Oil trader begins West Africa STS route for Venezuelan cargoes

Low-profile oil trader and former Glencore executive Murtaza Lakhani is the director of the company, formerly known as IMMS Pte Ltd, which owns these ships. There is no suggestion the company breached US sanctions

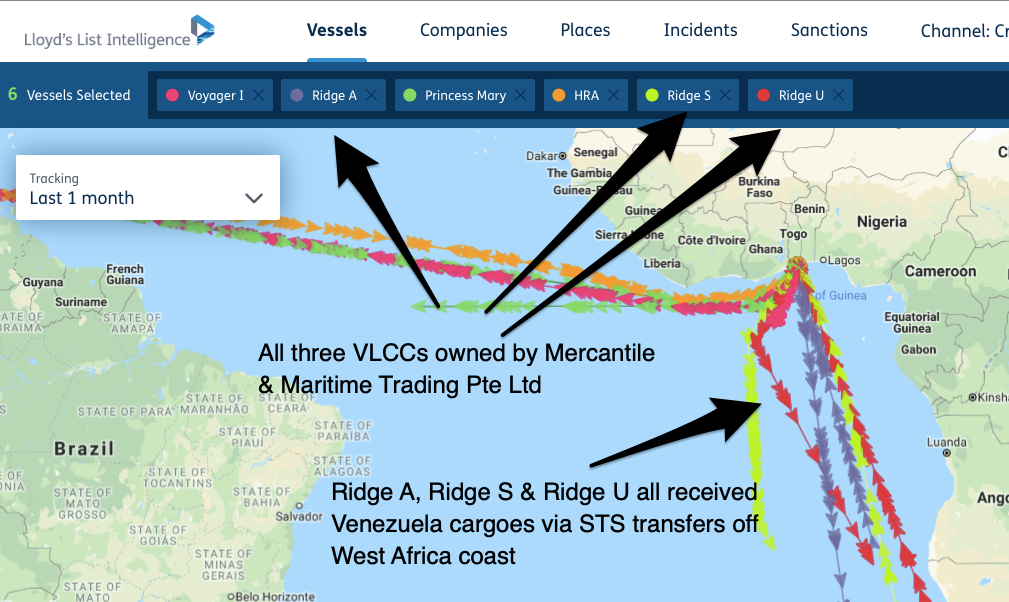

Singapore-based Mercantile & Maritime Group is using newly purchased tankers bought for $100m to receive Venezuelan cargoes off Togo coastline

A NEW shipping company is channelling Venezuelan cargoes to Asia via ship-to-ship transfers off the Gulf of Guinea in the latest logistics route established to disguise the origin and destination of cargoes as crippling US sanctions continue to choke exports.

Singapore-based Mercantile & Maritime Trading Ptd Ltd is the commercial operator of eight tankers, including five very large crude carriers purchased last November. All but one of the fleet is now tracked on this new trade route over the past four weeks. Three of the VLCCS were purchased in October for just under $100m in total from Ridgebury Tankers.

Since December 7, Lloyd’s List Intelligence tracking shows VLCCs Ridge S, Ridge U, and Ridge A received transfers of crude loaded from Venezuela just off the coast of Lome, Togo.

Low-profile oil trader and former Glencore executive Murtaza Lakhani is the director of the company, formerly known as IMMS Pte Ltd, which owns these ships.

There is no suggestion the company breached US sanctions.

“As a global business operating across the oil and gas value chain, the Mercantile & Maritime Group is in full compliance with all international trade laws and maritime regulations,” Mercantile & Maritime Trading said in a statement to Lloyd’s List.

“We have long-established compliance procedures and internal controls in place to ensure we are compliant with the applicable rules and regulations in the specific territories in which we operate.”

The statement said the company does not comment on specific clients or contracts in response to questions about its relationship with Russian oil company Rosneft.

The Venezuelan-loaded VLCCs supplying the crude were the Marshall Islands-flagged Voyager 1, the Liberian-flagged Princess Mary, and the Malta-flagged HRA, vessel-tracking shows.

These ships appear to have been engaged in regular Venezuela-Togo runs since November, with all three heading back on cross-Atlantic routes since discharging their cargo off the West African coast. They are not owned by Mr Lakhani.

Rosneft’s trading arm is selling most of the Venezuelan crude available for export on behalf of government owned Venezuelan oil company PDVSA.

Remaining buyers India and China shunned direct purchases once the US administration tightened sanctions in August.

Exports dwindled to multi-decade lows over 2019’s final quarter, with November shipments tracked at 570,000 bpd, according to Lloyd’s List Intelligence data. That’s about a third the level of shipments seen 12 months ago just before sanctions were imposed.

US-based companies and citizens can’t trade or sell crude and refined products from the South American country, but restrictions have a global impact because transactions can’t be undertaken in US dollars.

Nayara Energy, which owns India’s Vadinar refnery and is in turn owned by Rosneft, is being used as an intermediary for some sales.

Nevertheless, Last October, some major oil charterers imposed a ban on any vessels that had loaded Venezuelan crude in the prior 12 months.

In November, Lloyd’s List also tracked tankers laden with Venezuelan crude to Malaysia, where they remained unsold and in floating storage for up to four weeks, pending ship-to-ship transfers to other tankers for eventual shipment to China. Over the past year, STS transfers have also been observed off Malta and Gibraltar coasts.

Some 80% of ships involved in Venezuelan exports were chartered by Russian energy firm Rosneft, with China using the Russian country as a “beard” to cover its purchases, Caracas Capital managing partner Russ Dallen told Lloyd’s List on November 11.

The STS strategies mirror tactics used by Iran to circumvent US sanctions over 2019. Iran’s national oil national company has established hub and spoke operations via Malaysia to distribute liquefied petroleum gas, fuel oil, crude and condensate.

This was done in part using elderly VLCC tonnage bought from December 2018 to April 2019 by privately owned, newly established companies especially for these routes. The infamous VLCC Grace 1, now Adrian Dayra I, was one such vessel.

The Ridge A will be the first VLCC scheduled to reach Asia, and is now in the Indian Ocean, about 10 days’ sailing from the Strait of Singapore. Whether it will undertake further STS operations off Malaysia, or sail direct to China is unclear. Both the Ridge S and Ridge U are off the Angolan and Namibian coast and have yet to circumvent South Africa’s Cape of Good Hope.

Other Mercantile & Maritime Trading vessels now off Venezuela’s coast include the Panama-flagged aframax Happy C, Malta-flagged 38,877 dwt product tanker Port S, Liberian flagged VLCC Power M and 7000 dwt tanker Zayn.

All are in the vicinity of Aruba, a Caribbean Island where PDVSA owns storage tanks and terminals and where STS transfers have also been observed.