Daily Briefing October 18 2017

What shipping can expect from China’s party congress

Lloyd's List is part of Maritime Intelligence

This site is operated by a business or businesses owned by Maritime Insights & Intelligence Limited, registered in England and Wales with company number 13831625 and address c/o Hackwood Secretaries Limited, One Silk Street, London EC2Y 8HQ, United Kingdom. Lloyd’s List Intelligence is a trading name of Maritime Insights & Intelligence Limited. Lloyd’s is the registered trademark of the Society Incorporated by the Lloyd’s Act 1871 by the name of Lloyd’s.

This copy is for your personal, non-commercial use. For high-quality copies or electronic reprints for distribution to colleagues or customers, please call UK support at +44 (0)20 3377 3996 / APAC support at +65 6508 2430

Printed By

What shipping can expect from China’s party congress

| Table |

|---|

What shipping can expect from China's party congress

The heavylift shake-up is gathering pace

Piracy hotspots Gulf of Guinea and Southeast Asia top the risk list

Who are the 100 most influential people in shipping?

The increasing cost of capital will hurt shipowners' bottom line

Chevron raises the curtain on LNG shipping's peak demand season

Seafarer charities underspent during recession

South Korean police want to arrest Hanjin's group chief on embezzlement charges

Golden Ocean has snapped up two capesize bulk carriers for $86m

DNV GL is rolling out e-certificates for its classed vessels

Hapag-Lloyd has raised $414m from a share sale

Philippines customs bureau has eased up on inspections to fight port congestion

Receive the email to your inbox Classified Advertisements

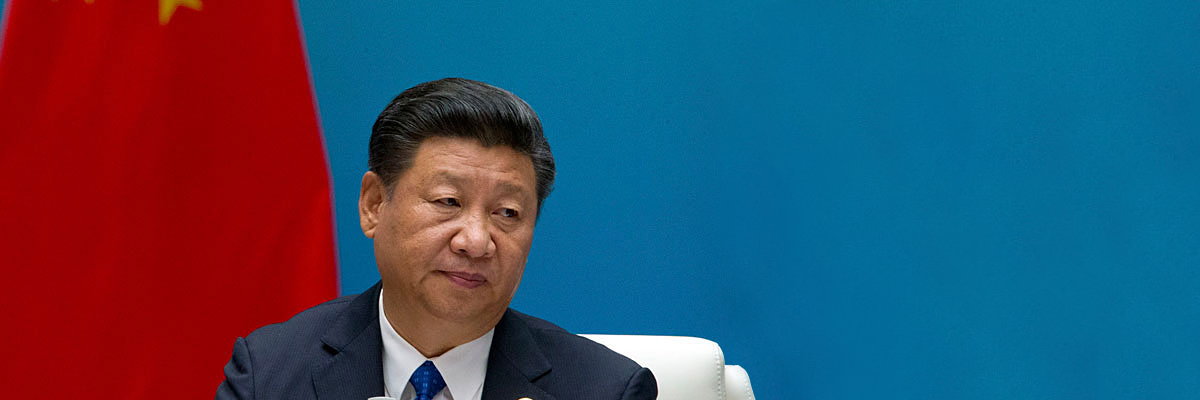

THE 19th congress of China's Communist Party, beginning on Wednesday, is likely to outline the direction of the country's political and economic development over the next decade and perhaps further.

Most attention centres on the supremacy of president Xi Jinping, and how long he would like to stay in power amid all the new entrants to the politburo standing committee, the supreme echelon of Chinese power. At the same time, Mr Xi will review his administration of the past five years and unveil his goals for the next half decade.

But what are these to do with shipping?

Well, for those who keep a close eye on the China's state-owned enterprises in the industry, they may soon hear announcements of some major mergers and acquisitions, as part of Beijing's efforts to drive SOE reform.

Final decision on those deals - which may include a tie-up between China's two largest shipbuilders CSIC and CSSC, and Cosco Shipping's alleged next major container shipping takeover - are now pending the conclusion of the congress.

They are waiting for a clearer vision and further guidance in policy direction, in addition to other commercial factors, industry sources said.

The scrap-and-build policy, created to encourage fleet renewal and help China's loss-making shipowners and shipbuilders, in particular the state-owned ones, was due to finish at the end of this year. The decision on whether to extend it is still being considered by the government bodies that oversee the issue.

Critics argue handouts are unnecessary today, because state owners, such as Cosco Shipping, have returned to profit and most of their old tonnage has been dismantled in the past few years. Those in favour of an extension argue Chinese shipyards still need a hand amid the dismal market conditions, while some state owners remain keen to renew their fleet, such as the very large crude carrier owners. The result will largely depend on how serious Beijing is about tackling shipyard overcapacity, especially in the public sector.

