Tankers de-flagged for using Iranian sanctions-busting tactic

Four tankers among 16 discovered manipulating AIS to show a vessel is in one place while it is actually at another loading Iranian crude

Extent and prevalence of new tactic can blindside US government agencies that have placed Automatic Identification System vessel-tracking at the cornerstone of international shipping guidance to identify illicit shipping practices used to evade sanctions

ST KITTS and Nevis has de-flagged four sanctions-busting tankers involved in smuggling Iranian oil that were using a new, game-changing deceptive shipping practice to avoid detection.

The 2002-built very large crude carrier Geissel (IMO 9246279) was de-flagged on August 4 following press reports it had visited an Iranian port, the registry confirmed in a statement.

The 2003-built VLCC Amfitriti (IMO 9273337), 2000-built VLCC Lerax (IMO 9181194) and the 2002-built Ekaterina (IMO 290078)] were also removed at the same time for the same reason.

The tankers were among 16 vessels deploying a newly identified tactic that manipulates Automatic Identification Systems data so that it shows the vessel in one place when it is actually in another.

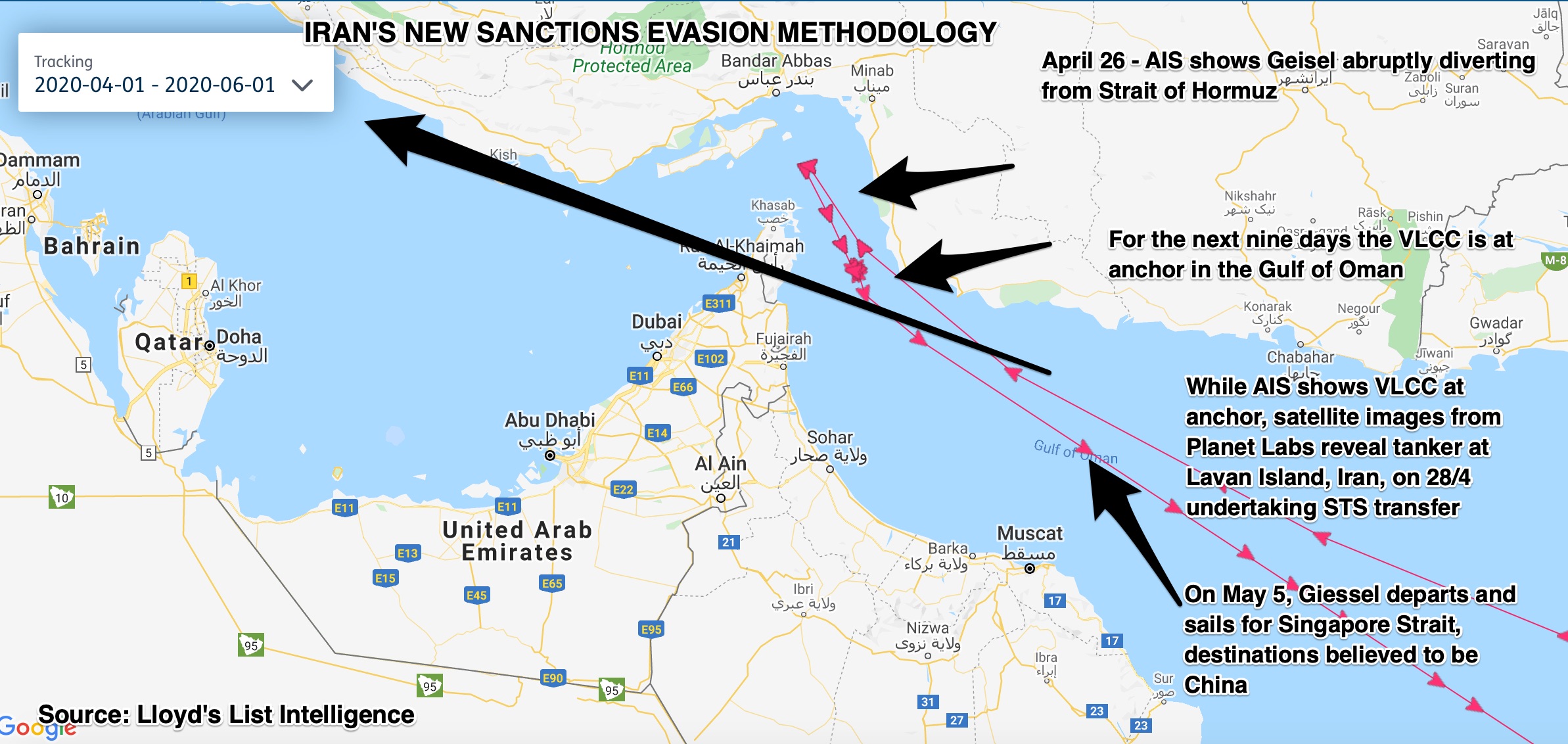

Earth observation satellite images from Planet Labs broadcast by US media on August 7 showed the Giessel undertaking a ship-to-ship transfer off Lavan Island in the Persian Gulf, while AIS vessel tracking showed it 100 miles away for a period of nine days.

The new tactic, also used by a further 15 vessels over a 12-month period, was first identified by Tankertracking.com in conjunction with Planet Labs in late July.

The extent and prevalence of this tactic is unknown and will potentially blindside US government agencies implementing the Trump administration’s “maximum pressure” and “zero exports” rhetoric on oil exports and shipping sanctions that underpin foreign policy on Iran and Venezuela.

AIS vessel-tracking is the cornerstone of US Treasury, state department and coast guard guidance for international shipping released in May to identify illicit shipping practices for evading sanctions on Iran and North Korea.

Marine insurance companies, flag registries, shipowners, operators, charterers and banks were all advised to monitor and investigate AIS tracking, seeking transmission gaps which suggested tankers were ‘going dark’.

That practice has been well-used by Iranian-linked vessels, turning off transponders while sailing to destinations to discharge or load Iranian or Venezuelan crude to evade detection.

Under this new tactic tankers no longer ‘go dark’ and keep transmitting AIS signals.

