Banks pump tanker stocks after bumper December

This year, tanker demand growth was forecast at 5.7%, with VLCC earnings averaging $53,000 daily, up 28% on 2019

The strong tanker outlook will continue into early 2020 say two banks covering listed shipping companies, citing US oil supply growth, the lowest orderbook since 1997, rising asset prices and scrubber premiums

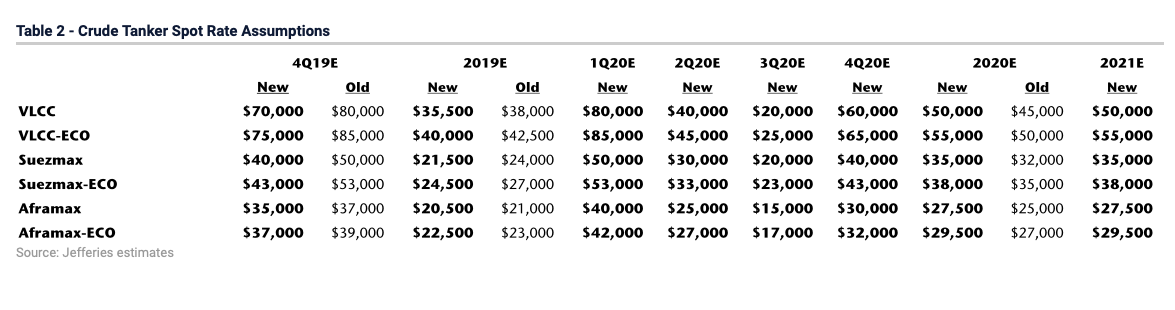

JEFFERIES has upgraded its estimates for crude tanker earnings this year by $5,000 daily for the largest ships, citing rising crude oil exports from the Atlantic Basin, geopolitical tensions and delayed scrubber retrofits.

The New York investment bank forecasts very large crude carrier daily earnings for a non-eco ship at $50,000 in 2020, up from its prior estimate of $45,000 six weeks ago.

So-called eco-type VLCCs, which are generally younger and more efficient, will earn $55,000 daily, according to its fourth-quarter preview published January 27. Daily first-quarter earnings were estimated to average $80,000.

Suezmax daily rates were revised higher by $3,000 to $32,000, with 2020 averages for aframax tankers trading in the dirty market forecast at $27,500, up from prior estimates of $25,000.

“We believe 2020 will be a very strong year for crude tankers as multiple demand drivers coupled with manageable fleet growth should help continue to support rates,” the report said. “Refinery capacity throughput should increase substantially this year as multiple capacity expansion projects are completed in the Middle East and in Asia and refinery maintenance downtime should be much more in line with historical norms compared to 2019 when refiners prolonged refinery maintenance ahead of IMO 2020.”

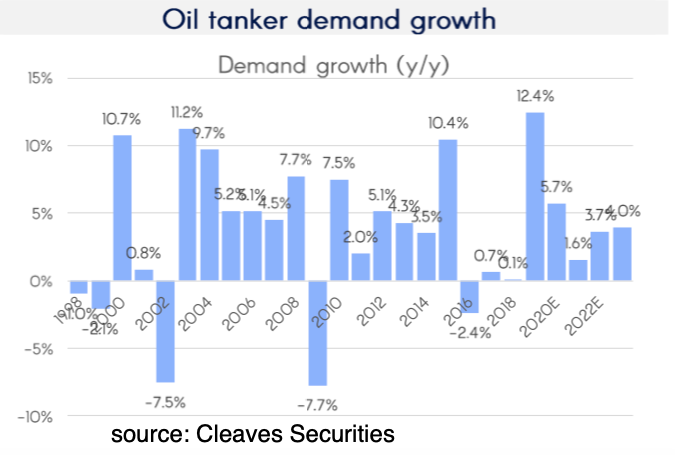

Norwegian investment bank Cleaves Securities also remained bullish, saying implied demand growth of 12.4% in 2019 was the highest on records going back to 1998. This year, tanker demand growth was forecast at 5.7%, with VLCC earnings averaging $53,000 daily, up 28% on 2019.

“With a very sobering level of newbuilding contracting during 2019 despite stellar earnings, a historically low orderbook is still one of the main reasons why we are highly positive towards the outlook for tankers,” the report said. “We expect that uncertainty over future regulations and technology could keep ordering below modelled levels going forward as well.”

Cleaves estimates the orderbook at 8.7% of the current trading fleet, the lowest in 22 years, with high levels of scrapping estimated this year as IMO 2020 regulations remove older tonnage from the market.

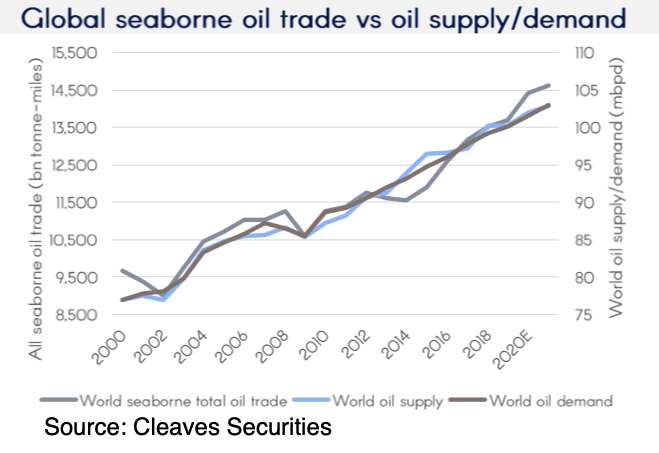

Strong oil supply growth in the Atlantic versus large oil demand growth in the Far East will be highly beneficial for tonne-miles this year, the report added.

“Adding scrubber premiums above our previous forecast and continuously rising asset prices, the outlook for both earnings and share prices looks very positive,” it said. Uncertainty over future regulations and technology could weigh on ordering.