Daily Briefing November 13 2017

Is Cosco Shipping positioning itself to end European dominance of the container shipping industry?

Lloyd's List is part of Maritime Intelligence

This site is operated by a business or businesses owned by Maritime Insights & Intelligence Limited, registered in England and Wales with company number 13831625 and address c/o Hackwood Secretaries Limited, One Silk Street, London EC2Y 8HQ, United Kingdom. Lloyd’s List Intelligence is a trading name of Maritime Insights & Intelligence Limited. Lloyd’s is the registered trademark of the Society Incorporated by the Lloyd’s Act 1871 by the name of Lloyd’s.

This copy is for your personal, non-commercial use. For high-quality copies or electronic reprints for distribution to colleagues or customers, please call UK support at +44 (0)20 3377 3996 / APAC support at +65 6508 2430

Printed By

Is Cosco Shipping positioning itself to end European dominance of the container shipping industry?

| Table |

|---|

Small and beautiful carriers are takeover targets as container consolidation continues apace

Chemical tanker market is set to recover by late 2018, says Drewry

Shipping will benefit from the global economy's 'new normal'

The US box import boom could be about to slow down

Dry bulk trade growth is about to outweigh fleet expansion

Industry bodies want to ease the administrative burdens on shipping

A new Greek shipbroker Xclusiv has opened

Singapore is gearing up to be a key player in the global maritime arbitration sector

DHL reported mixed third quarter results for forwarding arm

HMM posted a third-quarter net loss

Strong cruiseship demand continues to drive Fincantieri profits

GoodBulk posted a good second-quarter profit

DSME has sold its majority stake in Romanian yard to Damen for $26.5m

Receive the email to your inbox Classified Advertisements

Is Cosco Shipping positioning itself to end European dominance of the container shipping industry?

THE number of truly global container lines continues to shrink, with some familiar names missing from the latest rankings.

But there are many more changes still to come, with the 2018 list of top carriers likely to look very different from the 2017 table, which, at first glance, does not seem all that different from the 2016 rankings.

The four largest lines in terms of fleet capacity remain the same — Maersk Line, Mediterranean Shipping Co, CMA CGM and Cosco Shipping.

Evergreen, once number one in the world, has slipped down another rung, Hapag-Lloyd has gained a spot, and Hamburg Süd has dropped back.

So this hardly looks like the great shake-up that has dominated the headlines for the past couple of years.