Most analysts do not expect any major changes in Beijing's policy goals, because stability remains the central government's top priority. The party congress, which is set to further consolidate Mr Xi's power, will probably pave the way for him to accelerate putting his existing agenda into effect.

That means policies such as the cut in production in the steel-making industries and the crackdown in the housing markets will likely continue. This may not bode well for shipping firms carrying China's exports and imports, at least in the short term.

On the bright side, though, China is expected to exert greater influence over international trade through its Belt and Road strategy and the Regional Comprehensive Economic Partnership. Box shipping carriers have already cited the strong volume growth on intra-Asia trades this year.

The party congress is a political event with little focus on a detailed economic agenda, which means shipping players seeking a greater clarification on the China's direction may have to wait until the Central Economic Work Conference in December and the National People's Congress in March.

GERMANY'S BBC Chartering and Dutch outfit Jumbo have launched a heavylift sector giant alliance with immediate effect. Elsewhere, BigRoll has outlined its strategy for going it alone in the wake of the recent departure of BigLift shipping.

The shake-ups mark the latest twist in what is proving to be a watershed year for the troubled sector, which has already seen Rickmers hand over its Rickmers-Linie arm to Zeaborn and K Line sell its SAL Heavy Lift unit to Harren & Partner.

The ongoing musical chairs appear to be driven by the poor market conditions in heavylift over the last reporting period. Intriguingly, though, there are hints the worst could be over.

THE London-based International Maritime Bureau has highlighted concerns over vessel attacks by pirates in the Gulf of Guinea and Southeast Asia in the first nine months of 2017. It also noted a rise in the number of incidents off the coast of Venezuela and attacks on vessels off the coast of Libya, including an attempted boarding, "highlighting the need for vigilance in other areas".

There were a total of 121 reported incidents of piracy and armed robbery against vessels in the January to September 2017 period compared with 141 in the same period a year ago.

In a regional breakdown, Southeast Asia had 47 incidents, Africa had 41 incidents, the Americas had 20, the Indian subcontinent had nine, East Asia had two and the rest of the world had two.

During this period, 92 vessels were boarded, 13 were fired upon, 11 saw attempted attacks and five were hijacked.

The IMB said no incidents were reported off the coast of Somalia, a piracy hotspot in the quarter. However, successful attacks earlier in the year seemed to indicate pirates in the vicinity are still able to target merchant vessels far from the coastline.

ROBIN Sharma, the Canadian former lawyer best known for a series of leadership books beginning with The Monk who sold his Ferrari, once wrote that leadership is not about title, it's about impact, influence and inspiration. Insofar as 'influence' involves the capacity to affect the attitudes and behaviour of others, it's the key quality of those who have the greatest effect on shipping.

Lloyd's List is keen to hear about maritime leaders who have had, and continue to have, influence - they have changed the way we think about our industry, their views demand a response and, crucially, they inspire fellow leaders.

We agree with Mr Sharma. Our Top 100 list will not be determined by job title, or even solely by career trajectory. Our list will be a gathering of influencers, from all sectors and all regions, both those early in their career and those standing on decades of experience. The editorial team at Lloyd's List have some great influencers in mind, and we would like you to suggest who you would like to see on that list.

So a simple question: who do you regard as being the maritime influencers of this generation? The Top 100 is one of the most enthusiastically read publications, and not only by the leaders themselves.

The changing maritime world brings new influencers every year. This year's list could see entries from the logistics, technology and security sectors; perhaps commodity traders or investors; maybe politicians, bankers, and business executives. These top influencers could have had an effect from within a different sector, yet their impact on shipping is seen as vital.

To make your nomination to the Lloyd's List Top 100 list, use the email address newsdesk@lloydslist.com. Even monks who choose to walk are welcome to nominate.

THE exodus of commercial banks from ship lending has now reached a critical mass and that means that shipowners are going to have to lower their profit expectations to account for the increasing cost of capital.

Gone are the days of shipping companies borrowing 80%-85% of a ship's value at a rate of London interbank borrowing rate plus a margin of 1%. Financial boutiques are here to help, but their services come with a higher price tag.

Tobias Backer of Fleetscape gave us a glimpse of that when he said at a recent Capital Link conference in New York that shipowners looking to borrow at 5% or 6% should look elsewhere. Fleetscape just announced the launching of an Oaktree-backed $400m fund targeting the maritime industry.

Other financial boutiques sniffing for deals include Meerbaum Capital Solutions (also an Oaktree-backed fund), Alterna Capital Partners, Northern Shipping Funds, Wafra Capital, and Breakwater Capital.