The vessels identified by TankerTrackers.com and Planet Labs are all part of a subterfuge fleet of elderly tankers with multiple ownership and flag changes, complex ownership structures, and shell companies ranging from the Seychelles to Dominica.

In most cases the vessels do not have protection and indemnity marine insurance with the International Group which insures 90% of the world’s fleet, because it has been withdrawn over the last 18 months. This suggests that prior deceptive shipping practices have already been noted.

They include vessels flagged with Cormoros, Gabon, Dominca, Belize, St Kitts & Nevis, Honduras, Sao Tome & Principe and Sierra Leone, according to data of Iranian-linked tankers compiled by Lloyd’s List using Lloyd’s List Intelligence data.

The London-based St Kitts & Nevis registry confirmed the tankers’ deletions, via a spokesman. But International registrar Liam Ryan had yet to respond to further questions about the other tankers and whether the registry could confirm or identify AIS manipulation by publication deadline.

Crucially, it is unknown whether the methodology to make the ship appear in one place while it is actually in another can also be applied to Long Range Identification Tracking data.

LRIT is mandatory to comply with international safety conventions with signals transmitted alongside AIS providing frequent and real-time information about the vessel’s location. LRIT can only be accessed by each vessel’s flag authority.

Other vessels involved included the Gabon-flagged, 1999-built aframax Ark Rescue (IMO 9199828), the 2001-built VLCC Vera (IMO 9203277), the Cormoros-flagged, 2000-built VLCC Asta (IMO 9203253), the 2000-built Cormoros-flagged VLCC Tiana (IMO 9203265) and Dominca-flagged suezmax Gulf Sky (IMO 9150377).

Gulf Sky’s registered owner Taif Mining Services is already subject to US sanctions.

Inmarsat, a satellite provider that transmits AIS signals, has been approached for comment.

The Cormoros-flagged tankers were cancelled on January 22, said Ayaz Burud, marine consultant for the National Agency of Maritime Affairs in an email to Lloyd’s List. He did not elaborate on the reasons for the de-flagging.

AIS is easy to manipulate because it is unencrypted and data can be changed both away from the vessel and from within it, one AIS expert told Lloyd’s List.

“The system is very open to abuse,” he said, adding that “any A-level hacker could do it.”

The ability to manipulate AIS data so that a ship appeared to be in one place while it was in another was well known within the maritime intelligence community, he added.