Venezuela-China oil flows fail to stem plunging tanker demand

Since the US government sanctioned national oil company PDVSA, shipments of oil, which comprises some 95% of Venezuelan revenue, have collapsed to levels not seen since oil strikes in 2002 and 2003

US sanctions against Venezuela are hammering down its oil exports, but it is maintaining shipments to China

HARSHER US sanctions have pushed Venezuelan crude exports to multi-decade lows over August as record volumes divert to ship-to-ship transfers in waters off Malaysia, as well as northwest Europe and the Caribbean. The shipments help disguise the oil’s origin and destination.

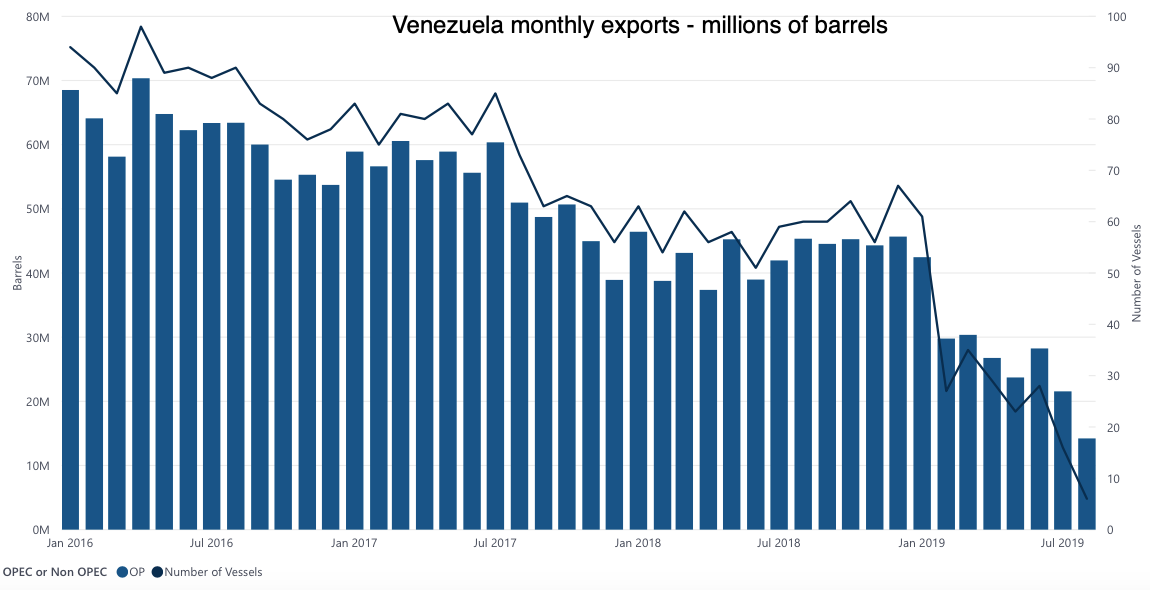

Seventeen tankers had loaded 14.2m barrels this month from Venezuelan ports, according to Lloyd’s List Intelligence data through to August 23. That compares with 22 shipments and 25.5m barrels for the entire month of July.

The collapse in exports is also mirrored in ton-mile demand, which shrunk to 14.1bn miles this month, compared with 34.4bn miles in January, before sanctions started on January 25. This has implications for very large crude carrier, aframax and suezmax tonnage, which comprises 40%, 39% and 16% respectively of tankers that transport Venezuelan oil. Ton mile demand multiplies volumes carried by distance travelled and measures the health of utilisation levels for a route or vessel sector.

