Boxship sales hit $1bn in June

Rates have gained so quickly that owners are seeking longer-term charter periods, skewing traditional indices as the rise and rise of the boxship sector sets new records weekly

Of the 47 containerships sold in June, 29 were feedermax size, according to Piraeus shipbroker Golden Destiny

SALES of containerships topped $1bn in June as demand growth in box trades stoked record-breaking charter rates amid a shortage of feedermax vessels to help lines manage congested ports and container imbalances.

Scarcity of fixable ships means charter rates are now reaching levels at which they are skewing traditional indices, said Hamburg-based Verband Hamburger und Bremer Schiffsmakler in its weekly report.

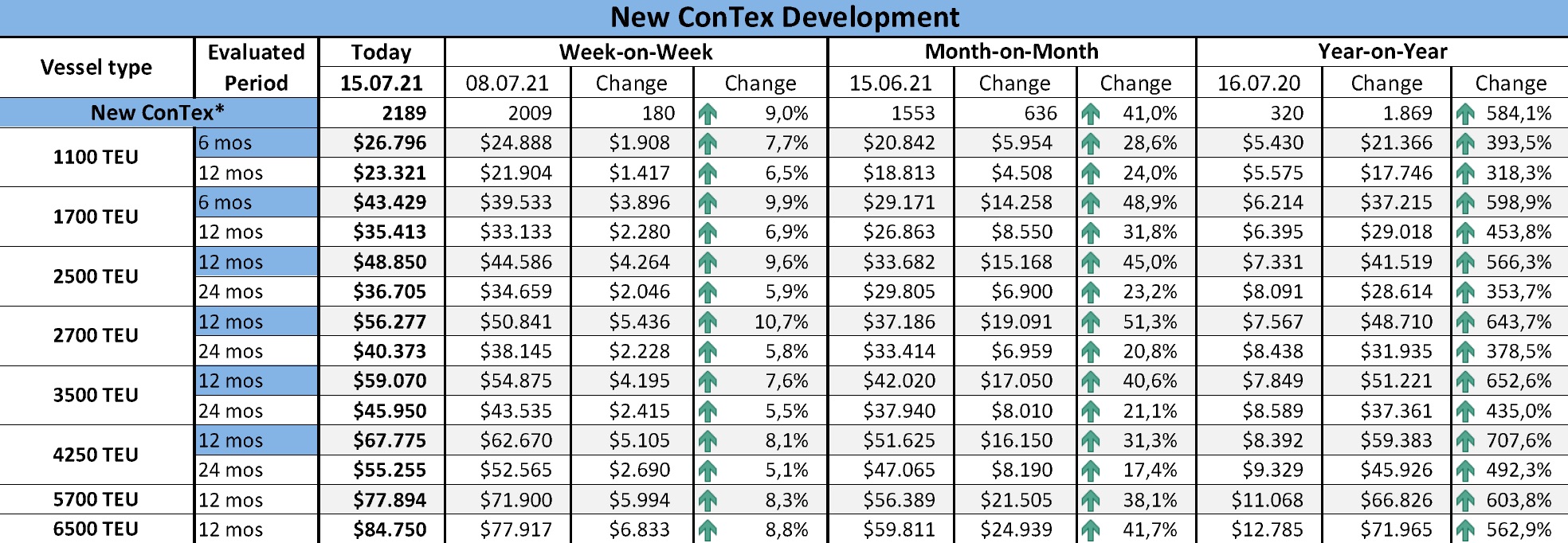

The association of Hamburg and Bremen shipbrokers produces a weekly assessment via its ConTex indices of eight different ship sizes over 24-, 12- or six-month periods.

Owners seeking to fix boxships for as long as possible at the market peak has seen most periods set at three-year or five-years, according to VHBS.

Longer-term rates were decoupling from shorter periods challenging the methodology behind indices assessments and “the evaluated periods are not really representing the physical market any more,” the report said.

The frenzy for boxship tonnage also translated to some 1.1bn of the vessels sold in June, up 34% month on month, according to Piraeus-based shipbroker Golden Destiny’s monthly report.

Containerships comprised 24% of all second-hand sales in June, with 47 vessels sold, the shipbroker said.

Of these 12 sales were confidential, with total invested capital for the remaining 34 vessels said to be worth $827mn lifting the total figure over $1bn.

Of these 47 ships, 29 were in the feedermax category (of 2,000 to 3,000 teu), signalling the rising popularity of the flexible-sized ships.

They are also commending rates at about $75,000 per day, based on fixtures reported by brokers.

The 2007-built, 2,741 teu Posen (IMO: 9349887) was chartered for 12 months for $75,000 daily while Interasia Lines took the smaller and younger Hansa Colombo (IMO: 9357781) for three years at a daily rate of $28,000.

Rates are up between 10.7% and 5.5% week on week, and between 45% and 17.4% higher on the month-ago period, and as much as seven times the going rate 12 months ago, according to VHBS.

Negotiations were said to be “fierce” according to one broker report, with “robust hire levels are being posted for short period and those ‘short periods’ continue to stretch out further”.

In June, 102 bulk carriers and 34 tankers were also sold, with total sales of all three categories at $3.4bn according to Golden Destiny.