Owners with upper hand keep boxship charter rates at record highs

Longer terms and higher rates to charter containerships seen extending throughout 2022

Regional carriers seen most impacted by elevated market conditions as they lock into deals for smaller tonnage beyond anticipated duration of strong freight rates

CONTAINERSHIP chartering rates are set to remain at record-breaking levels throughout 2022 on a critical shortage of tonnage, allowing owners to leverage longer hire periods as some carriers seek advance deals for existing vessels that are not available until 2023.

“We’re doing deals we couldn’t have imagined three months ago,” one shipbroker told Lloyd’s List, attributing continued high demand for vessels partly to longer-lasting supply chain and inland logistics challenges in importing countries.

“Three to four months ago, we all thought that port congestion problems would probably be resolved in the first half of 2022, and we would have a slow return to normal, yet we still have a firm container market because there are essentially very few newbuildings being delivered this year.

“Then in 2023 peak tonnage would start (delivering) and then we would see a softening of charter rates, not back to pre-coronavirus levels but a more normal market. But the tune has changed.”

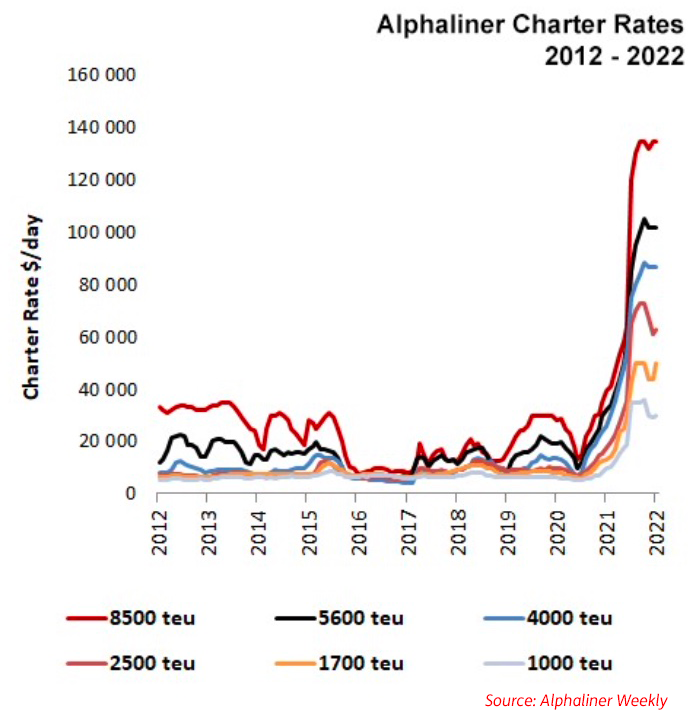

After pausing super-charged growth in October, charter rates remained elevated and have posted gains in January’s first half, as demand for vessels continues to outpace supply as lockdowns, cancelled sailings, supply imbalances and port congestion wreaks havoc on schedule reliability and extends sailing times.

Twelve-month deals for containerships with capacity between 5,700 teu and 6,500 teu exceed $100,000 daily, more than three times levels seen 18 months ago, the latest ConTex index assessments show.

Unlike the dry bulk and tanker markets which have an active spot market, single-voyage terms for boxships are extremely rare.

Short-term charters are viewed as six to 12 months’ duration, with longer periods more commonplace as container lines typically operate a mixed fleet of chartered and owned tonnage on dedicated routes and need greater certainty.

Container lines are now approaching non-operating owners about boxships that do not come off charter until 2023, offering to fix forward at a slight discount, another shipbroker told Lloyd’s List.

“We’ve seen a few deals but it’s not something we could call a trend yet; we may start to see some of that after the Chinese New Year,” they said.

