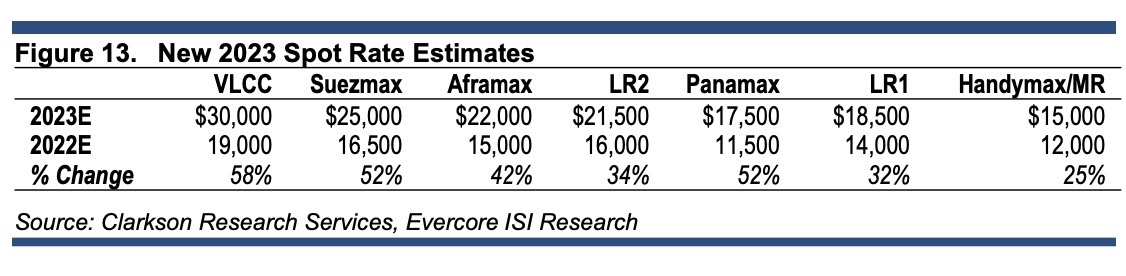

Evercore forecast that in 2023, VLCC rates would gain 58% year on year to average $30,000 per day, with suezmaxes 52% higher at $25,000 daily and aframaxes at $22,000, a 42% gain.

This would return all eight companies covered to profit, the report said. That also included Ardmore Shipping, Double Hull Tankers, Euronav, Nordic American Tankers, and Teekay Tankers.

The report said “there was nothing close to liquidity risk” for investors exposed to Euronav, Teekay Tankers and Ardmore Shipping.

The report cited many caveats for its outlook, amid financial, economic and geopolitical uncertainty.

“Absent myriad wild cards, some potentially good (lifting of Iranian sanctions, Russia/Ukraine escalation) and some potentially bad (new Covid variants delaying a demand recovery, China/Taiwan escalation), the longer the tanker market remains in the doldrums because demand recovery is being met by persistent inventory drawdowns, the greater the magnitude of the eventual rebound when new oil/product supply accelerates to meet not only increasing consumption levels, but also to restock inventories that are approaching dangerously low levels,” according to Evercore.

It also cited a widening divide between the more well-capitalised companies and those most exposed to the market downturn.

However, it ruled out dilutive equity raises based on cash flow and debt repayment assumptions, but excluded at-the-market offerings that were often “completed under the radar”.