Oil trader Vitol’s diesel-laden VLCC sails for Rotterdam

Asian refineries produce more middle distillates than are needed for the region, with the surplus exported to northwest Europe, Africa and Latin America

Newbuilding tanker trading clean on first voyage after loading in Malaysia

THE port of Rotterdam will take delivery of its first very large crude carrier loaded with diesel in nearly 12 months on the Vitol-owned tanker Elandra Kiliminjaro, now sailing from Malaysia to northwest Europe with a 2m barrels cargo of middle distillates.

The newbuilding VLCC is making its first voyage since leaving a South Korean shipyard last month for Malaysia and Singapore, where the cargo was loaded, according to energy intelligence provider Vortexa.

The diesel-laden tanker is signalling it will sail to the Netherlands via the Cape of Good Hope. It is the first clean cargo shipped on a VLCC since the last quarter of 2019. Low tanker rates over last year’s first half resulted in at least 12 newbuilding VLCCs trading clean on their first voyage, shipping jet fuel, diesel or gasoil to northwest Europe or to the US Gulf for storage, from Asia. Although VLCCs are built for transporting crude cargo, the tanks remain clean for the first voyage, allowing vessels to carry refined products if market conditions are favourable.

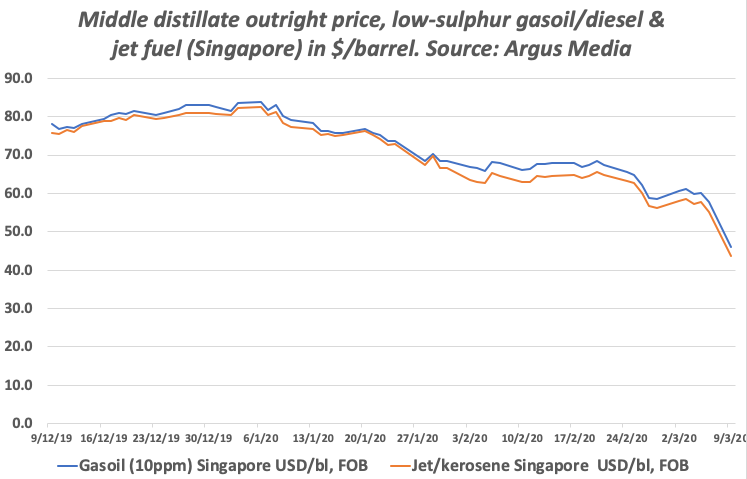

The Elandra Kiliminjaro’s cargo is moving east to west as demand tumbles in Asia for middle distillates, used for land and air transportation as well as heating. The regional oversupply means assessed prices for low-sulphur gasoil and diesel in Singapore dropped 20% in a day on Monday, while jet fuel was 21% lower, according to price reporting agency Argus Media. The warmest winter on record, which dented demand for gasoil for heating, had already depressed gasoil prices before the coronavirus outbreak became clear in early February.

Asian refineries produce more middle distillates than needed for the region, with the surplus exported to northwest Europe, Africa and Latin America. Jet fuel is regularly shipped to the UK, and the Amsterdam-Rotterdam-Antwerp area, as well as to the Mediterranean from South Korea on long range one and long range two product tankers. Gasoil to Africa is also a key market.

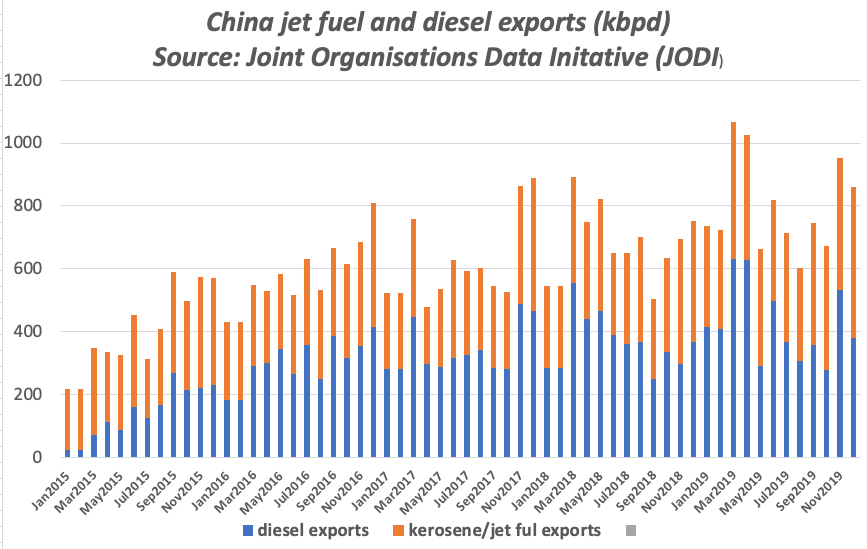

China has a worsening diesel and jet fuel surplus because new refineries that opened last year added additional market capacity just as domestic demand tumbled. Singapore-bound diesel loaded from China and South Korea last month exceeded 230,000 barrels per day, according to Vortexa, which was nearly 50% higher than the previous month. About half of volumes were discharged into storage terminals, and the rest continued west and remained in transit. The number of floating storage on tankers in Malaysia’s Tanjung Pelepas lightering area is rising week on week, Vortexa said in a report.

Traders anticipate record middle distillates exports from China in March. Some 859,000 bpd was exported in December according to the Joint Organisation Data Initiative, the latest month for which data is available. Vortexa estimated China exported 500,000 bpd of diesel and 260,000 bpd in February. That compares with JODI data showing total exports at 723,000 bpd in February, 2019.