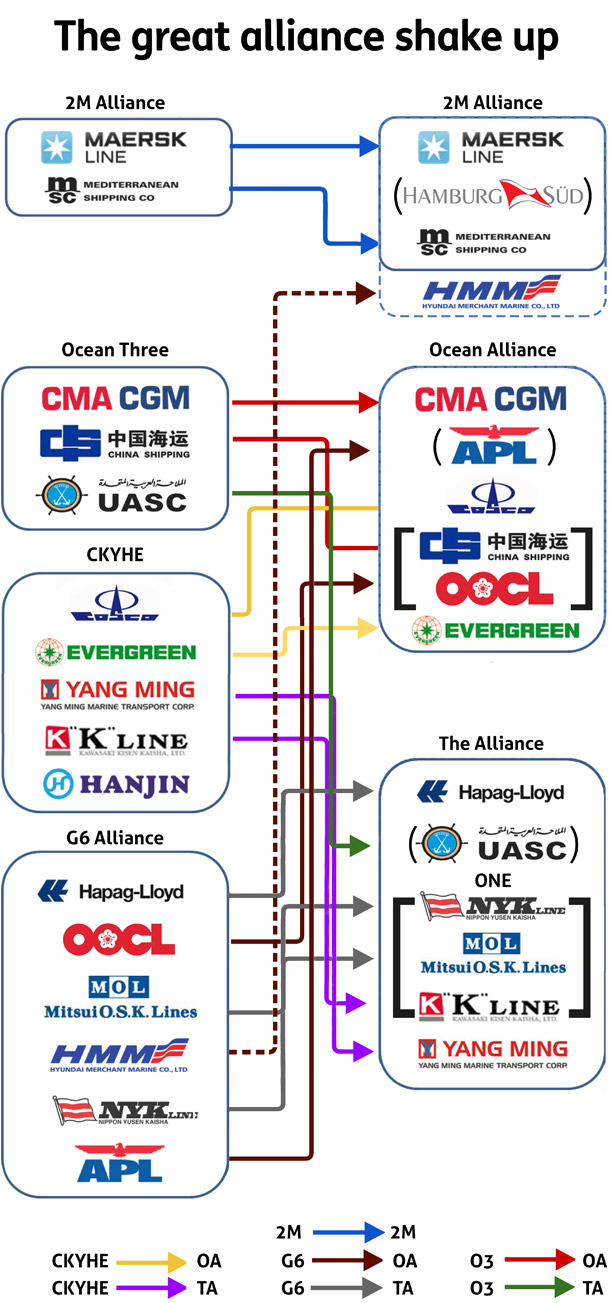

That is because much of the consolidation that is condensing container shipping into just a handful of industry heavyweights is still a work in progress. In the meantime, the industry has consolidated into three global vessel-sharing agreements — 2M, the Ocean Alliance and The Alliance — with the latter two inaugurating services in April.

Subsidiaries:

• APM-Maersk includes Maersk Line, Safmarine, MCC-Transport, Seago Line and Mercosul Line

• MSC includes WEC Lines

• CMA CGM Group includes CMA CGM, APL, ANL, Cheng Lie Navigation Co, Feeder Associate System, MacAndrews, OPDR and CoMaNav

• Cosco Shipping Co Ltd (formerly known as COSCO Container Lines) integrates the former CSCL- operated fleet (with affiliates Shanghai Puhai Shipping Co (SPS) and Golden Sea Shipping (GSS))

• Evergreen Line includes Evergreen Marine Corporation (EMC), Evergreen Marine (UK) Ltd, Evergreen Marine (HK) Ltd and Italia Marittima

• Hapag-Lloyd integrates the previous CSAV and UASC fleets

• Zim includes Gold Star Line

• Pacific International Lines includes Advance Container Line, Pacific Direct Line and Mariana Express Lines Ltd

• Hamburg Süd Group includes Hamburg Süd, Aliança and CCNI

• IRISL Group includes IRISL, HDS Lines, Valfajre Eight Shg Co and Khazar Shipping Co

• X-Press Feeders Group includes Sea Consortium, X-Press Container Line and Rederi TransAtlantic

Probably the most ambitious merger now under way involves the three Japanese lines, MOL, NYK and K Line, which are being combined in to Ocean Network Express, a line that will rank number six in the world in terms of fleet capacity when it introduces services next April. For now, the three lines are continuing to operate separately, and are ranked 9th, 11th and 15th respectively in the latest listings produced by Alphaliner.

More change will involve OOCL, now number seven in the world, which is in the process of being acquired by Cosco Shipping in a move that will elevate the Chinese powerhouse into the world’s top three, at least in the short-term and depending on how newbuilding activity changes the order in years to come. Cosco Shipping, of course, is already the product of a merger between two Chinese state-owned carriers, Cosco and China Shipping.

Another line set to lose its independence is Hamburg Süd, which is likely to be formally taken over by Maersk before the end of the year, once regulatory clearances have been obtained. The Danish line has promised to retain the brand, but the takeover removes another prominent player from the top 10 that has already seen a number of names disappear from the premier league over the past few years.

In 2016, United Arab Shipping Co was the world’s 10th largest carrier. Now, it has gone, through its merger with Hapag-Lloyd, which had already swallowed up Chilean line CSAV.

Another line that still featured in the top 20 last year was Hanjin Shipping, which collapsed in August 2016 and has now gone from the scene entirely.

But a South Korean newcomer has emerged from that bankruptcy, SM Line, which makes its debut at number 29.

Other lines that find themselves moving up the rankings, not through any expansion strategy but because some others have dropped out altogether, include Zim, which has climbed up from number 16 at the end of October 2016, to 13 this year, Singapore’s Pacific International Lines, which has moved up from 14th spot to 12th, and Taiwanese carrier Wan Hai that has risen from 17th to 16th place. Another climber is X-Press Feeders, up from 18 to 17 in the listings.

But what is clear from the fleet numbers is the huge gap now opening up between the top six and the rest of the industry, a gulf that looks set to widen further as the industry settles down into a handful of lines that are genuinely global. another tier of large regional players, and then feeder or shortsea operators.

The container shipping industry continues to be dominated by three European lines, all in family control, and setting the agenda in many ways.

Maersk, which remains the world’s largest containership operator with an owned and chartered fleet of more than 3.5m teu, compared with 3.2m teu a year earlier, and a still sizeable orderbook, is in the process of integrating its shipping, ports, and forwarding operations into a single transport and logistics business designed to maximise synergies between the three activities.

