Daily Briefing September 11 2017

Exclusive: Uncovering North Korea's clandestine seaborne fuel imports

Lloyd's List is part of Maritime Intelligence

This site is operated by a business or businesses owned by Maritime Insights & Intelligence Limited, registered in England and Wales with company number 13831625 and address c/o Hackwood Secretaries Limited, One Silk Street, London EC2Y 8HQ, United Kingdom. Lloyd’s List Intelligence is a trading name of Maritime Insights & Intelligence Limited. Lloyd’s is the registered trademark of the Society Incorporated by the Lloyd’s Act 1871 by the name of Lloyd’s.

This copy is for your personal, non-commercial use. For high-quality copies or electronic reprints for distribution to colleagues or customers, please call UK support at +44 (0)20 3377 3996 / APAC support at +65 6508 2430

Printed By

Exclusive: Uncovering North Korea's clandestine seaborne fuel imports

| Table |

|---|

Exclusive: Uncovering North Korea's clandestine seaborne fuel imports

The UK has promised to do “whatever necessary” to attract international shipowners

Comment: Why shipping must work with other transport modes to ensure a ‘good’ Brexit

Box lines eye green shoots of recovery

Pacific and Jones Act product tankers are benefiting from hurricane season

Near-term headwinds are testing Dynagas Partners’ mettle

NAVES acquisition will help Braemar diversify risk and mitigate impact of digitalisation

Daewoo dismisses ‘fake’ North Korea news but confirms 22,000 teu MSC orders are still on the table

China has approved the Cosco-OOIL takeover deal

Keppel, Pavilion Energy and PLN are teaming up for Indonesian LNG projects

Skuld technical results slipped $22m into the red

Receive the email to your inbox Classified Advertisements

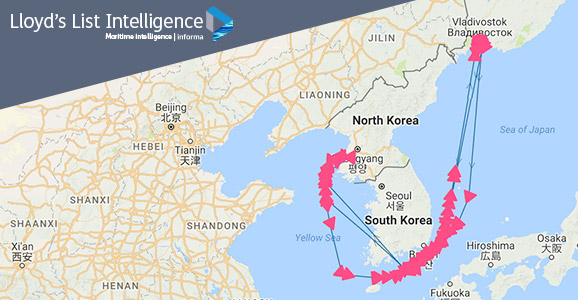

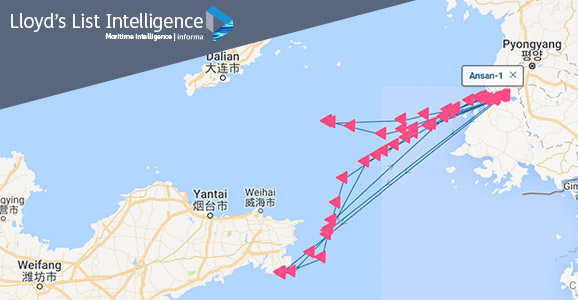

An aged fleet of rusting product tankers transport gasoline and diesel cargoes to the North Korean port of Nampo every year, from oil refineries in northeastern China and Russia’s far east, but the number of shipments appear to have fallen sharply in 2017.

It is unclear how much of the decline in fuel shipments for Pyongyang can be attributed to Beijing’s recent attempts at curtailing trade with the pariah state and how much is because of crackdowns on Pyongyang’s clandestine fuel networks in the region.

But the fuel shipments are notable given increased calls for an oil embargo on the country.

In total, only 10 product tankers were seen calling at the North Korean port of Nampo in the first eight months of 2017, while the whole of 2016 saw as many as 40 product tankers calling there. This however may not represent the full volume of tanker traffic for Nampo.

North Korea’s imports of gasoline and diesel are vital to the country's agriculture, transportation, and military sectors, and in 2016, China reportedly exported 6,000 barrels per day of oil products to North Korea, according to the US energy department’s analysis of UN customs data.

Forty small product tankers would account for less than a third of this estimated volume.

The tankers tracked in our investigation have been on commercial shipping routes for decades, and there is a distinct possibility that North Korean fuel imports by sea have “gone dark”, with their tracking systems turned off as global scrutiny intensifies.

Still, an analysis of the fleet used to supply North Korea with petroleum products shows some interesting trends.

Read the full investigation, revealing how North Korea imports fuel by sea and why oil sanctions may not be having the desired impact here

UK shipping minister John Hayes has told Lloyd’s List that he wants more shipowners to relocate to the UK, and he wants to “go further” than the current offering to attract international businesses.