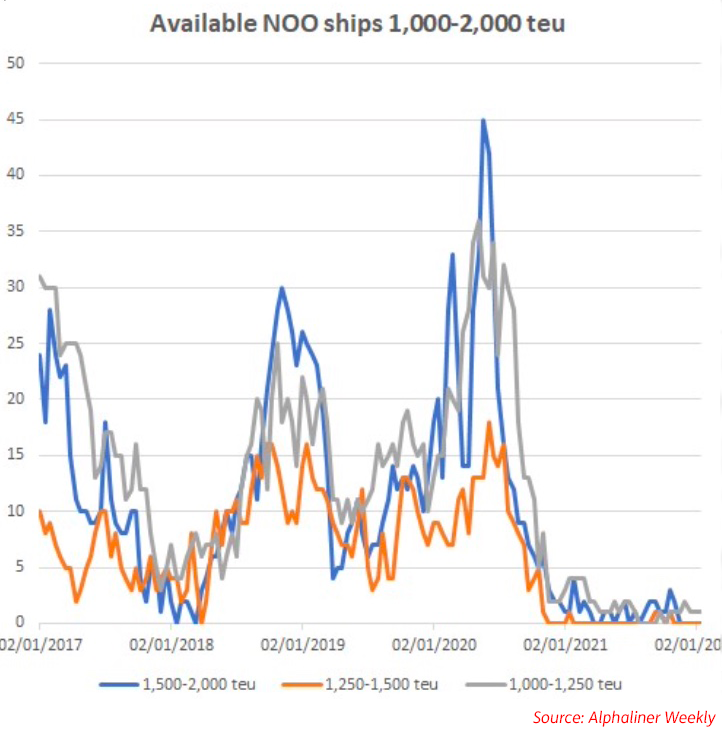

Most of the containership fleet of 6,000 teu and above are either owned by lines or tied up on longer-term charters, with limited availability for new charters also curbing deals, which have focused on smaller segments of 4,250 teu capacity or lower. The overall fleet is 6,600 ships.

Although interest is on larger sizes, “less than a handful” will be physically available with charters expiring in 2022, Lloyd’s List was told.

“Rates will remain at exceedingly elevated levels as they basically topped out several months ago,” said Lars Jensen, chief executive of containership consultancy Vespucci Maritime. “The game is more on the terms of the fixture period, and it seems the norm is now getting to three years and beyond if you want to get your hands on any vessels at all.

“I do not see that abating because the underlying driver here is that all the carriers are opportunistically putting more services into transpacific (Asia-US west coast trades) and in Asia-to-Europe, which is where a lot of these ships ended up.

“As long as we don’t have enough big ships on these deepsea trades, this pressure is going to continue on the smaller vessel sizes. “The pressure on the deepsea trades depends on whether we can resolve the bottlenecks.

“The short answer to that is ‘no’, that is highly unlikely to happen and in the next couple of months, it’s just going to get worse.”

Charter rates continue to evolve at historic highs particularly in the 1,700-2,800 teu sizes, according to Alphaliner, the research consultancy of Paris-based shipbroker BRS.

“Shipowners remain very bullish for the coming months, on the back of a persistent lack of ships and continuously positive signals on the cargo front,” it said in its latest weekly report. “Although demand might falter throughout the Lunar New Year in February, it is expected to pick up again afterwards.

“How long the bonanza will then last is up for discussion, but it is unlikely that the current environment will change until at least until the second half of the year.”

Regional lines — rather than the larger carriers operating on larger, international trades — face the most pressure from these extraordinary market conditions, according to Mr Larsen.

“You are going to see a number of regional players being tied into much higher (chartering) costs for years, even when this crisis is then over,” he said, before recounting the experience of one line.

“They had one of their vessels come off charter and obviously wanted to extend it. They were given a price by the owner, and they said, ‘You’ve got to be nuts, we’re never going to pay that much amount of money.’ And so they lost the vessel.

“Then vessel number two came up for renewal, and it was the same story. Vessel three came up for renewal. Same story. When vessel four came up they had to pay the price and sign up for three years. Because what are you going to do?”

Freight rates that have soared by as much as 466% on Asia-Europe trades over the past year have also supported a robust sale-and-purchase market, with economics making it cheaper to buy a boxship than charter it in the latter half of 2021.

However, there are now fewer candidates for sale, shipbrokers told Lloyd’s List.

“To some extent the (S&P market) will be different this year as it has matured,” one said. “We have taken away a lot of the sellers who for legacy reasons would sell.

“You had hedge funds that took over loan portfolios on whatever cents on the dollar (back after 2008) and, then kept the ships for a while. These were sold off and they couldn’t believe that they could sell the tonnage that they wanted. Now we’re now back to people who can afford to sit and wait.”

Speculators are still seen buying old ships, executing one-year charters at super-high rates that will depreciate the vessel “down to scratch in the first year,” the shipbroker added.

The pace of demand growth for the container sector remains uncertain, and alongside supply chain congestion is seen as one indicator of elevated chartering rates duration.

A faster return to normal consuming patterns which would increase spending on services and travel would see demand rise around 3-4%, Lloyd’s List was told. Growth would be higher if the Omicron variant lingered, as this would delay the return to more balanced consumer spending behaviour for goods and services.