Scale will be boosted by the imminent takeover of north-south specialist Hamburg Süd which also has strong presence in the reefer trades.

At the same time, AP Moller-Maersk is withdrawing from energy-related activities in order to allow top management to concentrate on one core business.

MSC, which has grown its container fleet organically rather than through corporate acquisitions, has stuck to that tried and tested formula, investing in tonnage instead of companies. The Geneva-based line owned by the Aponte family recently placed an order for 11 ships of 22,000 teu capacity in a move that should help it retain its position as the world number two, with a current fleet of close to 3.2m teu and an orderbook equivalent to 12% of its existing capacity. A year earlier, MSC’s fleet stood at 2.8m teu.

Third-ranked CMA CGM is benefiting considerably from its takeover of Singapore line APL that was finalised in mid-2016, and which has now returned to profit under its new ownership. The French line is also in the process of buying South American carrier Mercosul from Maersk, which had to dispose of it as a condition of its Hamburg Süd takeover, as well as purchasing a majority stake in Pacific Islands specialist Sofrana.

CMA CGM is also selling a majority interest in its Los Angeles terminal Global Gateway South, and was the first to order the new class of 22,000 teu ships, to be built in China.

The Saadé-controlled line has seen fleet capacity rise from 2.2m teu to 2.5m teu over the year, but there is a question mark over what happens next. Turkish investor Robert Yildirim still owns a 24% share of CMA CGM, but has said he wants to sell in order to fund ports investments.

At the same time, CMA CGM will lose its position as the biggest member of the Ocean Alliance, once Cosco Shipping has completed its $6.3bn takeover of Hong Kong’s OOCL.

Many think it is now just a matter of time before Cosco Shipping starts to challenge for the top spot.

The fact that European lines dominate the industry is something of an anomaly now, considering that neither Denmark, where Maersk is headquartered, nor landlocked Switzerland, where MSC’s head office is located, are big export countries. And even CMA CGM’s home country France hardly compares with China in terms of cargo interests.

The acquisition of OOCL will give Cosco a huge leg-up in the industry, while there are constant whispers that family-owned PIL could be next in line for a takeover approach from China.

Then there is Evergreen, and where next for the line that was once number one in the world and challenging the European shipping establishment with round-the-world services, and other innovations. Will the sons of the late Chang Yung-fa start to get more actively involved in the Taiwan line or decide to sell up? Will Evergreen eventually absorb state-controlled Yang Ming, which would greatly strengthen their respective positions?

And what of Israeli line Zim? Will it be able to continue with its global-niche strategy, concentrating on a few deepsea routes where it has a strong market share, or be forced to give up its independence – that is if a buyer or partner could be found?

The outcome of this unprecedented round of consolidation is to elevate operators that have barely changed their fleet sizes or ambitions into the top 20 – those such as Korean line KMTC and Hong Kong’s SITC, while Iran’s IRISL is just outside. Others, too, will be promoted next year as the three Japanese lines disappear, to be replaced by ONE, and both OOCL and Hamburg Süd are removed from the list.

So that could mean carriers such as Turkey’s Arkas Line becoming a top 20 player.

But it is the battle at the top that will be the real showstopper. Will European lines be able to retain their dominance, or will Asian carriers from China, Japan, Taiwan and even South Korea, assert themselves as the masters of this new universe that is unfolding?

Compared previous rounds of consolidation, the acquirers appear more proactive. The trend towards liner shipping consolidation will continue and it is the “small and beautiful” companies that are likely to become the next prime takeover targets, according to Drewry China director Han Ning. The likes of Maersk Line and Cosco are keen to reduce the number of shipping lines to improve capacity management and support vessel utilisation level up to 90%, especially when faced with a huge orderbook of megaships to be delivered over the next two years. Adding a ‘smal and beautiful’ acquisition could provide acquirers with a substantial supplement in capacity and networks on certain trades.

THE chemical tanker market, which is experiencing a soft patch, is expected to see a recovery from late 2018 onwards amid restrained ordering by owners and a shrinking supply-demand gap for tonnage, according to Drewry in a report. It is forecasting tonne-mile demand for chemicals to increase by 3.8% for the whole of 2017 versus 2016, although the estimate for organic trade will rise by a mere 1.5%.

