Tanker scrapping to rebound from 23-year low

Gap between resale value and scrap price for larger tankers narrows to $4m from $10m at the end of 2020, while sale and purchase market also weakens

More than 90 vessels in excess of 34,000 dwt are forecast for scrapping in 2021, compared with only 25 last year, shipbroker says

TANKER scrapping in 2021 is forecast to rise from a 23-year low as poor earnings, regulatory pressure, higher steel prices and the lack of floating storage close the gap between resale and demolition prices.

Three very large crude carriers have already sold for demolition in 2021, according to Paris-based shipbroker BRS, which estimates the rebound will see some 93 tankers above 34,000 dwt sent to breakers’ yards this year.

They include 25 very large crude carriers, 14 suezmaxes, 21 aframax tankers, two long range two vessels and 18 medium-range tankers, the shipbroker said in its weekly Alphatanker newsletter.

Some 25 tankers of more than 34,000 dwt were scrapped in 2020, according to Alphatanker.

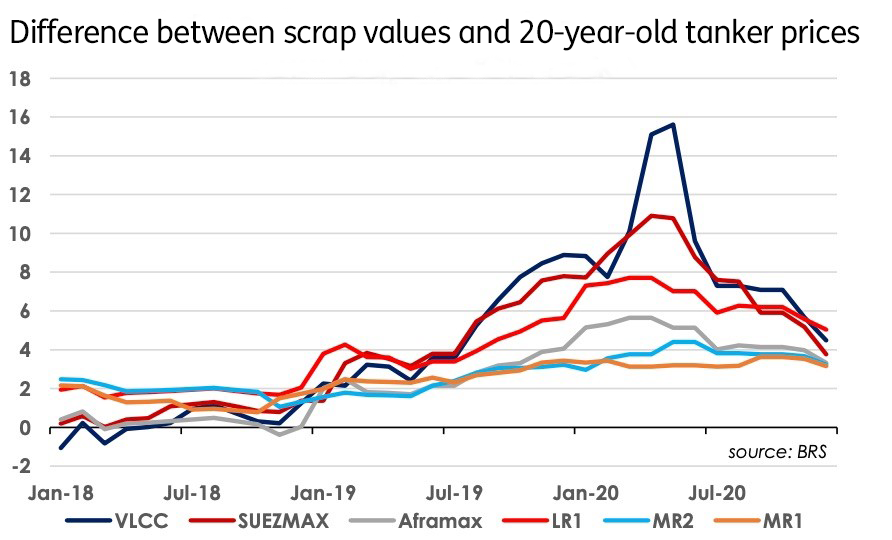

“Perhaps the most important development during the past few weeks, which has motivated tanker owners to consider demolition, has been the narrowing delta between scrap prices and resale prices for vintage tankers,” the report said.

“Six weeks ago, scrap prices were significantly below secondhand tanker prices but since then scrap prices have firmed while resale prices have weakened.”

Record volumes of vintage tankers sold to anonymous owners using them to ship sanctioned crude over the past 18 months has been attributed for skewing resale values last year, with owners including Frontline noting the trend.

By last November the difference in price between the resale and scrapping value was as much as $10m, with owners of elderly tonnage preferring to sell them for alternative use.

However the scrapping price for larger tankers in Bangladesh has gained 9.6% so far this year, data from the Baltic Exchange shows.

Bangladeshi yards were paying $468.75 per light displacement tonnage the exchange’s January 15 assessment showed, although cash buyer GMS pegged levels closer to $450/ldt.

BRS said scrapping prices for Bangladesh, India and Pakistan averaged $453/ldt, compared with $365/ldt at the beginning of December.

Rates had slumped as low as $298/ldt in July exchange data shows, after many yards closed because of coronavirus concerns and extraordinarily high freight rates for tankers discouraged recycling.

“Secondhand prices for vintage crude tankers have softened over the past six weeks driven by a surfeit of vintage tonnage on the sale and purchase market,” BRS said.

Resale prices for a vintage VLCC at $21.4m were $4m higher than scrapping prices, but operators needed to consider investments in ballast water treatment systems — a similar amount — as special surveys were due at the 20-year mark, it said.

The Alphatanker report has not changed scrapping estimates despite the rising steel price, which it noted could reach as high as $500/ldt if China restarts scrap steel exports that were suspended in 2019.