Daily tanker earnings reach $300,000 as traders add to Saudi-led tonnage frenzy

Oil traders and Asian refiners charter a further 25 VLCCs in past 48-hours, accelerating the upward rates trajectory

All deals ‘on subjects’ with market waiting to see which are finalised to establish market ceiling on rates.

A 2012-BUILT very large crude carrier is poised to earn $299,000 daily as an escalating tanker chartering frenzy drove a tenfold rise in rates over a 72-hour period leading to record volumes of freight futures traded in London.

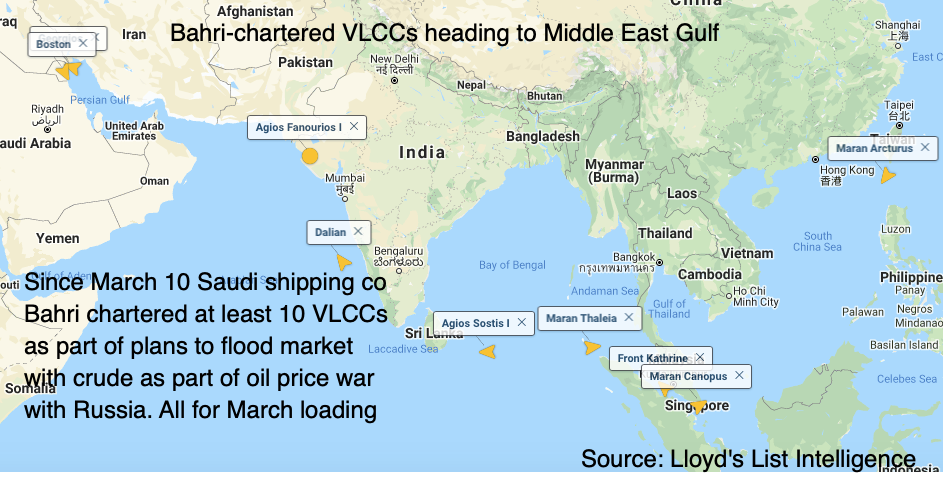

Maran Tankers Management-operated Maran Antares was chartered by Thai oil company PTT, earning $299,982 daily, according to Tankers International. A second VLCC, 2009-built Georgios, exceeded earnings of $205,000 daily. Georgios is one of at least ten VLCCs provisionally hired by Saudi shipowner Bahri since Monday (see map below from Lloyd's List Intelligence) as the kingdom ramps up exports after launching an oil price war with Russia over the weekend.

The huge and unexpected grab for tonnage spooked oil Asian refiners and oil traders, who then locked in charters for a further 25 VLCCs over the same period, paying ever-accelerating levels, according to fixtures published by Tankers International.

All deals are ‘on subjects’ — and therefore not finalised — with the market now awaiting to see which will go ahead and thus represent the true market ceiling.

Aside from the Saudi export surge, the tumbling oil price is also underpinning demand for crude tankers, which has simultaneously revived demand to charter VLCCs for floating storage.

“Everyone is scrambling for tonnage,” said Oslo-based shipbroker Fearnleys in its weekly report published today.

“We already see VLCC cargoes being split in both West Africa and Middle East Gulf, just adding more fuel to the fire for suezmaxes.”

Owners were taking advantage of the situation, and putting on the breaks, the report added. “We expect the peak to continue for the rest of the week, at least as long as we see this cargo activity, the only question to ask is how far can this go?”

The rapid upward trajectory returns the market to a similar three-day period last October, when US sanctions on two of Chinese-government owned shipowner Cosco’s tanker entities induced panicked VLCC chartering. Charters were agreed at levels that equated to earnings exceeding $300,000 per day, but ultimately very few of the sky-high deals actually materialised, with most failing to go ahead.

The VLCC frenzy has now spilt over to the suezmax sector. Rates for Black Sea loading for voyages to the Mediterranean gained 17%, while West Africa-Europe routes rose by 13% to $51,000 per day, according to the London-based Baltic Exchange.

Forward freight agreement contracts also rallied, in volumes and prices. Yesterday record volumes traded, according to Braemar ACM, the world’s largest shipbroker for the FFA tanker sector.

The Baltic Exchange’s average VLCC time charter earnings were assessed at $139,130 per day on Wednesday, from $28,245 two days earlier. The biggest rises are seen on VLCC routes to Asia, with the route to Singapore assessed at $171,000 per day.

Shell was also reported to have booked three VLCCs for three-month storage options, while the United Arab Emirates’ national oil company ADNOC also said it was accelerating oil production, potentially adding more cargoes into the market.

Saudi Aramco said today it would boost oil production capacity to 13m barrels per day, from 12m bpd, while ADNOC will rise to 4m bpd. Brent crude was trading at $36.20 at 1715 hrs London time on the ICE Futures Europe exchange, with the August contract at $39.13 per barrel — a difference in price that would support floating storage economics at chartering levels of around $35,000 daily.

While oil shipments to Asia are set to rise over the next month, oil cartel the Organisation of the Petroleum Exporting Countries estimated crude demand in China, the biggest seaborne importer, would contract this year.

“For 2019, Chinese oil demand grew by 360,000 bpd, while oil demand in 2020 is projected to decrease by 130,000 bpd,” Opec said in its monthly report released today.

This suggests that soaring rates could soon be capped, especially if Russia and Saudi Arabia reach any impasse or agreement in the battle for market share, amid the coronavirus-led demand downturn.