Tanker rates hit fresh 15-year high

Shipbrokers have struggled to digest the unprecedented surge, last seen in 2007 and 2008 when one ship fixture would result in a six-figure commission. Shipbrokers typically earn 1.25% of the chartering cost

Rates surged after US sanctions imposed on September 25 on two tanker subsidiaries owned by China’s state-owned Cosco for shipping Iranian crude spooked refiners and traders, who shunned all tonnage connected with the world’s largest shipping company

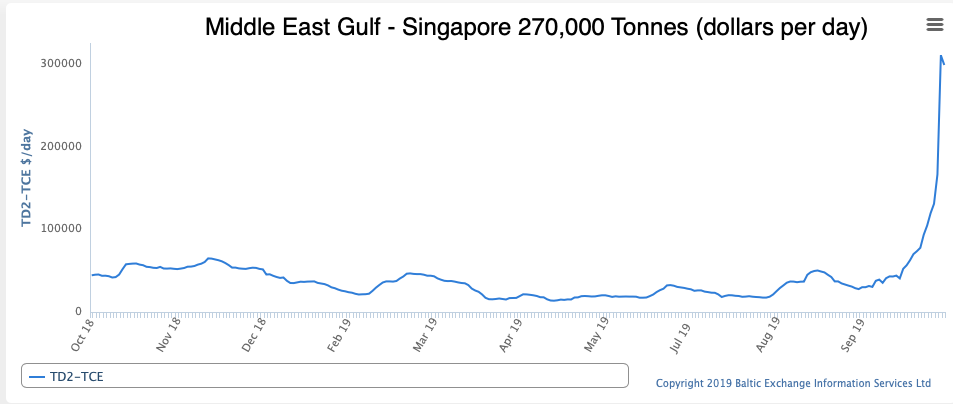

VERY large crude carrier rates stabilised near the $300,000 per day level on Monday, as traders and charterers sought direction from China-Iran trade negotiations to determine the duration of the highest shipping costs in 15 years.

The last VLCC reported as provisionally chartered was the 2004-built, Dynacom-owned Folegandros, by Reliance, at $273,000 per day according to Tankers International calculations, which included idling days.

The vessel’s age and ex-drydock status represented a discount for the Middle East Gulf-India voyage, and was below several fixtures seen on Friday above $300,000 per day.

Shipbrokers have struggled to digest the unprecedented surge, last seen in 2007 and 2008 when one ship fixture would result in a six-figure commission. Shipbrokers typically earn 1.25% of the chartering cost.

Monday’s earnings dropped between 9% and 3% on key routes today after massive gains reported on Friday. The shortage of immediately available tankers in the Middle East Gulf saw Baltic Exchange VLCC earnings on the Middle East Gulf to Singapore route nearly doubled in a day on October 11, extending to $305,998 daily, up from $162,048 on Thursday, data show.

Likewise, suezmax rates on the West Africa-China route reached $278,057 per day, gaining nearly $135,000 in 24 hours last Friday. They steadied to $255,169 daily on Monday. Aframax rates also appeared to be stabilising, although brokers warned that spikes were still possible as traders and oil companies re-examined loading schedules.

“The answer to how long things are sustained and to what levels we go probably lies in politics,” said ACM Braemar in its weekly report. The shipbroker estimates one fifth of the trading VLCC fleet, a sixth of all suezmaxes and 10% of the aframax and long range two fleet were “relatively restricted” for international trade.

Rates surged after US sanctions imposed on September 25 on two tanker subsidiaries owned by China’s state-owned Cosco for shipping Iranian crude spooked refiners and traders, who shunned all tonnage connected with the world’s largest shipping company. Two oil companies, ExxonMobil and Unipec, have also added clauses to charters also excluding those vessels that have called at Venezuela in the past 12 months.

“We expect rates in the VLCC segment to remain strong for as long as charterers continue to shun Cosco, and we are seeing a trickle-down effect as rates for smaller tankers are also firming rapidly,” said Alphatanker, the research division of Paris-based tanker broker BRS.

The two-tier market has sidelined some 15% of VLCC and 12% of suezmax tonnage based on Cosco ownership and Venezuela callings, according to Lloyd’s List Intelligence data. That has dragged spot earnings for VLCCs up by 516% in the seven-day period to October 11, to an average of $308,000 per day, according to Clarkson, the world’s biggest shipbroker.

Adding to the backdrop is the removal of many tankers for retrofitting of scrubbers ahead of the IMO 2020 lower-sulphur marine fuel regulations, which come into effect on January 1. Scrubbers will allow tankers to remain compliant but burn cheaper, but higher-sulphur fuel.

Refiners are also needing to produce more middle distillates to meet increased demand for marine gasoil, adding to increased demand on key routes to Asia.

Freight derivatives trading is also at fresh highs, with some 6,693 lots trading for the week ending October 11, Baltic Exchange data show. Each lot represents 1,000 tonnes of freight.