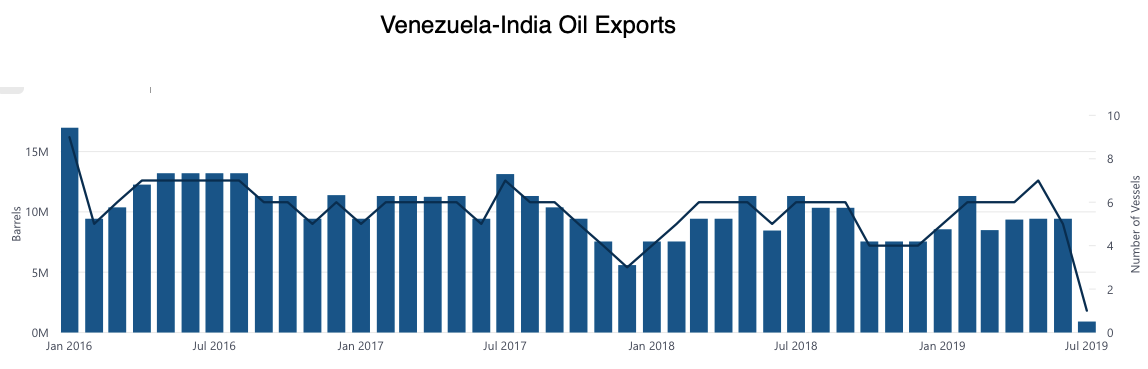

The US Treasury extended sanctions on Venezuela on August 5 to freeze assets and property to businesses helping the government of Nicolas Maduro. While oil buyers from India and Europe have drastically curbed imports even before these new measures, they are failing to stem cargoes heading for China, the biggest buyer. Sanctions rule out any transactions by US businesses or those connected with them, restricting companies with subsidiaries in the US from trading with the Venezuelan government, its entities and those running them. This prevents trades being undertaken in US currency, and also limits the vessel used, and destination of crude.

Since the US government sanctioned national oil company PDVSA, shipments of oil, which comprises some 95% of Venezuelan revenue, have collapsed to levels not seen since oil strikes in 2002 and 2003. Alongside crumbling oil infrastructure and maintenance, exports have plunged to 460,000 bpd in August according to Lloyd’s List Intelligence data. That is less than a quarter of levels seen three years ago, and well below the 1.37m bpd tally in January when sanctions were first announced.

Of the 22 tankers that loaded in July, six are sailing for China, three to Malaysia, and one to Singapore. A further three are destined for Asia, Lloyd’s List Intelligence data shows. August loadings show seven of the 17 are destined for Asia, with three signalling China as their next destination and one for Malaysia.

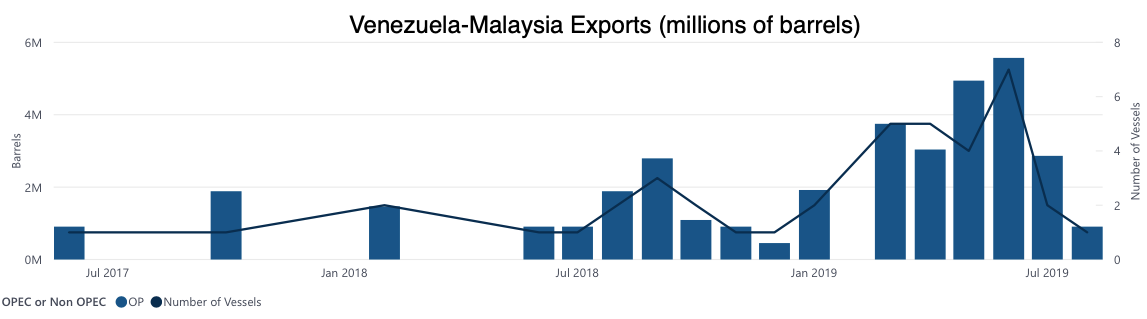

Exports to Malaysia have spiked to the highest levels observed over May, June and July, data shows. Most vessels are offloading cargoes on to other tankers in ship-to-ship transfers in lightering zones off Malaysia, an Iranian-style tactic used to evade sanctions or obfuscate the origin and destination of the crude.

Twelve tankers carrying 9.3m barrels have discharged cargo at Malaysia since June, data shows, almost more than called there for the entire duration of 2018. Most of the STS cargoes are reportedly heading to China, based on vessel-tracking data, which shows a corresponding spike in the country’s imports from Malaysia.

India’s Reliance refinery, which has a branch in the US, hasn’t imported a cargo since June. India, the second-largest buyer earlier this year, received its last Venezuelan cargo in July.

Most European refineries except Spain and Sweden stopped buying over the first quarter. Belgium took its last cargo in March, Italy in January and the Netherlands in February. However, Spain continues to import crude, with 9.2m barrels delivered via 16 tankers data shows. The most two recent vessels arrived in August. Four STS transfers were seen in the North Sea, while transfers were also observed in waters off Gibraltar.

China receives oil in exchange for loans, similar to Russian’s Rosneft, explaining the high number of Venezuelan cargoes destined for the country’s refineries. Some six cargoes were delivered in July and three so far in August data shows.

“I think their deal with the Chinese is causing Venezuela pain as the value of the oil has plummeted and more oil is being shipped to China to pay off the debt,” said Marie Bates, tanker analyst with Lloyd’s List Intelligence.

Rosneft is now said to undertake marketing and sales for PDVSA as the national oil company struggles to find buyers for its crude. Rosneft reported that PDVSA owes $1.1bn on the $6.5bn loaned since 2014, based on its second-quarter results. Some $700m was paid back over the second quarter.