While Mr Hayes offered little in the way of specifics and stated that pledges on taxation were up to the UK Treasury, he confirmed that he is considering many of the industry recommendations due to be published on Wednesday in a new assessment of the UK’s sector.

While touting low rates of corporation tax, the ease of doing business and a pro-business government, Mr Hayes conceded that more could be done to lure international operators.

Speaking on the eve of London International Shipping Week, Mr Hayes said the government was aware of industry concerns regarding tonnage tax, visa red tape and so-called ‘non-dom’ rules that have resulted in an exodus of ‘London Greeks’ in recent years. The government is looking at ways to increase the use of business investment relief, as a way to encourage non-doms to invest in UK businesses, Mr Hayes said.

Read the full interview with Minister of State at the Department for Transport John Hayes here

As the global maritime industry gathers to celebrate London International Shipping Week, now is the time to set a course together with other transport modes to devise practical solutions, argues former UK MEP and transport spokesman in the European Parliament Mark Watts. These solutions must ensure the continued growth and prosperity of the shipping industry, and take into account the huge technological and environmental changes we face. With the support of those in aviation, road and rail, the maritime sector can influence the negotiators. If we don’t force politicians to recognise transport as a priority, we risk politically motivated bureaucratic rules hindering trade, rather than the progressive practical solution we know is possible. This will benefit not just EU-UK, but global trade. Trade which is predominately maritime.

London Shipping Week is upon us and Lloyd’s List is going free to read for the week as the industry descends on the UK. Fill in your details on our LISW page and get free, unrestricted access to Lloyd’s List for the duration of the event. Keep an eye on the page for details of a high-level meeting of shipping leaders at 10 Downing Street, and catch up with the pre-event hype including Jeffrey Evans, Lord Mountevans on London retaining its unique maritime role and Lloyd’s List’s look at why LISW is a moment of truth for the UK Ship Register.

SHIPPING is often accused of “sleepwalking” towards a crisis. So often, in fact, that it would be an unusual year if the industry had aligned itself to commitments made on its behalf by regulators. This time it’s different.

The global sulphur cap has been approved at the International Maritime Organization to slash the industry's emissions of pollutants that cause acid rain and health problems in communities near ports and busy shipping lanes. It will be expensive to implement and inconvenient; it will drive some ships to recycling, and divide the better-funded businesses from those just-about-managing. Even so, with less than 850 days to go before the transition from high-sulphur to low-sulphur fuels, there are significant areas of uncertainty. What will the impact be on shipbuilding, on scrapping, on ship finance, and on availability?

The global sulphur cap has been approved at the International Maritime Organization to slash the industry's emissions of pollutants that cause acid rain and health problems in communities near ports and busy shipping lanes. It will be expensive to implement and inconvenient; it will drive some ships to recycling, and divide the better-funded businesses from those just-about-managing. Even so, with less than 850 days to go before the transition from high-sulphur to low-sulphur fuels, there are significant areas of uncertainty. What will the impact be on shipbuilding, on scrapping, on ship finance, and on availability?

Our ExxonMobil-sponsored Business Briefing today at London International Shipping Week sets out to address some of these issues head-on. This will be neither a restatement of the options nor a reiteration of the usual “What happens if?” scenarios. Our panel of fuel and lubricant experts, lawyers, financiers, and insurers work with vessel operators day after day: they have thought deeply about the impact this regulation will have across the industry. Time is pressing, money is short, questions are many.

If there is one takeaway from this event, it has to be “urgency”. There is a temptation to leave any decisions until late 2019 in the hope that something will turn up — a temptation that effectively killed off any prospect of the sulphur cap being delayed until 2025. The right decision depends on the vessels in the fleet, ships’ age, engine type, and corporate strategy. There is no single solution: matching others’ choice just won’t work. This measure will take shipping away from a single-fuel environment to a multi-fuel future.

This event won’t be comfortable for everyone.

This London International Shipping Week, join Lloyd’s List and industry leaders, from fuel suppliers to financial institutions and legal practitioners, to discuss strategies needed to avoid risk pitfalls.

Monday September 11, from 1400 hrs at 8 Northumberland Avenue

THERE is little doubt that the downturn that has pummelled the container shipping sector over the past two years is past its worst.

Industry bellwether and market leader Maersk Line managed to turn a profit in the second quarter, as did a number of other major lines, particularly those in Asia. And for the lines that did not return to the black, at least losses were minimised.