But why should shipowners or shareholders of listed shipping companies care about higher debt costs? Because these costs will eat into their bottom line. In a fragmented industry like shipping, shipowners are price takers and they must make do with a total return of capital invested that historically has ranged between 7% to 9%.

Unless the industry becomes more profitable, the various providers of capital (debt and equity) will engage in a zero-sum game trying to slice a 7% to 9% pie. The bottom line for shipowners will unfortunately be that the more they pay for debt, the less will be left for them or their public shareholders.

THE Chevron-led Wheatstone project is preparing to export its first cargo of liquefied natural gas, taking the lead in a string of LNG projects due to come online by year-end to meet the winter demand up-pick.

After the Western Australia project began production on October 9, vessel tracking data from Lloyd's List Intelligence showed the Chevron-owned, 160,000 cu m Asia Venture has been at the site, near Onslow, since Monday.

Asked on the sidelines of Oil & Money conference when the first LNG cargo would be loaded, Chevron Australia's general manager for commercial matters Peter Hagen stressed that the project was "condition driven, not schedule driven".

But he added: "The condition is good."

While the 8.9m-tonnes-per-year Wheatstone project is about to begin commercial exports, Australia Pacific LNG, a joint venture between Origin, ConocoPhillips and Sinopec, could soon raise exports after its second train on Curtis Island started to produce commercial volume earlier this month.

On the US side, Cheniere Energy Partners announced the substantial completion of the fourth train at Sabine Pass, while Dominion Energy's Cove Point project is due to begin exports from end-2017 after being declared 95% complete in September.

UK SEAFARER charities did not spend enough during the recession, potentially creating more long-term challenges, according to a new study covering more than a decade of activities.

The report, which reviewed the maritime welfare charity sector from 2005 to 2015, concluded that the charities, despite having amassed funds, did not use them to meaningfully increase their spending during the last recession, and probably should have spent more as the gap could create further problems in the future.

"During the global recession, the sector's overall income flattened out, only picking up from 2013 onwards. And while overall spending increased in the first couple of years of the recession keeping pace with demand, it fell in 2010, only picking up again from 2014 onwards," it said.

Funding also grew increasingly imbalanced in favour of the Royal Navy and Royal Marines, leaving merchant and fishing fleet seafarers in a more strained situation.

SOUTH Korean police sought on Monday an arrest warrant for Cho Yang-ho, the chairman of Hanjin Group, the parent company of the now-defunct Hanjin Shipping, who stands accused of embezzling funds to renovate his private home. Mr Cho was questioned by police last month over accusations of using approximately Won3bn ($2.66m) of funds from Hanjin Group for renovating his own house between May 2013 and January 2014, according to local media reports.

In addition, police asked to take into custody a top Hanjin executive also surnamed Cho as it is believed that he was also involved in the embezzlement.

GOLDEN Ocean Group has signed a deal to buy two capesize bulk carriers from another John Fredriksen-linked entity, Hemen Holding, at $43m apiece. Hemen is Golden Ocean Group's largest stakeholder. The company has also begun a share issuance as it seeks to raise gross proceeds of $66m from institutional investors, which will be used for general corporate purposes. It will also issue new shares worth up to $34m at a per-share price equal to the offer price to Hemen as part payment for the two vessels.

DNV GL has promised to reduce administrative processes and document handling costs for shipowners, regulators, charterers and crew by issuing electronic certificates across its entire fleet. Following a pilot project 45 flag state administrations have allowed the class society to issue statutory e-certificates on their behalf.

HAPAG-LLOYD has successfully raised ?352m ($414m) in gross proceeds from the capital increase announced last month to pay off debts and to fund general corporate purposes. The move, in which 96.5% of shareholders exercised subscription rights, was one of a number of conditions set as part of its merger with Middle Eastern carrier United Arab Shipping Co earlier this year.

According to the Hamburg-based group, a total of 11.7m new shares were placed at a subscription price of ?30 each. As a result, the company's share capital will be increased to ?175.8m. The new shares will carry full dividend rights as of January 1 this year.

THE Philippines Bureau of Customs has watered down cargo inspection regulations as part of a bid to alleviate port congestion caused by trucks. As of October 12, the authorities have foregone X-ray inspections on truck shipments comprised of perishables, reefer shipments, imports by government agencies and multinational companies. Instead, these shipments will merely be subject to document checks, said the bureau in a statement.

Previous regulations required all cargo trucks to undergo X-ray examinations or document checks after the authorities decided to clamp down on smuggling and other illicit customs practices.

Please Note: You can also Click below Link for Ask the Analyst

Ask The Analyst

Your question has been successfully sent to the email address below and we will get back as soon as possible. my@email.address.

All fields are required.

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.