Beirut explosion hits container links

Beirut is Lebanon’s largest container terminal. But as carriers report offices either destroyed or badly damaged, local supply chains will come under pressure

Neighbouring Tripoli lacks the capacity to handle volumes from Beirut as carriers start to reroute ships

THE explosion at the port of Beirut is likely to seriously impair the country’s containerised supply chains, threatening its ability to import essential supplies.

It has also dealt a severe blow to the French container giant CMA CGM.

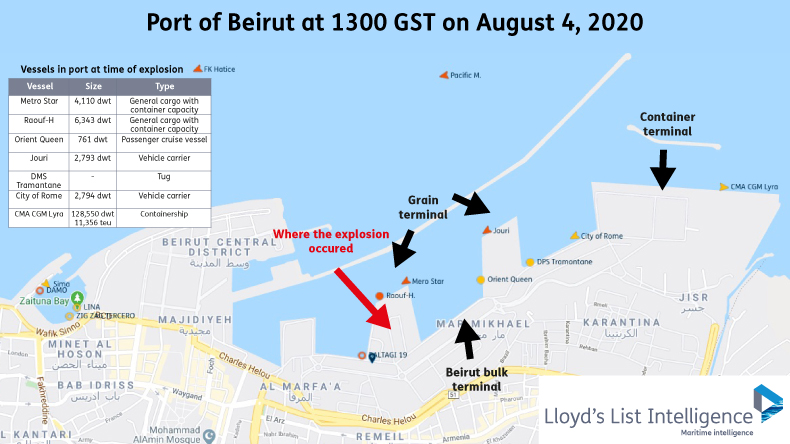

The French line, which has close links with Lebanon, had a ship in port at the time of the explosion, the 11,400 teu CMA CGM Lyra.

In a statement, CMA CGM said the vessel, which was 1.5 km from the blast, was not damaged and neither were any crew members hurt.

However, the group’s Merit Shipping headquarters in Beirut has been severely damaged. Of the 261 staff in the city, two have sustained serious injuries while one is missing.

CMA CGM and its subsidiary CEVA Logistics have offered the Lebanese and French governments logistics and maritime assistance in order to respond to the emergency.

An operational organisation has been put in place to establish a logistics hub in Tripoli. All ships will be diverted to Tripoli or other terminals in the region until further notice. In order to maintain business continuity, the group said it had set up three recovery sites, of which two are in Beirut and one in Tripoli.

Other shipping lines are also rapidly drawing up contingency plans. Hapag-Lloyd, whose Beirut offices were completely destroyed in the blast, had no ships in Beirut at the time of the explosion, but told customers that probably most laden and empty containers in the port were caught up in the blast.

The German line said the 2,760 teu Fleur N, deployed in its Levante Express, has cancelled its Beirut call scheduled for August 7. Beirut import cargo loaded on the ship will be discharged at Damietta, in Egypt.

In its East Med Express, the 6,300 teu APL Norway will also omit its August 7 Beirut call, and will instead divert to the Lebanese port of Tripoli to discharge cargo.

Another line whose agent’s offices were totally wrecked, Grimaldi, said one of its vessels was due to call in Beirut on Sunday. This ship, which usually serves Tripoli as well, may discharge its cargo there instead, depending on how the situation evolves. Neither company reported any staff casualties.

Earlier, Maersk had said its offices had been damaged and three employees injured, but they were discharged from hospital on Tuesday evening.

Mediterranean Shipping Co, which did not have a ship in port at the time of the explosion, has advised customers that it will be using several alternative ports for Lebanon cargo until Beirut’s container terminal is operational again. These include Gioia Tauro, Tekirdag, Mersin, and Piraeus. In the meantime, staff have been told to work from home.

Beirut is Lebanon’s key container port, and while the extent of the damage to the container terminal remains unknown, damage to surrounding port infrastructure is likely to severely impact throughput.

“The silos that exploded were around 1.5 km away from the main quay of the container terminal, which is in itself not that far, on the other hand, it might be far enough not to have damaged all of the critical infrastructure,” Dynamar consultant Frans Waals told Lloyd’s List.

Container capacity limited

The port handled 1.2m teu in 2019 and Lebanon will struggle to replace that capacity at alternative ports (see chart below). Tripoli has just 600 m of quay space with two cranes, compared with the 1,100 m at Beirut with 16 cranes. Tripoli has capacity for only 400,000 teu per year.

The terminal can serve ships of up to 18,000 teu, although small feeder vessels make up the majority of the terminal’s calls.

“Assuming Lebanon does not want to be dependent of Israel, its only alternative is, ironically, Lattakia, in Syria,” Mr Waals said.

Only four major deepsea services call at Lebanon, with three of these going to Beirut, according to data from Sea-Intelligence. Of these, the 2M AE20/Dragon service is currently suspended, leaving the Ocean Alliance BEX and MX1 services as the only direct deepsea calls to Beirut.

The collapse of the Lebanese economy and the collapse in demand brought about by the pandemic meant that there were only three deepsea calls to Beirut in June, compared with 12 in the same month last year.

But the port has an important role in eastern Mediterranean transhipment and feeder services. CMA CGM and Mediterranean Shipping Co are the container terminal’s major clients, responsible for over 80% of transhipment cargoes.

CMA CGM has a regional headquarters building near the port in the centre of Beirut and has six feeder services for intra-Mediterranean and northern Europe.

As part of a government privatisation plan, Beirut port authority Gestion et Exploitation du Port de Beyrouth earlier this year called for international bids for a concession to manage, operate and maintain the Beirut’s container terminal.

Bids were due at the end of March, but Lloyd’s List understands that delays caused by the pandemic meant that the process had been put back at least until the end of this year.

CMA CGM, which provides a third of the terminal’s business, was considered a likely bidder, but the future of the privatisation programme is now in doubt following the damage to the wider port.