Tanker rally muted as stocks curb crude seaborne shipments

Oil demand is rebalancing over the past quarter, but traders are forecast to release as much as 100m barrels to the physical market when floating storage contracts expire

Tanker earnings currently at 2020 low as production cuts and a slower-than-anticipated rebound in oil demand seen ahead of the seasonally strongest fourth-quarter rally

THERE are signs of a muted fourth-quarter rally for crude tanker markets, even as oil demand recovers, with refineries estimated to draw down above-average global inventories to meet supply shortfalls.

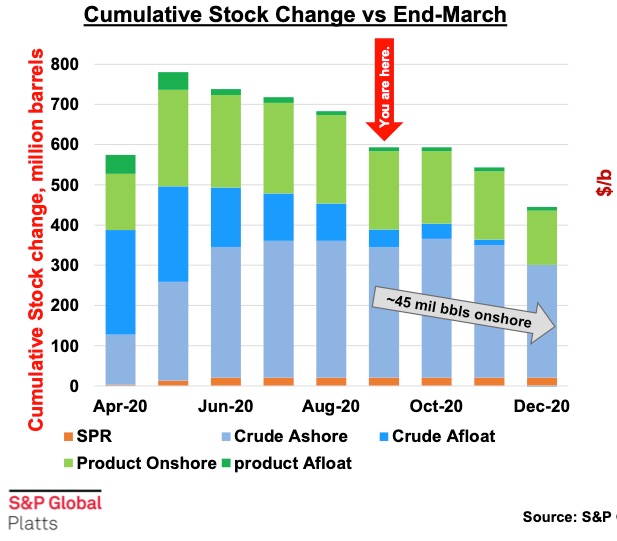

The cumulative stock change — which calculates additional barrels added to global inventories since March — has declined from the May peak of around 800m barrels to 600m barrels, the S&P Global Platts European Refining Virtual conference heard.

Along with oil held on tankers used for floating storage, these inventories are expected to be sold into the physical market from October, displacing seaborne exports from producing countries that are shipped to refineries.

That suggests that earnings for the seasonally strongest fourth-quarter may not reach owners’ expectations, especially for the global fleet of some 770 very large crude carriers currently trading that typically lead rates direction.

Onshore crude inventories were forecast to draw by a further 45m barrels by the end of the year, Platts energy analyst Nicole Leonard told the conference.

She also estimated that US shale oil production would fall by 3.1m barrels per day within a year, and there would be a 5.6m bpd worldwide crude shortfall that the Organisation of the Petroleum Exporting Countries plus their allies would need to plug from December.

That compares with the 21m bpd of excess supply emanating from the 23-nation Organisation of the Petroleum Exporting Countries-plus alliance in April, at the height of coronavirus lockdowns that caused demand to plunge on an unprecedented scale.

“Opec is going to save the day in 2021 when US shale demand collapses, and is unable to produce at previous levels,” Ms Leonard said. But until then there was a gap between demand and the supply of oil from the cartel and its allies.

As well as onshore inventories and floating storage to meet the deficit, some 6m bpd of oil production was offline due to geopolitical tensions.

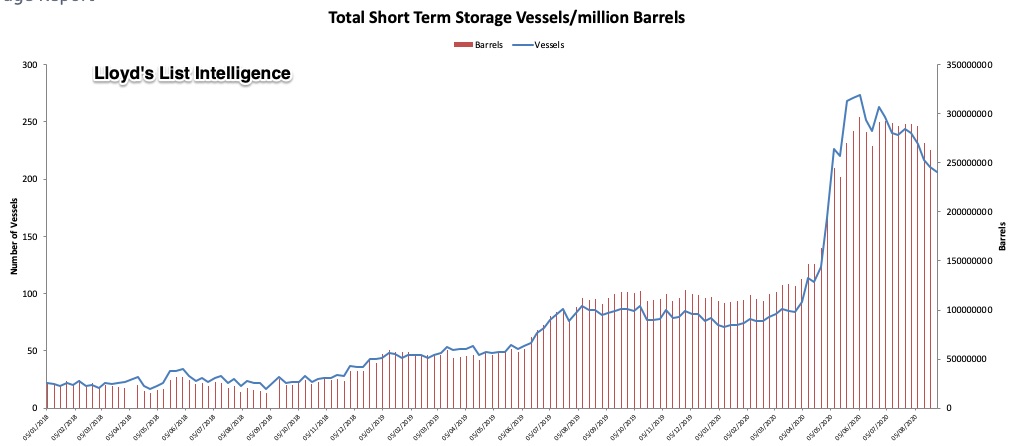

Most of the large tankers used for floating storage were chartered in April for six months by traders taking advantage of the oil price, according to Ms Leonard.

“Six months after April is October. Contango players either have the option now to roll-over depending on the contango in the market and it does not look great,” she said. “It’s more likely that those with floating storage will sell those physical barrels into the market.”

As much as 3m bpd, or around 100m barrels of crude was held on tankers for floating storage that could be sold to the market from October, she said.

Platts estimated there was as much as 300m barrels in floating storage earlier in the second quarter.

Lloyd’s List Intelligence tracks clean and dirty volumes at 257m barrels on 206 tankers for the week ending August 29, down from a peak of 307m barrels in early July.

Not all these vessels tracked at anchor for more than 20 days were chartered for storing contango cargoes. The tally includes ships laden with Iranian crude or condensate that cannot trade due to US sanctions, as well as those awaiting discharge at congested Chinese ports.

“Quite a bit of supply coming out of storage into the market provides a bearish risk to crude prices,” Ms Leonard added.

Volatile tanker earnings for the largest ships have ranged from $250,000 per day earlier this year to yesterday’s 2020 low of just over $9,000 daily on the benchmark route from the Middle East Gulf to Asia, Baltic Exchange data show.

The coronavirus backdrop and geopolitical upheaval of the past six months remains unchecked as demand for land and air transport fuels rebounds slower than anticipated in the final half of 2020.

Demand in some countries such as China was recovering on government stimulus packages, Ms Leonard said. Nevertheless she forecast weak refinery margins for the remainder of the year.

“We are still looking at a relatively bearish market,” Ms Leonard said.