The week in charts: Lebanon needs port options for economic recovery

Lloyd’s List and Lloyd’s List Intelligence look at the data behind the Beirut port blast and its likely impact

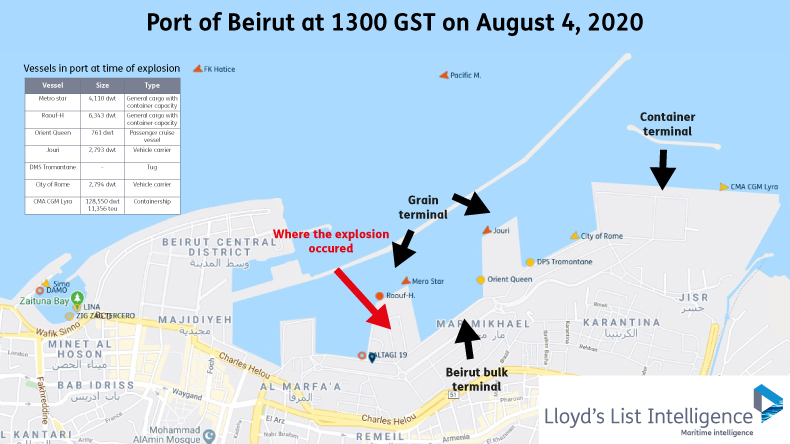

Week in charts: The devastating explosion in Beirut resulted in hundreds of deaths and thousands injured. We look at the impact the blast and damage to the port is likely to have on shipping, trade and the country’s economic recovery.

BEIRUT is Lebanon’s main port for the import of food and goods and is critical to the economy of the country.

With the port now closed and key infrastructure destroyed, there will now be great pressure to rebuild and ramp up vessel capacity, where possible, at other ports to ensure emergency supplies can be delivered and normal trading resume.

Lebanon is a relatively small and poor country economically and was already in the midst of its worst financial crisis since the civil war of 1975-1990 when the coronavirus pandemic hit and further weakened demand for goods.

Its reliance on imports is greater than its exports, leaving it with a deficit. The country’s total value of imports was $14.2bn last year, while its exports totalled $3bn.

Food shortages are rife and half a million children in the city of Beirut were already going hungry, according to Save the Children.

The country imports 80% of its food annually and is particularly reliant on the import of wheat to make bread.

Lebanon typically imports 1.2m tonnes of wheat and 900,000 tonnes of corn each year. Barley imports amounted to 70,000 tonnes last year, although the country was expected to import up to 200,000 tonnes during the 2020-21 season, according to analyst Maxigrain, as cited by Standard & Poor's.

It mainly relies on Russia and Ukraine for its grains shipments.

Imports are most intensive during the late summer and autumn, with monthly averages ranging from 150,000 tonnes to 300,000 tonnes, Jesper Buhl, managing director of grains consultancy BullPositions, said.

Grain silo

The explosion destroyed a key grain silo at the port, which was located very close to where the blast occurred, with a capacity of 120,000 tonnes. With this now gone it is very unlikely to see how this level of imports can be maintained.

The silo housed up to 85% of the national grain reserves, according to analyst estimates, which will make the food shortage situation even worse.

Lloyd's List Intelligence data shows that 150 fully cellular containerships called at Beirut last year, followed by 121 general cargo ships with container capacity.

Sixty-eight vehicle carriers also made their way there in 2019, while 56 chemical tankers and 33 bulk carriers visited the port.

Beirut was expecting to see six vessel calls at the port on August 8, the highest number of vessels in the coming week, Lloyd's List Intelligence data shows.

Three were due on Tuesday, while five were scheduled for today and another five on August 6. A further five vessels were due on August 10. All have now been rerouted to Tripoli or other regional ports.

As discussed, Beirut is by far the most significant import gateway for Lebanon with 610 vessel calls in the past year, according to Lloyd’s List Intelligence data. It is the key container port.

Beirut handled 1.2m teu in 2019 and Lebanon will struggle to replace that capacity at alternative ports. Tripoli is not set up to increase operations overnight and has just 600 m of quay space with two cranes, compared with the 1,100 m at Beirut with 16 cranes. Tripoli has capacity for only 400,000 teu per year.

BullPositions’ Jesper Buhl said that while Tripoli does not have grain handling capacity, supplies could potentially be shipped there and stored in warehouses nearby.

Other alternatives must be found and quickly in order to bring in supplies and get the economy moving again. The two main regional replacement options are in Syria and Israel, which are politically very sensitive.

Mediterranean Shipping Co, which did not have a ship in port at the time of the explosion, has advised customers that it will be using several alternative ports for Lebanon cargo until Beirut’s container terminal is operational again. These include Gioia Tauro, Tekirdag, Mersin, and Piraeus.