WITH most economic indicators across the globe pointing to positive territory at the moment, BIMCO has said the shipping industry’s growth outlook amid the ‘new normal’ could not be better.

It noted that the International Monetary Fund has raised expectations for global output by 0.1 percentage point to 3.6% for 2017 versus 3.6% in 2016.

For the shipping sector, the IMF’s forecast for world trade volumes has also been revised 0.2 percentage points higher to 4.2% for 2017, which is a substantial boost from the 2.4% growth seen in 2016.

US CONTAINER import growth is forecast to stall during November as retailers clear inventories, according to the National Retail Federation. The NRF forecasts that US retail sales this will grow between 3.2% and 3.8% over 2016 and that this year’s holiday sales would grow between 3.6% and 4%.

DRY bulk trade growth is expected to outpace fleet expansion this year and next, which should support a continued recovery. According to Clarksons estimates, global trade will rise by 4.2% this year and 2.7% in 2018. That compares with the dry bulk fleet increasing by 3.5% and 1.2%, respectively. The higher trade volumes will be led by iron ore and coal thanks to China's resurgent robust demand.

Read our full round of dry bulk markets analysis for the week here

EUROPEAN shipowners and workers are calling for regulators to ease administrative burdens for vessels calling at ports in the region.

The European Community Shipowners’ Associations and European Transport Workers’ Federation have both noted that the Reporting Formalities Directive, which was intended to simplify and facilitate reporting procedures in European ports, has not been able to alleviate administrative workloads.

They claimed that with no unified European system in place, vessel crews, along with owners and operators, are now dealing with different ship reporting platforms used by EU member states.

This has led to an increased administrative workload, raising the risk of seafarer fatigue, which affects job satisfaction and the smooth flow of operations.

A NEW shipbroking company has been launched in Athens by some familiar names from the Greek shipbroking scene. Xclusiv Shipbrokers, as the new outfit has been named, opened for business this month and will provide services spanning sales and purchase, newbuildings, retrofitting, finance, trading, market intelligence and valuations. Founders include John N. Cotzias, who is the current president of the Hellenic Shipbrokers Association, and Panos Tsilingiris, both of whom recently left Intermodal Shipbrokers, a well-established shipbroking house in Athens. In addition to their respective focus on newbuilding and secondhand deals, Mr Cotzias and Mr Tsilingiris will both be involved in sourcing finance for clients and projects.

With the launch of the Singapore Ship Sale Form and the recent developments to the widely used standard maritime forms, Singapore is well-positioned to continue to gain traction as one of the leading seats of arbitration for the global maritime community, write Allen & Gledhill’s Gina Lee-Wan and Jonathan Choo

DEUTSCHE Post DHL on Friday reported mixed third-quarter results for its DHL Global Forwarding business division, with rising rates eroding the margins and profits of its ocean freight and air freight forwarding businesses, offset by a recovery in road freight margins.

SOUTH Korea’s Hyundai Merchant Marine posted a net loss of Won60.3bn ($55.2m) for the third quarter of 2017, down from a WonW297bn net income in the same period last year. Operating losses narrowed to Won29.5bn from a Won230bn loss in the 2016 quarter, while total revenue was up 20.1% at Won1.29tn amid cost-cutting efforts.

ITALY-based Fincantieri has posted earnings before interest, taxes, depreciation and amortisation of €233m ($271.4m) for the first nine months of 2017 versus €185m in 2016 owing to continued strong demand for cruise ships. Revenue rose to €3.6bn compared with €3.2bn in the same period a year ago.

GOODBULK, the expanding John Michael Radziwill-led dry bulk carrier owner, has eked out a second straight profitable quarter. The company, which was launched last December and is trading on the Norwegian over-the-counter market, reported a $1.3m profit from operations on revenues of $9.7m from an average 10.1 ships on the water during the three-month period. Net profit for the period came to just over $0.4m. As a recent start-up, there were no comparable results for the same period a year ago.

SOUTH Korea’s Daewoo Shipbuilding & Marine Engineering has agreed to sell its majority stake in Romanian yard Daewoo Mangalia Heavy Industries, which is worth Won29bn ($26.5m), to Holland’s Damen Shipyards Group. The two companies are expected to complete the deal by November 29, according to a statement from DSME.

Please Note: You can also Click below Link for Ask the Analyst

Ask The Analyst

Your question has been successfully sent to the email address below and we will get back as soon as possible. my@email.address.

All fields are required.

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.