One could be forgiven for thinking that carriers had found the magic formula for making money again, but one would almost certainly be mistaken.

In other words, it would have been relatively difficult to not make money in the past quarter.

Nevertheless, the atmosphere at the Global Liner Shipping conference in Singapore at the start of this month was one of the more optimistic seen in recent years. Container shipping, it seems, has a spring back in its step again.

There are, however, still some dark clouds on the horizon. The orderbook overhang still looms large over the market, with a significant amount of capacity due to enter the market next year. Moreover, scrapping has slowed in recent months, reversing a trend in capacity management that had provided some relief. And after two years of virtually no box ships being ordered, carriers are returning to yards in the expectation that more tonnage will be needed in two years’ time, when the ships slip out of the yards.

Whether these vessels will be required by demand then remains to be seen. But for now, container shipping is enjoying an uptick as it eyes the green shoots of recovery. After the past two years, it could do with a break.

Full story

THE US hurricane season has underscored the complex nature of product tanker trades, with sentiment firm in Pacific and Jones Act trades amid a sharp downwards correction in Atlantic rates. As Hurricane Harvey earlier shut many export terminals and oil refineries in Texas for more than a week, oil firms have been soaking up tonnage to ship oil products from Asia to the US and Latin America to fill the supply gap. However, the rally is expected to be over once Irma passes and the US Gulf oil facilities recover from Harvey. “No way the rate hike is sustainable,” independent analyst Court Smith said. “Once supply chains return to normal the ships will be idle again.”

DYNAGAS LNG Partners (news, data) reported weak results for the second quarter last week, primarily because three of its six liquefied natural gas carriers underwent special surveys. But shareholders should worry less about scheduled off-hire days, which only happen once every five years, and more about spot market exposure and higher interest costs. These two thorns will test the company’s ability to fully “earn” its dividend over the next several quarters, argues our US correspondent Lambros Papaeconomou.

“You can quite understand why the banks have changed their business model, but it does mean there is an opportunity for providers like NAVES to support their efforts,” Braemar Shipping Services chief executive James Kidwell told Lloyd’s List in an interview shortly after announcing their recent acquisition. The deal, which positions Braemar firmly in the corporate finance advisory field, is part of its strategy to diversify its revenue streams and better manage the impact of digitalisation on its shipbroking division.

Daewoo Shipbuilding & Marine Engineering is still discussing a potential order for 22,000 teu containerships from Mediterranean Shipping Co, but has dispelled media reports that the process was disrupted by North Korea’s recent nuclear tests. “The report is false and the deal is still being discussed,” a Seoul-based DSME spokesperson told Lloyd’s List. However, well-placed brokers have played down the prospect of MSC ordering new ships any time soon, given the balanced state of the market which is helping the container trades to recover.

Hong Kong-listed Cosco Shipping Holdings has received the green light from one of the Chinese state regulators regarding its acquisition of Orient Overseas (International) Ltd. The state-owned Assets Supervision and Administration Commission of the State Council is responsible for the managing of state-owned enterprises, including top executive appointments and for the approval of any mergers or sales of stocks or assets, among other things. Cosco will now hold an extraordinary general meeting to seek shareholders’ approval for the deal on October 16.

Singaporean companies Keppel Offshore & Marine and Pavilion Energy have teamed up with Indonesia’s state-run utility PT Perusahaan Listrik Negara to develop small-scale liquefied natural gas projects in Indonesia. Under the agreement, they will develop the supply chain to distribute LNG to remote islands of western Indonesia for power generation, a market estimated to need nearly $50bn of marine investment in the next 15 years.

Skuld saw a negative technical result of $22m for the six months to August 20, with the marine insurer’s combined ratio soaring as high 111%, on the back of “a small number of substantial claims”. But the day was saved by a positive contribution from commercial operations, leaving the P&I club and Lloyd’s syndicate member with an $8m surplus for the period, sharply down from the $29m seen at the same point last time round.

Please Note: You can also Click below Link for Ask the Analyst

Ask The Analyst

Your question has been successfully sent to the email address below and we will get back as soon as possible. my@email.address.

All fields are required.

All set! This article has been sent to my@email.address.

All fields are required. For multiple recipients, separate email addresses with a semicolon.

Please Note: Only individuals with an active subscription will be able to access the full article. All other readers will be directed to the abstract and would need to subscribe.